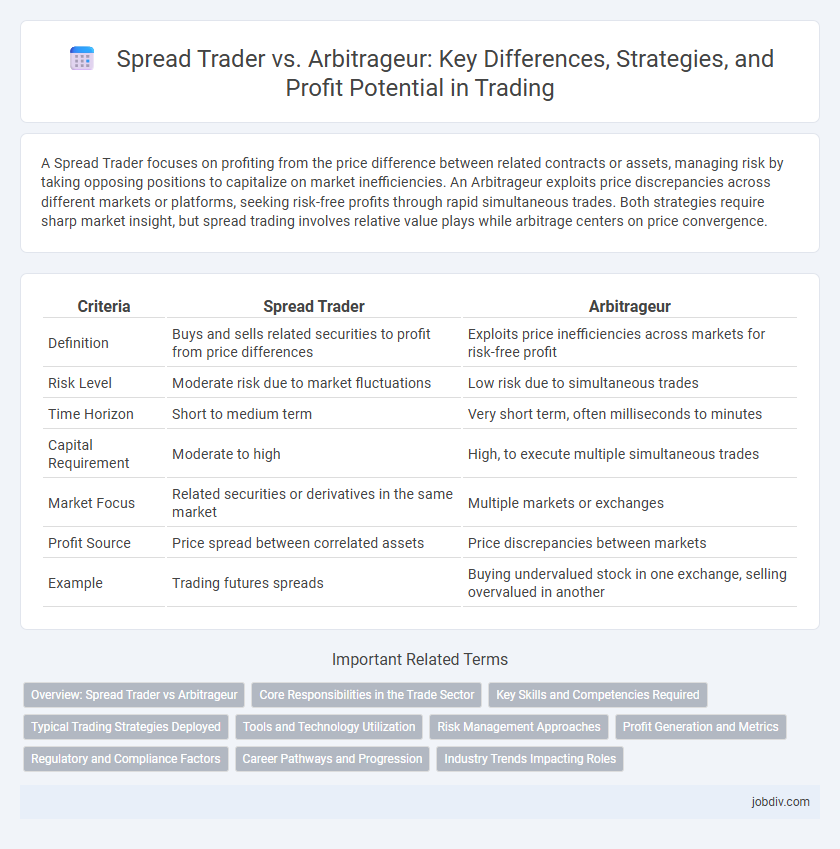

A Spread Trader focuses on profiting from the price difference between related contracts or assets, managing risk by taking opposing positions to capitalize on market inefficiencies. An Arbitrageur exploits price discrepancies across different markets or platforms, seeking risk-free profits through rapid simultaneous trades. Both strategies require sharp market insight, but spread trading involves relative value plays while arbitrage centers on price convergence.

Table of Comparison

| Criteria | Spread Trader | Arbitrageur |

|---|---|---|

| Definition | Buys and sells related securities to profit from price differences | Exploits price inefficiencies across markets for risk-free profit |

| Risk Level | Moderate risk due to market fluctuations | Low risk due to simultaneous trades |

| Time Horizon | Short to medium term | Very short term, often milliseconds to minutes |

| Capital Requirement | Moderate to high | High, to execute multiple simultaneous trades |

| Market Focus | Related securities or derivatives in the same market | Multiple markets or exchanges |

| Profit Source | Price spread between correlated assets | Price discrepancies between markets |

| Example | Trading futures spreads | Buying undervalued stock in one exchange, selling overvalued in another |

Overview: Spread Trader vs Arbitrageur

Spread traders capitalize on price differentials between related assets within the same market by simultaneously buying and selling to profit from relative price movements. Arbitrageurs exploit price discrepancies of identical or similar financial instruments across different markets or exchanges, aiming to secure risk-free profits through instant transactions. While spread trading involves managing correlated asset pairs and relative value strategies, arbitrage focuses on bridging market inefficiencies for immediate gains.

Core Responsibilities in the Trade Sector

Spread Traders primarily focus on identifying and exploiting price differentials between related financial instruments, managing risk through simultaneous buying and selling to profit from market inefficiencies. Arbitrageurs specialize in leveraging price discrepancies across different markets or exchanges, executing rapid trades to capitalize on temporary imbalances with minimal risk exposure. Both roles require in-depth market analysis and precise execution but differ in strategy and execution speed within the trade sector.

Key Skills and Competencies Required

Spread traders require strong analytical skills to identify price differentials and market trends across related securities, combined with risk management expertise to handle potential losses from spread fluctuations. Arbitrageurs must possess advanced quantitative skills, high-frequency trading capabilities, and deep knowledge of market inefficiencies to exploit price discrepancies instantaneously while managing execution risk. Both roles demand proficiency in data analysis, quick decision-making, and the ability to operate under high-pressure environments to optimize trade profitability.

Typical Trading Strategies Deployed

Spread traders typically exploit price differentials between related financial instruments, such as buying one asset while simultaneously selling a correlated asset to profit from converging spreads. Arbitrageurs identify and capitalize on temporary market inefficiencies by executing simultaneous buy and sell orders across different markets or instruments to lock in risk-free profits. Both strategies rely on rapid execution and precise risk management to maximize returns while minimizing exposure to market volatility.

Tools and Technology Utilization

Spread traders primarily utilize technical analysis software, advanced charting tools, and real-time market data platforms to identify price differentials across related assets and execute quick trades. Arbitrageurs rely heavily on ultra-low latency trading systems, high-frequency algorithms, and direct market access technologies to exploit price inefficiencies across multiple markets simultaneously. Both types of traders invest in robust risk management software and API integration to enhance execution speed and accuracy in fast-moving trading environments.

Risk Management Approaches

Spread traders manage risk by simultaneously holding long and short positions in related securities to capitalize on price differentials, thereby minimizing exposure to market volatility. Arbitrageurs employ risk management strategies that involve exploiting price inefficiencies across markets or instruments, often executing nearly risk-free trades by locking in profits from converging prices. Both approaches rely on precise execution and continuous monitoring to mitigate risks associated with price movements, liquidity, and execution delays.

Profit Generation and Metrics

Spread traders generate profit by exploiting price differences between related securities, utilizing metrics like bid-ask spreads and volatility to optimize entry and exit points. Arbitrageurs capitalize on price inefficiencies across different markets or instruments, relying on precise timing and liquidity metrics such as market depth and execution speed to secure risk-free gains. Both strategies demand rigorous analysis of market data and transaction costs to maximize profitability and minimize exposure.

Regulatory and Compliance Factors

Spread traders face less stringent regulatory scrutiny compared to arbitrageurs, as their strategies primarily involve capturing price differentials within the same market or related instruments. Arbitrageurs often operate across multiple markets or jurisdictions, triggering complex compliance requirements including cross-border regulations and anti-money laundering (AML) policies. Regulatory bodies scrutinize arbitrage activities more closely to prevent market manipulation, insider trading, and ensure transparency in multi-market transactions.

Career Pathways and Progression

Spread traders typically develop expertise in analyzing price differentials between related securities, building skills that lead to roles such as quantitative analyst or portfolio manager. Arbitrageurs cultivate a deep understanding of market inefficiencies and rapid execution strategies, paving the way for advanced positions in proprietary trading or risk management. Career progression in both fields demands strong analytical abilities, risk assessment proficiency, and adaptation to evolving financial technologies.

Industry Trends Impacting Roles

Spread traders capitalize on price differentials between related assets, exploiting market inefficiencies primarily in highly liquid markets such as futures and options. Arbitrageurs, on the other hand, identify and execute risk-free profits by simultaneously buying and selling equivalent assets across different markets, with technology advancements and high-frequency trading significantly enhancing their operation speed and accuracy. Current industry trends, including increased automation, regulatory scrutiny, and the integration of AI analytics, are reshaping both roles by driving greater efficiency, transparency, and competition within trade execution strategies.

Spread Trader vs Arbitrageur Infographic

jobdiv.com

jobdiv.com