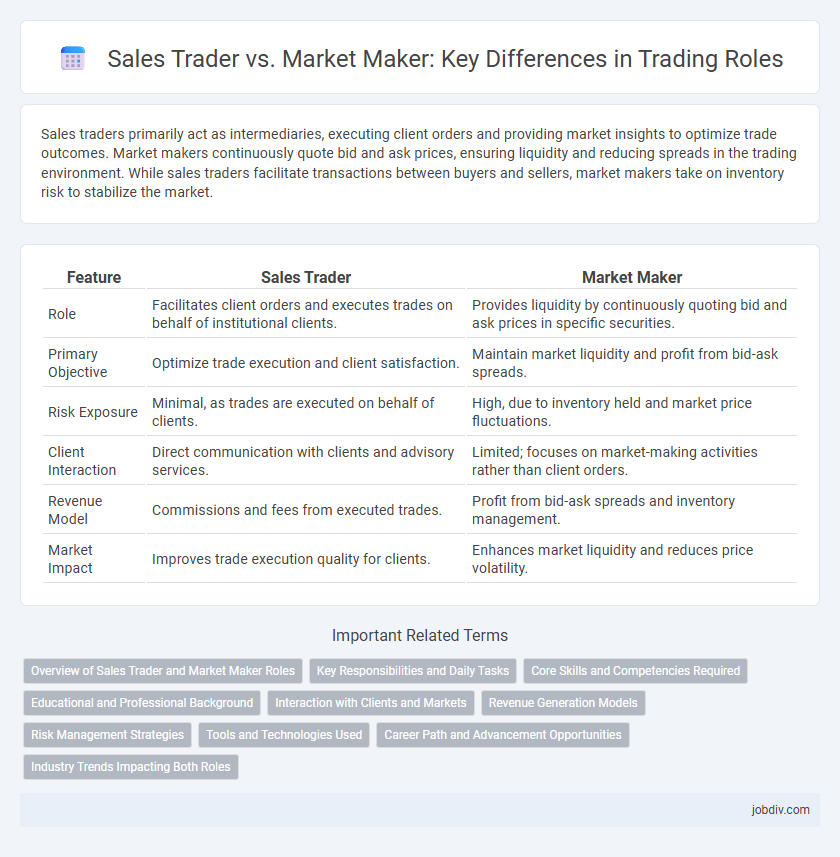

Sales traders primarily act as intermediaries, executing client orders and providing market insights to optimize trade outcomes. Market makers continuously quote bid and ask prices, ensuring liquidity and reducing spreads in the trading environment. While sales traders facilitate transactions between buyers and sellers, market makers take on inventory risk to stabilize the market.

Table of Comparison

| Feature | Sales Trader | Market Maker |

|---|---|---|

| Role | Facilitates client orders and executes trades on behalf of institutional clients. | Provides liquidity by continuously quoting bid and ask prices in specific securities. |

| Primary Objective | Optimize trade execution and client satisfaction. | Maintain market liquidity and profit from bid-ask spreads. |

| Risk Exposure | Minimal, as trades are executed on behalf of clients. | High, due to inventory held and market price fluctuations. |

| Client Interaction | Direct communication with clients and advisory services. | Limited; focuses on market-making activities rather than client orders. |

| Revenue Model | Commissions and fees from executed trades. | Profit from bid-ask spreads and inventory management. |

| Market Impact | Improves trade execution quality for clients. | Enhances market liquidity and reduces price volatility. |

Overview of Sales Trader and Market Maker Roles

Sales traders act as intermediaries between clients and the market, executing orders while providing market insights and tailored trading strategies. Market makers continuously quote bid and ask prices, ensuring liquidity and facilitating smooth transaction flows in financial markets. Both roles are critical for efficient trading, with sales traders focusing on client relationships and market makers maintaining market stability.

Key Responsibilities and Daily Tasks

Sales traders primarily manage client orders and execute trades on behalf of institutional investors while providing market insights and strategy guidance to optimize portfolio performance. Market makers maintain liquidity by continuously quoting bid and ask prices, managing inventory risk, and balancing supply and demand in financial markets. Both roles require monitoring market trends and rapid decision-making, but sales traders emphasize client relationships, whereas market makers focus on market efficiency and price stability.

Core Skills and Competencies Required

Sales traders excel in client relationship management, market analysis, and execution precision, requiring strong communication skills and deep knowledge of financial products. Market makers demand expertise in risk management, pricing strategies, and liquidity provision, emphasizing quick decision-making and quantitative analysis capabilities. Both roles necessitate proficiency in trading platforms, market dynamics, and regulatory compliance to optimize trade execution and market efficiency.

Educational and Professional Background

Sales traders typically possess strong educational backgrounds in finance, economics, or business administration, often holding degrees such as a Bachelor's or Master's in these fields. Their professional experience emphasizes client relationship management and execution of trades on behalf of institutional investors, requiring excellent communication and analytical skills. Market makers, on the other hand, usually have specialized training in quantitative finance, mathematics, or computer science, with a focus on algorithmic trading, risk management, and maintaining liquidity in financial markets through continuous bid-ask price quoting.

Interaction with Clients and Markets

Sales traders prioritize client relationships by executing orders and providing market insights tailored to individual needs, ensuring seamless communication and customized trade execution. Market makers continuously provide liquidity by quoting bid and ask prices, balancing their own inventory while managing risk across multiple markets. Client interaction for market makers is indirect, focusing on maintaining market stability, whereas sales traders act as the direct liaison between clients and market activity.

Revenue Generation Models

Sales traders generate revenue primarily through commissions and fees by executing client orders and providing personalized market insights, fostering strong client relationships to encourage recurring trades. Market makers earn revenue from bid-ask spreads by continuously quoting buy and sell prices, profiting from the difference while managing inventory risk and enhancing market liquidity. Both roles contribute to market efficiency but rely on distinct mechanisms: sales traders focus on client-driven transactions, whereas market makers optimize spreads for consistent profit.

Risk Management Strategies

Sales traders manage client orders by executing trades while mitigating market impact, employing stop-loss orders and order slicing to control risk exposure. Market makers continuously provide liquidity by quoting bid and ask prices, using hedging techniques and inventory limits to balance risk and maintain stable spreads. Both roles rely on real-time data analytics and algorithmic tools to optimize risk management in fast-paced trading environments.

Tools and Technologies Used

Sales traders primarily utilize advanced order management systems (OMS) and customer relationship management (CRM) platforms to execute client-driven trades and track market liquidity. Market makers rely heavily on algorithmic trading software, high-frequency trading (HFT) platforms, and real-time market data feeds to continuously provide bid-ask quotes and maintain market efficiency. Both roles leverage sophisticated risk management tools and advanced analytics powered by machine learning to optimize trade execution and pricing strategies.

Career Path and Advancement Opportunities

Sales traders focus on client relationship management and executing trades on behalf of institutional clients, offering a clear career progression toward senior sales roles or portfolio management. Market makers specialize in providing liquidity by continuously quoting bid and ask prices, with advancement opportunities toward trading desk leadership or risk management positions. Both paths demand strong market knowledge and analytical skills, but sales traders often advance through client engagement roles, while market makers progress via trading strategy expertise and market-making proficiency.

Industry Trends Impacting Both Roles

Sales traders and market makers are both significantly affected by the rise of algorithmic trading and increased market transparency. Regulatory changes, such as MiFID II and Dodd-Frank, have heightened compliance demands, reshaping execution strategies in both roles. The integration of AI and machine learning in trading platforms is transforming how sales traders interact with clients and how market makers manage risk and liquidity provision.

Sales Trader vs Market Maker Infographic

jobdiv.com

jobdiv.com