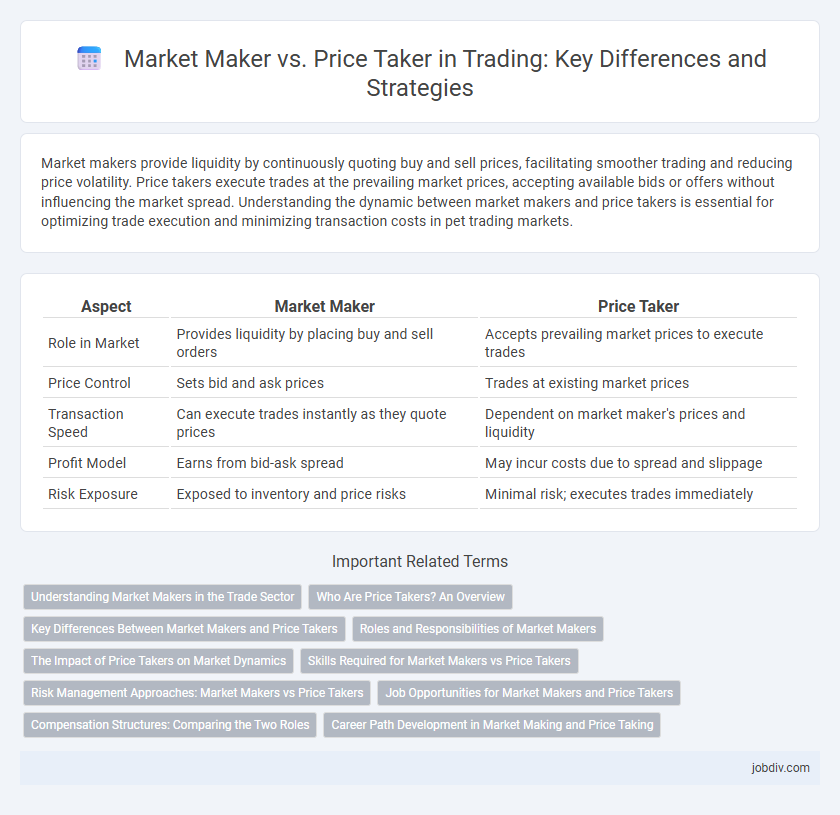

Market makers provide liquidity by continuously quoting buy and sell prices, facilitating smoother trading and reducing price volatility. Price takers execute trades at the prevailing market prices, accepting available bids or offers without influencing the market spread. Understanding the dynamic between market makers and price takers is essential for optimizing trade execution and minimizing transaction costs in pet trading markets.

Table of Comparison

| Aspect | Market Maker | Price Taker |

|---|---|---|

| Role in Market | Provides liquidity by placing buy and sell orders | Accepts prevailing market prices to execute trades |

| Price Control | Sets bid and ask prices | Trades at existing market prices |

| Transaction Speed | Can execute trades instantly as they quote prices | Dependent on market maker's prices and liquidity |

| Profit Model | Earns from bid-ask spread | May incur costs due to spread and slippage |

| Risk Exposure | Exposed to inventory and price risks | Minimal risk; executes trades immediately |

Understanding Market Makers in the Trade Sector

Market makers play a crucial role in the trade sector by providing liquidity and enabling smoother transactions through continuous bid and ask price quotes. Unlike price takers who accept prevailing market prices, market makers facilitate efficient trading and reduce price volatility by standing ready to buy or sell assets at stated prices. Their presence enhances market depth and stability, significantly impacting overall trading dynamics and execution quality.

Who Are Price Takers? An Overview

Price takers are market participants who accept prevailing prices without influencing them, typically individual traders or small firms lacking market power. They execute trades based on existing bid and ask prices set by market makers, contributing to market liquidity but not dictating price movements. Understanding the role of price takers helps clarify market dynamics and the balance between liquidity provision and price determination.

Key Differences Between Market Makers and Price Takers

Market makers provide liquidity by continuously quoting both buy and sell prices, enabling smoother and more efficient market operations. Price takers accept the existing market prices without influencing the bid-ask spread or order book depth. The key difference lies in market makers' active role in setting prices and maintaining market stability, whereas price takers passively execute orders at available prices.

Roles and Responsibilities of Market Makers

Market makers provide liquidity to financial markets by continuously quoting buy and sell prices for securities, ensuring smoother transactions and tighter spreads. They assume risk by holding inventories of assets and facilitate efficient price discovery, benefiting both traders and exchanges. Their responsibilities also include managing order flow, maintaining market stability, and supporting overall trading volume.

The Impact of Price Takers on Market Dynamics

Price takers influence market dynamics by accepting prevailing prices, which stabilizes liquidity and minimizes price volatility. Their trading behavior ensures efficient price discovery by reflecting true supply and demand conditions without attempting to manipulate the market. High participation of price takers promotes competitive markets, contributing to tighter bid-ask spreads and enhanced market depth.

Skills Required for Market Makers vs Price Takers

Market makers require advanced skills in risk management, deep market knowledge, and high-speed decision-making to provide continuous liquidity while maintaining profitable spreads. Price takers rely mainly on analytical skills to interpret market trends and execute trades quickly based on existing prices without influencing market direction. Understanding order book dynamics and mastering real-time data analysis are crucial skills that differentiate market makers from price takers.

Risk Management Approaches: Market Makers vs Price Takers

Market makers employ risk management strategies such as maintaining bid-ask spreads and using high-frequency trading algorithms to hedge inventory risk and minimize exposure during market volatility. Price takers rely more heavily on stop-loss orders and position sizing to limit downside risk, as they accept prevailing market prices without influencing spreads. Effective risk management for market makers involves dynamic adjustment of quotes in real-time to balance order flow, while price takers focus on execution discipline to avoid adverse price movements.

Job Opportunities for Market Makers and Price Takers

Market makers often find abundant job opportunities in financial institutions, hedge funds, and proprietary trading firms due to their crucial role in providing liquidity and stabilizing markets. Price takers, typically individual traders or passive investors, have fewer specialized job roles but are essential participants in executing market transactions at prevailing prices. The demand for skilled market makers remains high as algorithmic trading and electronic markets expand, while price takers mainly engage through brokerage platforms without direct employment in market-making functions.

Compensation Structures: Comparing the Two Roles

Market makers earn compensation through bid-ask spreads, profiting from the difference between buying and selling prices by providing liquidity to the market. Price takers, on the other hand, typically face transaction fees or commissions without earning spreads, as they execute trades at prevailing market prices. The compensation structure incentivizes market makers to maintain continuous price availability, while price takers prioritize execution speed and cost efficiency.

Career Path Development in Market Making and Price Taking

Market makers develop expertise in liquidity provision, risk management, and order book dynamics, positioning themselves for advanced roles in trading firms or proprietary trading desks. Price takers typically refine skills in execution strategies, market analysis, and client relations, which can lead to careers in brokerage, asset management, or trading support. Both career paths demand deep knowledge of market microstructure, but market making often offers greater exposure to algorithmic trading and market-making technologies.

Market Maker vs Price Taker Infographic

jobdiv.com

jobdiv.com