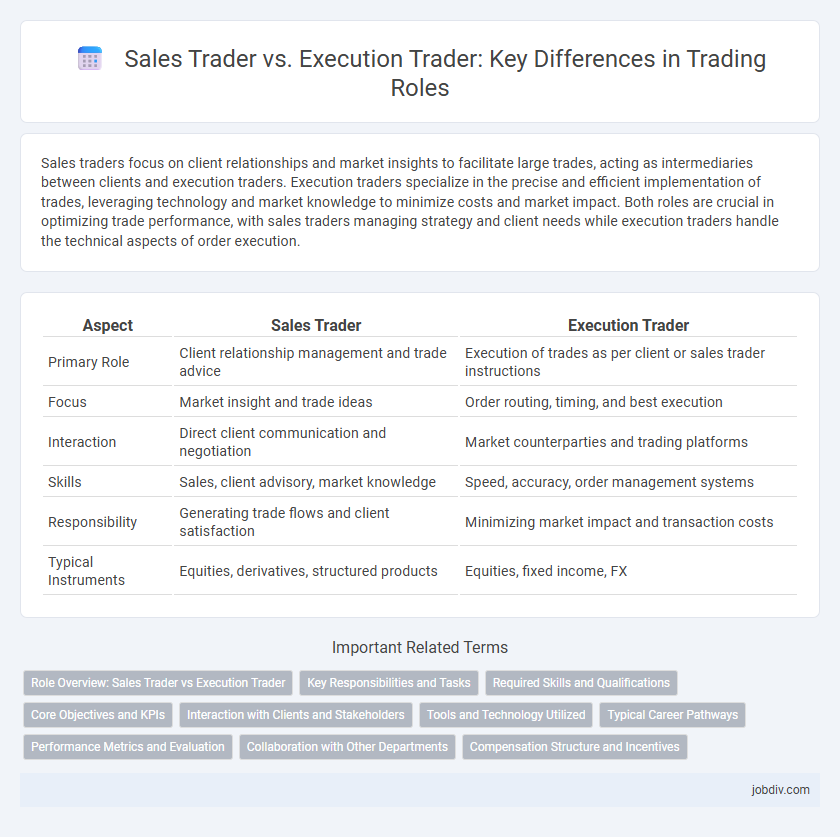

Sales traders focus on client relationships and market insights to facilitate large trades, acting as intermediaries between clients and execution traders. Execution traders specialize in the precise and efficient implementation of trades, leveraging technology and market knowledge to minimize costs and market impact. Both roles are crucial in optimizing trade performance, with sales traders managing strategy and client needs while execution traders handle the technical aspects of order execution.

Table of Comparison

| Aspect | Sales Trader | Execution Trader |

|---|---|---|

| Primary Role | Client relationship management and trade advice | Execution of trades as per client or sales trader instructions |

| Focus | Market insight and trade ideas | Order routing, timing, and best execution |

| Interaction | Direct client communication and negotiation | Market counterparties and trading platforms |

| Skills | Sales, client advisory, market knowledge | Speed, accuracy, order management systems |

| Responsibility | Generating trade flows and client satisfaction | Minimizing market impact and transaction costs |

| Typical Instruments | Equities, derivatives, structured products | Equities, fixed income, FX |

Role Overview: Sales Trader vs Execution Trader

Sales Traders act as intermediaries between clients and markets, providing market insights, trade ideas, and personalized advice to optimize trading strategies. Execution Traders specialize in implementing these trades swiftly and accurately, focusing on minimizing market impact and ensuring best execution. The collaboration between Sales Traders and Execution Traders enhances overall trade efficiency and client satisfaction.

Key Responsibilities and Tasks

Sales Traders focus on client relationship management, providing market insights, and facilitating order flow by advising clients on trading strategies to maximize returns. Execution Traders specialize in the precise and efficient execution of trades, ensuring best pricing and timely transaction completion while managing market impact and risk. Both roles require a deep understanding of market conditions, but Sales Traders emphasize client interaction, whereas Execution Traders prioritize trade implementation.

Required Skills and Qualifications

Sales Traders require strong communication skills, financial market knowledge, and the ability to build client relationships, alongside certifications such as Series 7 or CFA. Execution Traders emphasize proficiency in trading platforms, quick decision-making, risk management, and a deep understanding of market microstructure, often holding qualifications like FINRA licenses. Both roles demand analytical abilities, attention to detail, and the capacity to perform under pressure in fast-paced trading environments.

Core Objectives and KPIs

Sales Traders focus on client relationship management and order generation, prioritizing KPIs such as client acquisition, order flow volume, and revenue growth. Execution Traders specialize in optimizing trade execution, aiming to minimize transaction costs and market impact, with KPIs centered on execution speed, price improvement, and slippage reduction. Both roles collaborate to enhance overall trading efficiency while aligning with firm-wide profitability targets.

Interaction with Clients and Stakeholders

Sales traders cultivate strong relationships with clients by providing market insights, trade ideas, and tailored investment solutions, enhancing client engagement and trust. Execution traders focus on efficiently executing orders with minimal market impact, collaborating closely with sales traders and brokers to ensure optimal trade performance. Both roles require seamless communication and coordination with clients, portfolio managers, and market counterparties to align trading strategies and achieve investment objectives.

Tools and Technology Utilized

Sales traders utilize advanced customer relationship management (CRM) platforms and market analytics tools to facilitate client communication and provide tailored trading strategies. Execution traders rely heavily on algorithmic trading software, direct market access (DMA) systems, and order management systems (OMS) to optimize trade execution speed and minimize market impact. Both roles integrate real-time data feeds and financial technology solutions to enhance trading efficiency and accuracy.

Typical Career Pathways

Sales traders typically start their careers in client-facing roles within investment banks or brokerages, focusing on building relationships and understanding market needs before advancing to senior trading or sales management positions. Execution traders often begin as junior traders or trading assistants, honing skills in order execution, market analysis, and risk management, progressing towards specialized roles such as algorithmic trading or portfolio management. Both pathways emphasize developing deep market knowledge, technical trading expertise, and strong analytical abilities crucial for career advancement in financial trading environments.

Performance Metrics and Evaluation

Sales traders are evaluated primarily on client relationship management and trade facilitation efficiency, with key performance indicators (KPIs) including trade volume, client retention rates, and revenue generation. Execution traders focus on executing orders with minimal market impact and optimal pricing, emphasizing metrics like execution speed, slippage, and transaction cost analysis. Both roles require continuous performance monitoring to align trading strategies with overall market conditions and client objectives.

Collaboration with Other Departments

Sales Traders enhance collaboration with research and sales teams to tailor trading strategies based on client needs, ensuring seamless communication and client satisfaction. Execution Traders work closely with risk management and compliance departments to optimize trade execution while adhering to regulatory requirements. Both roles rely on strong interdepartmental coordination to balance client objectives and market impact effectively.

Compensation Structure and Incentives

Sales traders typically receive a compensation structure that combines a base salary with performance-based bonuses tied to client revenue generation and trade volumes, incentivizing strong client relationships and deal origination. Execution traders are often compensated with a more stable salary and smaller bonuses linked to trade accuracy, market impact minimization, and operational efficiency, promoting execution quality over client acquisition. The distinct incentive frameworks align sales traders with revenue growth targets, while execution traders focus on optimizing transaction costs and risk management.

Sales Trader vs Execution Trader Infographic

jobdiv.com

jobdiv.com