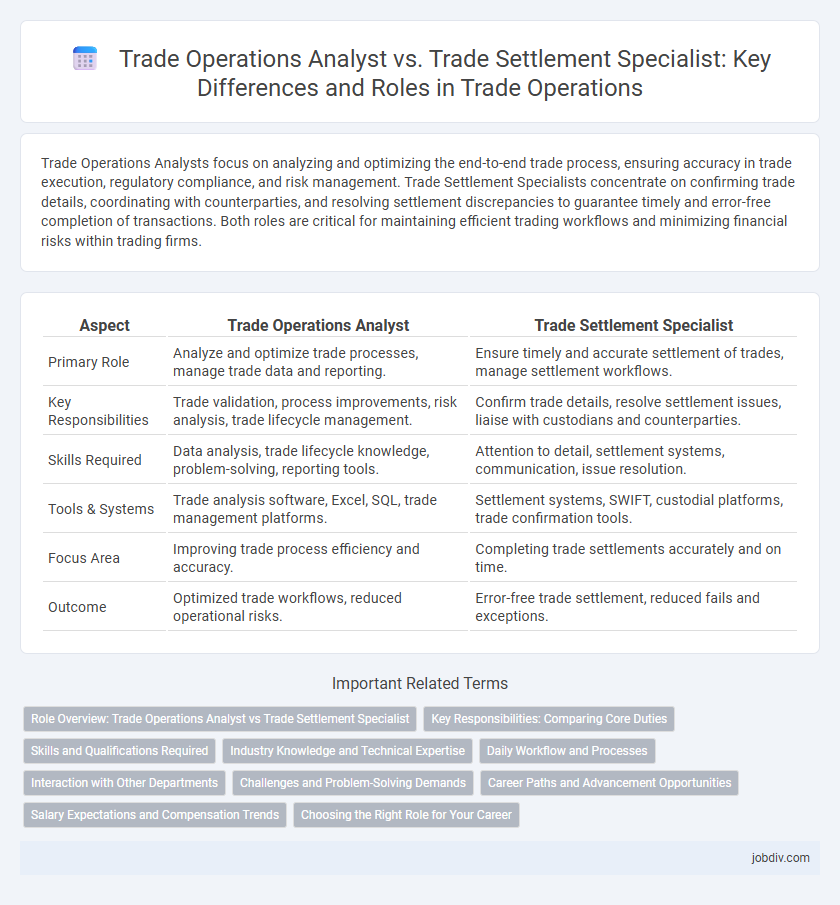

Trade Operations Analysts focus on analyzing and optimizing the end-to-end trade process, ensuring accuracy in trade execution, regulatory compliance, and risk management. Trade Settlement Specialists concentrate on confirming trade details, coordinating with counterparties, and resolving settlement discrepancies to guarantee timely and error-free completion of transactions. Both roles are critical for maintaining efficient trading workflows and minimizing financial risks within trading firms.

Table of Comparison

| Aspect | Trade Operations Analyst | Trade Settlement Specialist |

|---|---|---|

| Primary Role | Analyze and optimize trade processes, manage trade data and reporting. | Ensure timely and accurate settlement of trades, manage settlement workflows. |

| Key Responsibilities | Trade validation, process improvements, risk analysis, trade lifecycle management. | Confirm trade details, resolve settlement issues, liaise with custodians and counterparties. |

| Skills Required | Data analysis, trade lifecycle knowledge, problem-solving, reporting tools. | Attention to detail, settlement systems, communication, issue resolution. |

| Tools & Systems | Trade analysis software, Excel, SQL, trade management platforms. | Settlement systems, SWIFT, custodial platforms, trade confirmation tools. |

| Focus Area | Improving trade process efficiency and accuracy. | Completing trade settlements accurately and on time. |

| Outcome | Optimized trade workflows, reduced operational risks. | Error-free trade settlement, reduced fails and exceptions. |

Role Overview: Trade Operations Analyst vs Trade Settlement Specialist

A Trade Operations Analyst focuses on analyzing trade processes, identifying inefficiencies, and implementing improvements to optimize the overall trade workflow. A Trade Settlement Specialist is responsible for ensuring accurate and timely settlement of trade transactions, resolving discrepancies, and maintaining compliance with regulatory standards. Both roles require strong attention to detail and knowledge of trade lifecycle but differ in operational emphasis, with analysts concentrating on process enhancement and specialists on transaction execution.

Key Responsibilities: Comparing Core Duties

Trade Operations Analysts focus on analyzing trade data, optimizing workflows, and ensuring compliance with regulatory requirements to enhance operational efficiency. Trade Settlement Specialists concentrate on validating trade details, coordinating settlements, and resolving discrepancies to guarantee timely and accurate transaction completion. Both roles require strong attention to detail, but Analysts lean towards data-driven process improvements while Settlement Specialists emphasize precise execution and error resolution in post-trade processes.

Skills and Qualifications Required

Trade Operations Analysts require strong analytical skills, proficiency in financial software, and a deep understanding of market regulations to oversee trade processing and resolve discrepancies. Trade Settlement Specialists need expertise in trade confirmation, settlement procedures, and risk management, along with attention to detail and knowledge of settlement platforms such as SWIFT and DTCC. Both roles demand excellent communication skills, familiarity with compliance standards, and the ability to work under pressure in fast-paced trading environments.

Industry Knowledge and Technical Expertise

Trade Operations Analysts leverage comprehensive industry knowledge, including regulatory compliance and risk management, to optimize trade processes and ensure seamless transaction flows. Trade Settlement Specialists focus on technical expertise in post-trade activities, including trade confirmation, settlement matching, and resolving trade discrepancies to guarantee accurate and timely settlement of securities. Both roles require proficiency in trade lifecycle systems such as SWIFT, FIX protocol, and securities settlement platforms like DTCC and Euroclear to support efficient trade operations.

Daily Workflow and Processes

Trade Operations Analysts focus on monitoring and optimizing trade execution, ensuring accurate trade capture, validation, and compliance with regulatory standards throughout the trading lifecycle. Trade Settlement Specialists manage the post-trade process, coordinating the confirmation, matching, and settlement of transactions to mitigate settlement risk and ensure timely transfer of securities and funds. Daily workflows for analysts emphasize trade flow analysis and exception management, while specialists concentrate on resolving settlement discrepancies and coordinating with custodians and counterparties.

Interaction with Other Departments

Trade Operations Analysts collaborate closely with compliance, risk management, and IT departments to streamline transaction processes and ensure regulatory adherence. Trade Settlement Specialists primarily coordinate with middle and back-office teams, including custodians and clearinghouses, to confirm accurate and timely settlement of trades. Both roles require strong communication skills to resolve discrepancies and maintain seamless trade lifecycle management.

Challenges and Problem-Solving Demands

Trade Operations Analysts face challenges in data accuracy, regulatory compliance, and workflow optimization, requiring strong analytical skills and proficiency in trade processing systems. Trade Settlement Specialists encounter complex trade confirmation, discrepancy resolution, and timely settlement issues, demanding meticulous attention to detail and expertise in settlement protocols. Both roles require problem-solving abilities to address operational risks, resolve trade discrepancies, and ensure seamless transaction execution within dynamic market environments.

Career Paths and Advancement Opportunities

Trade Operations Analysts typically advance by gaining expertise in trade compliance, data analysis, and process optimization, often moving into roles such as Trade Operations Manager or Risk Analyst. Trade Settlement Specialists often progress by developing deep knowledge of settlement processes, regulatory requirements, and exception management, leading to positions like Settlement Manager or Compliance Officer. Both career paths offer opportunities in financial institutions, with advancement depending on proficiency in trade systems, regulatory frameworks, and cross-functional collaboration.

Salary Expectations and Compensation Trends

Trade Operations Analysts typically command higher salary expectations than Trade Settlement Specialists due to their broader responsibilities in managing trade lifecycle processes and analytics. Compensation trends indicate that Trade Operations Analysts benefit from performance bonuses and skill-based pay increases reflective of their strategic role in optimizing trade workflows. Trade Settlement Specialists, while essential for ensuring transaction accuracy and compliance, generally have more stable base salaries with incremental raises tied to tenure and operational efficiency improvements.

Choosing the Right Role for Your Career

Trade Operations Analyst roles emphasize data analysis, process improvement, and risk management, making them ideal for professionals seeking a strategic impact within trading firms or financial institutions. Trade Settlement Specialists focus on ensuring accurate and timely trade confirmations, settlements, and reconciliation, targeting individuals who excel in detail-oriented, compliance-driven environments. Career growth depends on aligning personal strengths with operational analytics in trade flows or transactional accuracy and regulatory adherence in settlements.

Trade Operations Analyst vs Trade Settlement Specialist Infographic

jobdiv.com

jobdiv.com