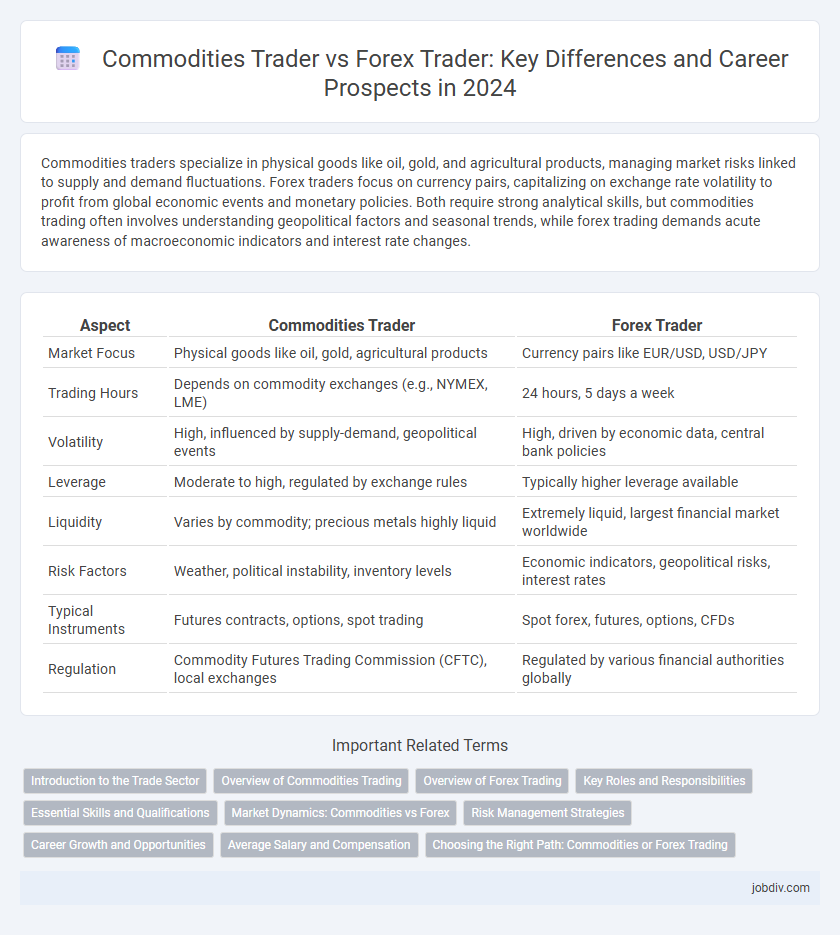

Commodities traders specialize in physical goods like oil, gold, and agricultural products, managing market risks linked to supply and demand fluctuations. Forex traders focus on currency pairs, capitalizing on exchange rate volatility to profit from global economic events and monetary policies. Both require strong analytical skills, but commodities trading often involves understanding geopolitical factors and seasonal trends, while forex trading demands acute awareness of macroeconomic indicators and interest rate changes.

Table of Comparison

| Aspect | Commodities Trader | Forex Trader |

|---|---|---|

| Market Focus | Physical goods like oil, gold, agricultural products | Currency pairs like EUR/USD, USD/JPY |

| Trading Hours | Depends on commodity exchanges (e.g., NYMEX, LME) | 24 hours, 5 days a week |

| Volatility | High, influenced by supply-demand, geopolitical events | High, driven by economic data, central bank policies |

| Leverage | Moderate to high, regulated by exchange rules | Typically higher leverage available |

| Liquidity | Varies by commodity; precious metals highly liquid | Extremely liquid, largest financial market worldwide |

| Risk Factors | Weather, political instability, inventory levels | Economic indicators, geopolitical risks, interest rates |

| Typical Instruments | Futures contracts, options, spot trading | Spot forex, futures, options, CFDs |

| Regulation | Commodity Futures Trading Commission (CFTC), local exchanges | Regulated by various financial authorities globally |

Introduction to the Trade Sector

Commodities traders specialize in buying and selling physical goods such as oil, gold, and agricultural products, leveraging market trends and supply-demand dynamics to maximize profits. Forex traders focus on currency pairs, capitalizing on fluctuations in exchange rates influenced by economic indicators, geopolitical events, and central bank policies. Both roles require deep market analysis and risk management but differ significantly in underlying assets and trading strategies within the trade sector.

Overview of Commodities Trading

Commodities trading involves buying and selling raw materials like oil, gold, and agricultural products on exchanges such as the CME Group or NYMEX. Traders analyze supply and demand factors, geopolitical events, and weather patterns to anticipate price movements and hedge risks. Unlike forex trading, commodities trading often requires a deeper understanding of physical goods markets and seasonal trends.

Overview of Forex Trading

Forex trading involves the exchange of currencies in the global foreign exchange market, which operates 24 hours a day and is the largest financial market by trading volume, exceeding $6 trillion daily. Unlike commodities trading, which focuses on physical goods like oil, gold, or agricultural products, forex traders capitalize on currency price fluctuations influenced by economic indicators, central bank policies, and geopolitical events. The high liquidity and leverage in forex trading create opportunities for significant profits as well as risks, requiring comprehensive market analysis and risk management strategies.

Key Roles and Responsibilities

Commodities traders specialize in buying and selling physical goods like oil, gold, and agricultural products, managing risks associated with price volatility and supply chain logistics. Forex traders focus on currency pairs, analyzing macroeconomic indicators, geopolitical events, and interest rate differentials to capitalize on exchange rate fluctuations. Both roles require strong market analysis, risk management, and decision-making skills, but commodities trading emphasizes physical delivery and inventory management, whereas forex trading centers on leveraging currency movements in a highly liquid global market.

Essential Skills and Qualifications

Commodities traders require deep knowledge of physical markets, supply chain dynamics, and geopolitical factors affecting raw materials like oil, metals, and agricultural products, alongside strong analytical skills and risk management expertise. Forex traders must excel in understanding global macroeconomic indicators, currency pair correlations, and technical analysis, with qualifications often including financial certifications such as the CFA or specialized forex trading courses. Both roles demand sharp decision-making abilities, proficiency in trading platforms, and comprehensive market research skills to execute timely and profitable trades in volatile environments.

Market Dynamics: Commodities vs Forex

Commodities traders operate in markets driven by physical supply and demand factors such as weather, geopolitical events, and production cycles, leading to high volatility and seasonal price fluctuations. Forex traders engage in global currency markets influenced primarily by interest rates, economic indicators, and central bank policies, resulting in continuous 24-hour trading with liquidity concentrated in major currency pairs like EUR/USD and USD/JPY. Understanding the distinct market dynamics of commodities and forex is essential for optimizing trading strategies and managing risk effectively.

Risk Management Strategies

Commodities traders often utilize diversification across energy, metals, and agricultural products combined with stringent stop-loss orders to mitigate volatility risks inherent in physical goods markets. Forex traders prioritize leverage control, currency correlation analysis, and real-time macroeconomic event monitoring to manage the rapid price fluctuations and geopolitical uncertainties affecting currency pairs. Both trader types employ position sizing and technical indicators as integral components of their comprehensive risk management frameworks.

Career Growth and Opportunities

Commodities traders specialize in physical goods like oil, gold, and agricultural products, often benefiting from market volatility and geopolitical factors that drive demand, offering opportunities in global supply chain firms and commodity-focused hedge funds. Forex traders concentrate on currency pairs, leveraging high liquidity and 24-hour market access, which allows career growth in major financial institutions, proprietary trading firms, and multinational corporations involved in currency risk management. Both career paths offer robust earning potential, but commodities trading may require deeper industry-specific knowledge, while forex trading demands strong analytical skills in macroeconomic trends and geopolitical events.

Average Salary and Compensation

Commodities traders typically earn an average salary ranging from $70,000 to $120,000 annually, with total compensation often boosted by bonuses linked to performance and market conditions. Forex traders usually have a slightly higher average salary, between $75,000 and $130,000, with compensation packages frequently including commissions and profit-sharing arrangements. Both roles offer significant earning potential dependent on experience, expertise, and the volatility of their respective markets.

Choosing the Right Path: Commodities or Forex Trading

Commodities trading involves buying and selling physical goods like gold, oil, and agricultural products, appealing to traders who prefer tangible assets and market volatility driven by supply and demand factors. Forex trading focuses on currency pairs in the global foreign exchange market, offering high liquidity, 24-hour trading, and leverage opportunities ideal for those seeking fast-paced market movements and diverse geopolitical influences. Selecting between commodities and forex trading depends on risk tolerance, market knowledge, and investment goals, with commodities often favoring longer-term strategies and forex suited for short-term trading and technical analysis.

Commodities Trader vs Forex Trader Infographic

jobdiv.com

jobdiv.com