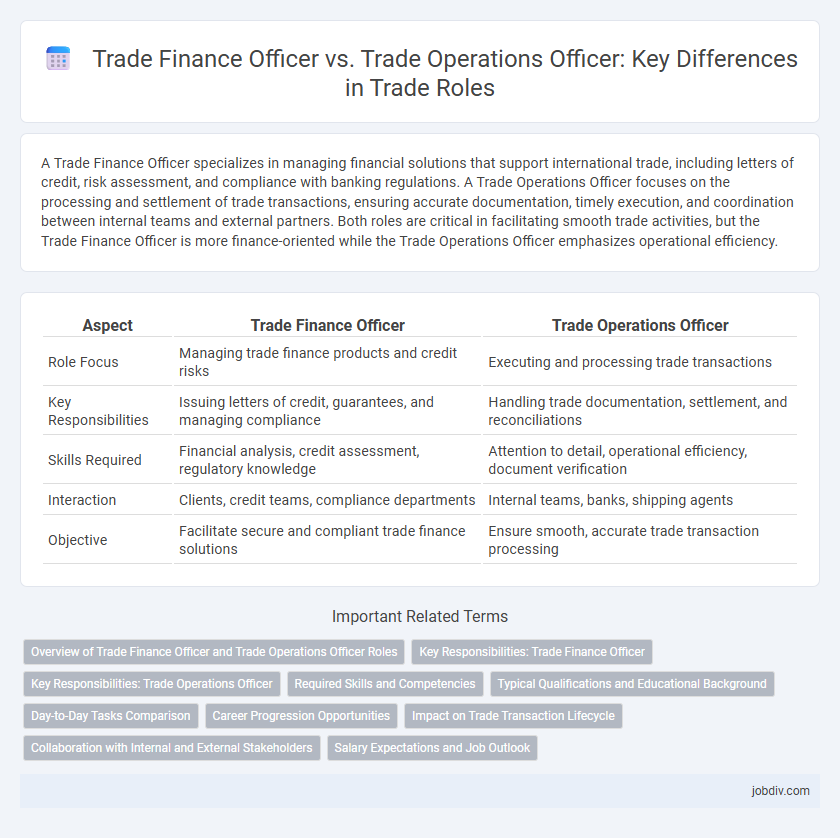

A Trade Finance Officer specializes in managing financial solutions that support international trade, including letters of credit, risk assessment, and compliance with banking regulations. A Trade Operations Officer focuses on the processing and settlement of trade transactions, ensuring accurate documentation, timely execution, and coordination between internal teams and external partners. Both roles are critical in facilitating smooth trade activities, but the Trade Finance Officer is more finance-oriented while the Trade Operations Officer emphasizes operational efficiency.

Table of Comparison

| Aspect | Trade Finance Officer | Trade Operations Officer |

|---|---|---|

| Role Focus | Managing trade finance products and credit risks | Executing and processing trade transactions |

| Key Responsibilities | Issuing letters of credit, guarantees, and managing compliance | Handling trade documentation, settlement, and reconciliations |

| Skills Required | Financial analysis, credit assessment, regulatory knowledge | Attention to detail, operational efficiency, document verification |

| Interaction | Clients, credit teams, compliance departments | Internal teams, banks, shipping agents |

| Objective | Facilitate secure and compliant trade finance solutions | Ensure smooth, accurate trade transaction processing |

Overview of Trade Finance Officer and Trade Operations Officer Roles

Trade Finance Officers specialize in managing financial products such as letters of credit, guarantees, and documentary collections to facilitate international trade transactions and mitigate associated risks. Trade Operations Officers focus on the execution and processing of trade transactions, ensuring compliance with regulatory requirements and accurate documentation handling. Both roles are pivotal in maintaining seamless trade workflows, with the Trade Finance Officer emphasizing financial risk assessment and structuring, while the Trade Operations Officer concentrates on operational efficiency and control.

Key Responsibilities: Trade Finance Officer

Trade Finance Officers primarily manage the assessment, processing, and approval of trade financing applications, ensuring compliance with financial regulations and mitigating risks related to letters of credit, export financing, and guarantees. They collaborate closely with clients, banks, and internal departments to facilitate smooth transaction flows and optimize cash management strategies. Their expertise includes analyzing creditworthiness, documentation verification, and maintaining adherence to international trade finance standards such as UCP 600 and ISBP.

Key Responsibilities: Trade Operations Officer

Trade Operations Officers manage the end-to-end processing of international trade transactions, ensuring compliance with regulatory standards and alignment with internal policies. Their responsibilities include verifying trade documents, coordinating shipment logistics, and liaising with banks and customs to facilitate smooth transaction flow. They play a crucial role in risk mitigation by monitoring trade finance activities and resolving discrepancies promptly.

Required Skills and Competencies

Trade Finance Officers require strong expertise in credit assessment, risk management, and knowledge of international trade regulations to facilitate financing solutions and ensure compliance. Trade Operations Officers must excel in transaction processing, documentation accuracy, and coordination between various departments to streamline trade workflows and mitigate operational risks. Both roles demand proficiency in financial software, attention to detail, and effective communication skills to support seamless trade execution.

Typical Qualifications and Educational Background

Trade Finance Officers typically hold degrees in finance, economics, or business administration, often supported by certifications like Certified Trade Finance Professional (CTFP). Trade Operations Officers usually have a background in finance, supply chain management, or business operations, with practical experience in trade documentation and compliance. Both roles benefit from strong analytical skills and knowledge of international trade regulations, but Trade Finance Officers focus more on credit risk and financing instruments.

Day-to-Day Tasks Comparison

Trade Finance Officers manage credit risk assessment, process letters of credit, and facilitate payment terms between importers and exporters to ensure smooth financial transactions. Trade Operations Officers handle transaction settlements, document verification, and compliance monitoring to maintain operational accuracy and regulatory adherence. Both roles are essential for efficient trade execution, with Trade Finance Officers focusing on financial structuring and Trade Operations Officers on transactional processing.

Career Progression Opportunities

Trade Finance Officers typically advance by gaining expertise in risk assessment, credit analysis, and client relationship management, leading to roles such as Senior Trade Finance Manager or Head of Trade Finance. Trade Operations Officers often progress by mastering transaction processing, compliance, and workflow optimization, moving into positions like Trade Operations Manager or Head of Trade Operations. Both career paths offer opportunities for specialization in international trade regulations, technology integration, and leadership roles within global financial institutions.

Impact on Trade Transaction Lifecycle

Trade Finance Officers directly influence the trade transaction lifecycle by managing financing arrangements, ensuring payment security, and facilitating letters of credit and guarantees. Trade Operations Officers primarily handle the execution phase, overseeing transaction documentation, shipment tracking, and compliance with trade regulations. Both roles are critical for seamless transaction processing, but the Finance Officer focuses on risk mitigation and funding, while the Operations Officer ensures operational efficiency and regulatory adherence.

Collaboration with Internal and External Stakeholders

Trade Finance Officers collaborate closely with internal credit, risk, and compliance teams to structure and approve trade finance solutions, ensuring adherence to regulatory requirements. Trade Operations Officers work directly with external parties such as banks, shipping companies, and customs authorities to execute and monitor trade transactions efficiently. Both roles require seamless communication and coordination to maintain transaction integrity and mitigate operational risks across the trade lifecycle.

Salary Expectations and Job Outlook

Trade Finance Officers typically earn higher salaries, ranging from $60,000 to $90,000 annually, due to their expertise in managing complex financial instruments and risk assessment in international trade. Trade Operations Officers, with a salary range of $50,000 to $75,000, focus more on processing transactions and ensuring compliance with trade regulations, reflecting a slightly lower pay scale but strong job stability. The job outlook for both roles remains positive, driven by the continuous growth in global trade and the increasing need for efficient trade finance and operations management.

Trade Finance Officer vs Trade Operations Officer Infographic

jobdiv.com

jobdiv.com