A commodity trader specializes in buying and selling raw materials such as oil, metals, and agricultural products, focusing on market factors like supply, demand, and geopolitical events. An equity trader deals with stocks and shares, analyzing company performance, earnings reports, and market trends to make investment decisions. Both roles require strong analytical skills, but commodity traders often navigate more volatile markets influenced by external factors beyond corporate fundamentals.

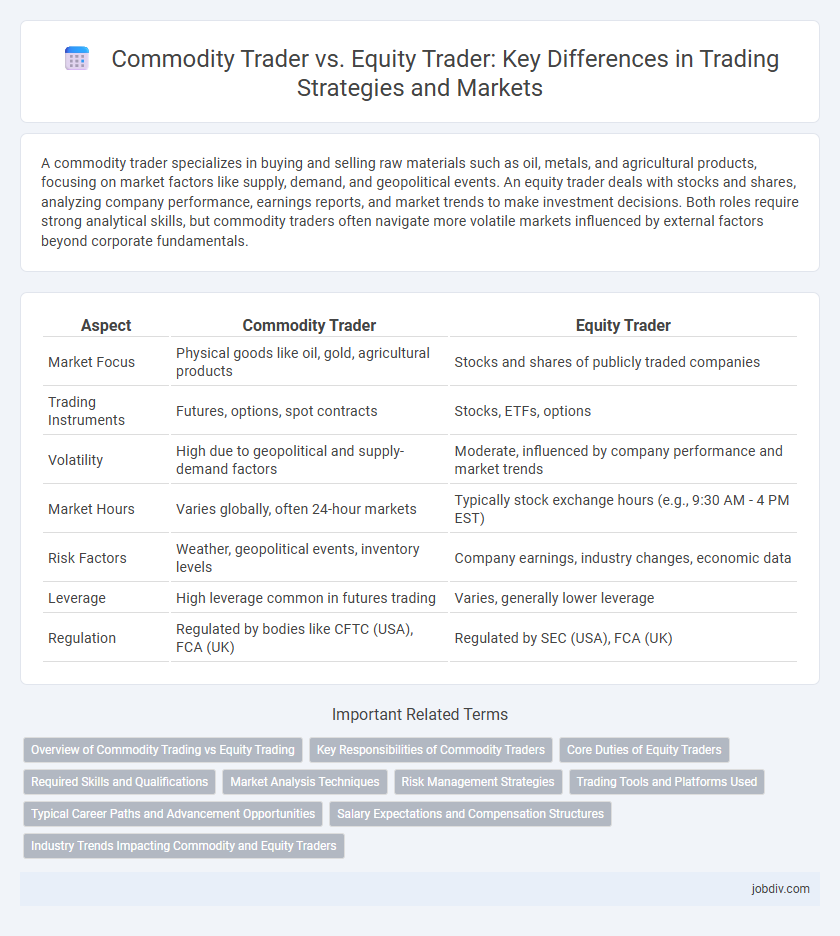

Table of Comparison

| Aspect | Commodity Trader | Equity Trader |

|---|---|---|

| Market Focus | Physical goods like oil, gold, agricultural products | Stocks and shares of publicly traded companies |

| Trading Instruments | Futures, options, spot contracts | Stocks, ETFs, options |

| Volatility | High due to geopolitical and supply-demand factors | Moderate, influenced by company performance and market trends |

| Market Hours | Varies globally, often 24-hour markets | Typically stock exchange hours (e.g., 9:30 AM - 4 PM EST) |

| Risk Factors | Weather, geopolitical events, inventory levels | Company earnings, industry changes, economic data |

| Leverage | High leverage common in futures trading | Varies, generally lower leverage |

| Regulation | Regulated by bodies like CFTC (USA), FCA (UK) | Regulated by SEC (USA), FCA (UK) |

Overview of Commodity Trading vs Equity Trading

Commodity trading involves buying and selling physical goods such as oil, gold, and agricultural products, often through futures contracts to hedge against price volatility and supply risks. Equity trading focuses on purchasing and selling shares of publicly listed companies, aiming to capitalize on company performance and market trends. The commodity market is influenced by factors like weather and geopolitical events, while equity markets respond more to corporate earnings, economic indicators, and investor sentiment.

Key Responsibilities of Commodity Traders

Commodity traders manage the buying and selling of physical goods such as oil, metals, and agricultural products, ensuring timely delivery and compliance with market regulations. They analyze global supply and demand trends, geopolitical risks, and weather patterns to make informed trading decisions and optimize profit margins. Risk management and contract negotiation are critical responsibilities, requiring close coordination with suppliers, logistics providers, and regulatory bodies.

Core Duties of Equity Traders

Equity traders specialize in buying and selling stocks on behalf of clients or institutions, focusing on market analysis, order execution, and portfolio management to maximize returns. Their core duties include monitoring real-time market data, researching company performance, and making swift decisions to capitalize on market trends. Unlike commodity traders who deal with physical goods like oil or metals, equity traders primarily engage with financial securities, emphasizing strategic investment in equity markets.

Required Skills and Qualifications

Commodity traders require strong analytical skills, in-depth knowledge of supply and demand dynamics, and expertise in risk management strategies specific to physical goods like oil, metals, and agricultural products. Equity traders must possess a solid understanding of financial markets, proficiency in technical and fundamental analysis, and the ability to interpret economic indicators that impact stock prices. Both roles benefit from excellent decision-making abilities under pressure, strong quantitative skills, and relevant certifications such as the Series 7 for equity traders or the Chartered Market Technician (CMT) for commodity traders.

Market Analysis Techniques

Commodity traders utilize technical analysis centered on price patterns, volume, and seasonal trends influenced by supply-demand dynamics, while equity traders often emphasize fundamental analysis, evaluating financial statements, earnings reports, and macroeconomic indicators. Both trader types employ quantitative models and sentiment analysis but adapt tools to the specific volatility and market drivers of commodities such as oil, metals, or agricultural products versus equities. Advanced methods include algorithmic trading and real-time data analytics tailored to the unique liquidity and market microstructure of commodity futures and stock markets.

Risk Management Strategies

Commodity traders employ risk management strategies such as futures contracts and options to hedge against price volatility influenced by factors like weather and geopolitical events. Equity traders focus on diversification and stop-loss orders to manage market risks linked to corporate performance and economic indicators. Both use value at risk (VaR) models and scenario analysis to quantify potential losses and protect investment portfolios.

Trading Tools and Platforms Used

Commodity traders primarily use specialized platforms such as CQG, TradeStation, and the CME Globex system, which offer advanced analytics and real-time data tailored to futures and options on physical goods like oil, metals, and agricultural products. Equity traders rely on platforms like E*TRADE, TD Ameritrade, and Interactive Brokers, featuring robust market data, stock screeners, and algorithmic trading capabilities optimized for stocks and ETFs. Both types of traders leverage high-frequency trading algorithms and risk management software, but the choice of tools reflects the distinct market structures and asset characteristics in commodities versus equities trading.

Typical Career Paths and Advancement Opportunities

Commodity traders typically begin as analysts or brokers specializing in physical goods like oil, metals, or agricultural products, advancing to senior trading roles by developing expertise in market fundamentals and risk management. Equity traders often start as junior analysts or assistants in stock firms, leveraging financial modeling and equity research skills to progress toward portfolio management or hedge fund positions. Both career paths offer advancement through demonstrated profitability, strategic decision-making, and mastery of regulatory compliance in their respective markets.

Salary Expectations and Compensation Structures

Commodity traders often receive higher base salaries and performance bonuses linked to market volatility and global supply-demand dynamics, reflecting the inherent risks and complexities of physical goods trading. Equity traders typically earn compensation structures emphasizing commissions, profit-sharing, and stock options based on transaction volumes and market liquidity in financial securities. Salary expectations for commodity traders generally surpass those of equity traders in emerging markets due to the specialized knowledge and volatile price movements in commodities trading.

Industry Trends Impacting Commodity and Equity Traders

Commodity traders are increasingly influenced by global supply chain fluctuations and geopolitical tensions, which drive price volatility in energy, metals, and agricultural products. Equity traders face growing challenges from algorithmic trading and regulatory changes affecting market liquidity and transparency. Both sectors must adapt to technological advancements and shifting economic policies that reshape market dynamics and risk management strategies.

Commodity Trader vs Equity Trader Infographic

jobdiv.com

jobdiv.com