Trade Finance Managers focus on facilitating and overseeing the financing of international trade transactions, ensuring liquidity and compliance with banking regulations. Trade Risk Managers specialize in identifying, assessing, and mitigating risks related to cross-border trade, including credit, market, and operational risks. Collaboration between these roles enhances the security and efficiency of global trade operations.

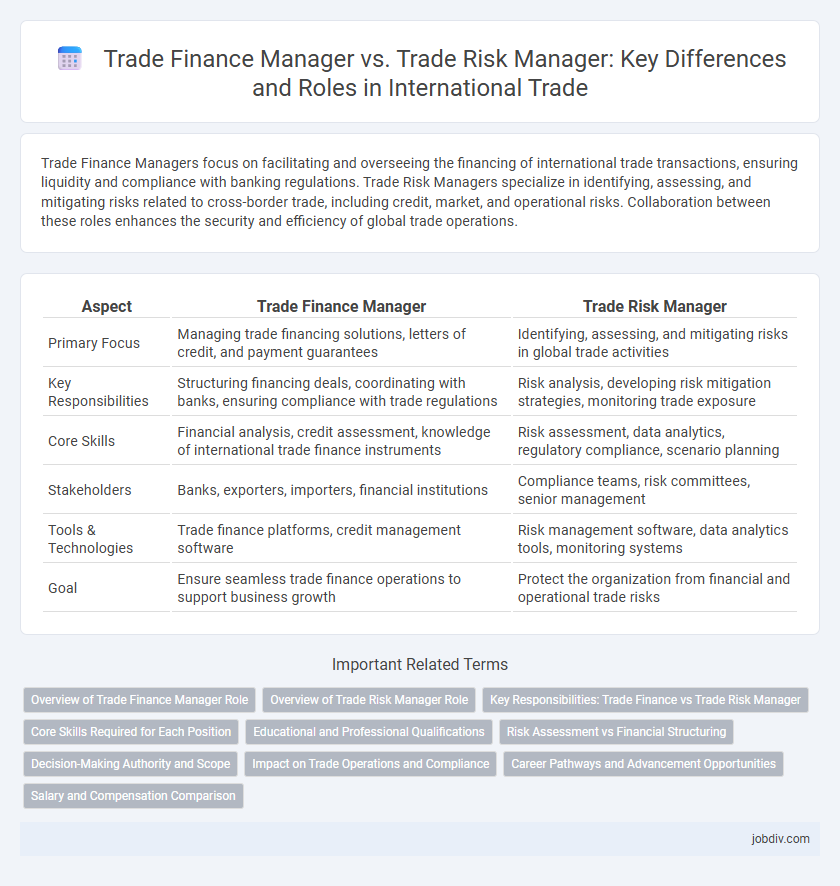

Table of Comparison

| Aspect | Trade Finance Manager | Trade Risk Manager |

|---|---|---|

| Primary Focus | Managing trade financing solutions, letters of credit, and payment guarantees | Identifying, assessing, and mitigating risks in global trade activities |

| Key Responsibilities | Structuring financing deals, coordinating with banks, ensuring compliance with trade regulations | Risk analysis, developing risk mitigation strategies, monitoring trade exposure |

| Core Skills | Financial analysis, credit assessment, knowledge of international trade finance instruments | Risk assessment, data analytics, regulatory compliance, scenario planning |

| Stakeholders | Banks, exporters, importers, financial institutions | Compliance teams, risk committees, senior management |

| Tools & Technologies | Trade finance platforms, credit management software | Risk management software, data analytics tools, monitoring systems |

| Goal | Ensure seamless trade finance operations to support business growth | Protect the organization from financial and operational trade risks |

Overview of Trade Finance Manager Role

Trade Finance Managers oversee and facilitate international or domestic trade transactions by securing financing solutions such as letters of credit, guarantees, and export credit to ensure smooth payment flows and risk mitigation. They collaborate closely with banks, importers, exporters, and corporate clients to structure trade deals that optimize working capital and compliance with regulatory requirements. Their role involves monitoring trade finance products, managing credit exposure, and ensuring documentation aligns with trade policies and global trade laws.

Overview of Trade Risk Manager Role

The Trade Risk Manager oversees the identification, assessment, and mitigation of risks associated with international trade transactions, ensuring compliance with regulatory requirements and minimizing financial losses. This role involves analyzing credit, operational, and geopolitical risks while collaborating with trade finance, legal, and compliance teams to develop risk management strategies. Expertise in trade regulations, risk assessment models, and financial instruments is essential for effectively safeguarding the organization's trade operations.

Key Responsibilities: Trade Finance vs Trade Risk Manager

Trade Finance Managers oversee the structuring, negotiation, and facilitation of financial instruments such as letters of credit, guarantees, and export financing to support international trade transactions. Trade Risk Managers focus on identifying, assessing, and mitigating risks related to currency fluctuations, credit exposure, compliance, and geopolitical factors that impact global trade operations. While Trade Finance addresses transaction funding and liquidity, Trade Risk emphasizes safeguarding assets and ensuring regulatory adherence in cross-border trade activities.

Core Skills Required for Each Position

Trade Finance Managers require expertise in credit analysis, financial structuring, and compliance with international trade regulations to efficiently manage trade transactions and financing solutions. Trade Risk Managers focus on identifying, assessing, and mitigating risks associated with trade operations, demanding strong skills in risk assessment, market analysis, and regulatory knowledge. Both roles necessitate proficiency in financial reporting, stakeholder communication, and a deep understanding of global trade policies.

Educational and Professional Qualifications

Trade Finance Managers typically hold degrees in finance, economics, or business administration and often possess certifications such as Certified Trade Finance Professional (CTFP) or Chartered Financial Analyst (CFA). Trade Risk Managers usually have backgrounds in risk management, finance, or economics, with professional qualifications including Financial Risk Manager (FRM) or Professional Risk Manager (PRM). Both roles require strong analytical skills and experience in international trade regulations, but Trade Finance Managers focus more on transaction facilitation while Trade Risk Managers emphasize risk assessment and mitigation.

Risk Assessment vs Financial Structuring

Trade Finance Managers specialize in financial structuring by designing and managing credit facilities, letters of credit, and payment terms that optimize cash flow and support international trade transactions. Trade Risk Managers focus on comprehensive risk assessment, evaluating geopolitical, credit, and operational risks to mitigate potential losses and ensure compliance with regulatory standards. Both roles are critical in global trade, balancing financial strategy with risk mitigation to safeguard company assets and facilitate smooth cross-border trade operations.

Decision-Making Authority and Scope

Trade Finance Managers hold significant decision-making authority over the structuring and execution of trade finance transactions, managing credit limits, and negotiating terms with banks and clients. Trade Risk Managers focus on identifying, assessing, and mitigating risks related to trade activities, including credit, operational, and compliance risks within a broader risk management framework. The scope of Trade Finance Managers centers on facilitating and optimizing trade deals, while Trade Risk Managers oversee risk policies and ensure regulatory adherence across the entire trade finance portfolio.

Impact on Trade Operations and Compliance

Trade Finance Managers streamline trade operations by facilitating payment processes, credit assessments, and ensuring liquidity for seamless international transactions. Trade Risk Managers focus on identifying, evaluating, and mitigating risks related to credit, compliance, and geopolitical factors to protect the organization from financial and regulatory penalties. Both roles are critical for maintaining operational efficiency and adherence to international trade regulations, minimizing disruptions and enhancing compliance frameworks.

Career Pathways and Advancement Opportunities

Trade Finance Managers specialize in facilitating global transactions by managing letters of credit, payment terms, and financing solutions, paving a clear career path towards senior treasury or finance director roles. Trade Risk Managers focus on identifying and mitigating risks associated with international trade, such as credit risk, currency fluctuations, and compliance issues, often advancing to senior risk management or chief risk officer positions. Both roles offer advancement opportunities in multinational corporations, with Trade Finance Managers leaning towards financial operations leadership and Trade Risk Managers towards strategic risk advisory and governance.

Salary and Compensation Comparison

Trade Finance Managers typically earn higher base salaries compared to Trade Risk Managers due to their direct involvement in structuring complex financing deals and managing client relationships. Trade Finance Manager salaries average between $90,000 and $130,000 annually, with bonuses often comprising 15-25% of total compensation. Trade Risk Managers usually command salaries in the range of $80,000 to $110,000, with variable pay linked to risk mitigation performance and operational compliance outcomes.

Trade Finance Manager vs Trade Risk Manager Infographic

jobdiv.com

jobdiv.com