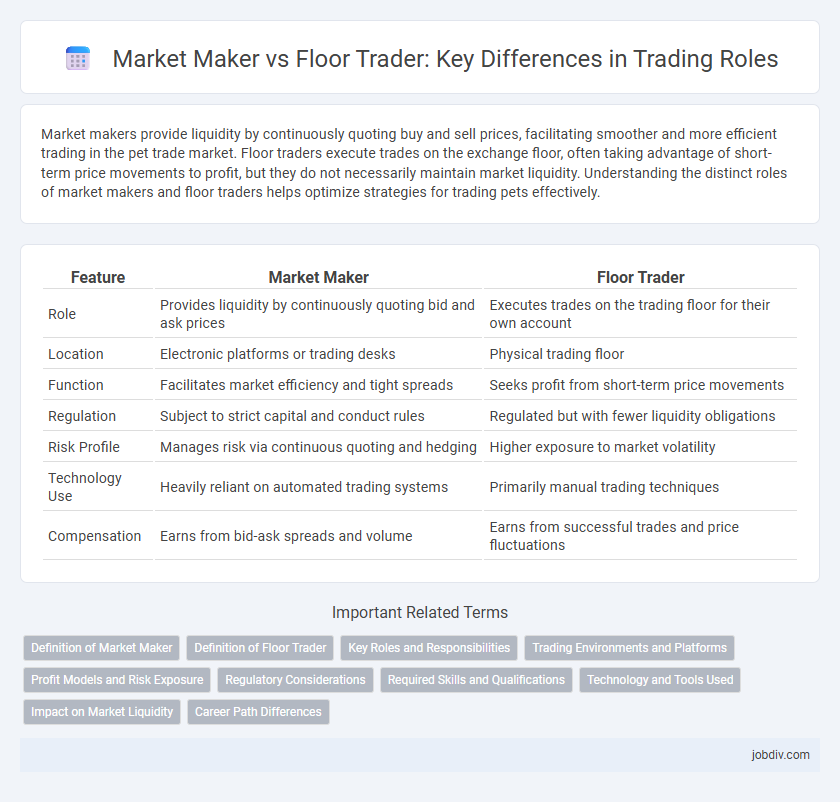

Market makers provide liquidity by continuously quoting buy and sell prices, facilitating smoother and more efficient trading in the pet trade market. Floor traders execute trades on the exchange floor, often taking advantage of short-term price movements to profit, but they do not necessarily maintain market liquidity. Understanding the distinct roles of market makers and floor traders helps optimize strategies for trading pets effectively.

Table of Comparison

| Feature | Market Maker | Floor Trader |

|---|---|---|

| Role | Provides liquidity by continuously quoting bid and ask prices | Executes trades on the trading floor for their own account |

| Location | Electronic platforms or trading desks | Physical trading floor |

| Function | Facilitates market efficiency and tight spreads | Seeks profit from short-term price movements |

| Regulation | Subject to strict capital and conduct rules | Regulated but with fewer liquidity obligations |

| Risk Profile | Manages risk via continuous quoting and hedging | Higher exposure to market volatility |

| Technology Use | Heavily reliant on automated trading systems | Primarily manual trading techniques |

| Compensation | Earns from bid-ask spreads and volume | Earns from successful trades and price fluctuations |

Definition of Market Maker

A Market Maker is a financial intermediary that continuously quotes both buy and sell prices for a specific security, providing liquidity and facilitating smoother market transactions. Unlike Floor Traders, who execute trades on the exchange floor primarily for their own accounts, Market Makers assume risk by holding inventories of the securities they trade to ensure market efficiency. This role is crucial in minimizing bid-ask spreads and maintaining orderly market function.

Definition of Floor Trader

A floor trader is a professional trader who operates on the trading floor of an exchange, executing buy and sell orders on behalf of their own account to capitalize on short-term price movements. Unlike market makers who provide liquidity by continuously quoting bids and offers, floor traders rely on their expertise and access to the physical trading environment to make strategic trades. Floor traders play a crucial role in price discovery and market efficiency through their active participation in open outcry trading.

Key Roles and Responsibilities

Market makers provide liquidity by continuously quoting buy and sell prices for securities, ensuring smooth market operations and reducing bid-ask spreads. Floor traders execute orders on the exchange floor, often trading for their own accounts to capitalize on short-term price fluctuations and support price discovery. Both roles are essential for market efficiency, with market makers stabilizing prices and floor traders enhancing market depth through active trading.

Trading Environments and Platforms

Market makers operate primarily in electronic trading platforms, providing liquidity by continuously quoting bid and ask prices, ensuring smooth and efficient market functioning. Floor traders trade in physical exchange environments, such as open outcry pits, relying on real-time face-to-face interactions and manual order execution to capitalize on short-term price movements. The shift from traditional floor trading to electronic platforms has significantly increased market accessibility, speed, and transparency, favoring market maker models in modern trading ecosystems.

Profit Models and Risk Exposure

Market makers generate profits primarily through the bid-ask spread by continuously providing liquidity and managing inventory risk, benefiting from high-frequency trading strategies that capitalize on small price movements. Floor traders, on the other hand, rely on directional bets and short-term market trends, seeking larger but less frequent profits with higher exposure to market volatility and adverse price swings. While market makers generally face lower risk due to balanced order flow and hedging techniques, floor traders accept greater risk for the potential of substantial returns in rapidly changing market environments.

Regulatory Considerations

Market makers are subject to stringent regulatory requirements, including capital adequacy, continuous quoting obligations, and transparency standards mandated by the SEC and FINRA to ensure market stability and investor protection. Floor traders face regulatory oversight primarily related to compliance with exchange rules, reporting requirements, and maintaining fair trading practices on the trading floor. Both roles must adhere to anti-manipulation laws and conflict-of-interest regulations designed to uphold market integrity and prevent abusive trading behaviors.

Required Skills and Qualifications

Market makers require strong quantitative skills, proficiency in algorithmic trading, and a deep understanding of market microstructure to provide continuous liquidity and manage risk effectively. Floor traders need excellent decision-making abilities, quick reflexes, and comprehensive knowledge of trading regulations to execute orders efficiently on the exchange floor. Both roles demand strong analytical skills, but market makers often emphasize technology and data analysis, while floor traders focus on real-time market dynamics and interpersonal communication.

Technology and Tools Used

Market makers leverage sophisticated algorithmic trading platforms, real-time data analytics, and high-frequency trading systems to provide liquidity and execute large volumes of trades efficiently. Floor traders primarily rely on direct, physical access to exchange pits, using handheld devices and open outcry communication methods to execute trades in real-time. The technological gap between market makers and floor traders highlights a shift towards automation and electronic trading infrastructures in modern financial markets.

Impact on Market Liquidity

Market makers contribute significantly to market liquidity by continuously quoting buy and sell prices, ensuring tighter bid-ask spreads and facilitating smoother transactions. Floor traders, operating primarily on exchange trading floors, impact liquidity through high-frequency trading strategies and rapid order execution within specific time frames. The combined presence of market makers and floor traders enhances overall market efficiency and depth, benefiting both institutional and retail investors.

Career Path Differences

Market makers typically build careers within financial institutions or broker-dealers, specializing in providing continuous liquidity and managing bid-ask spreads using advanced algorithms and risk management strategies. Floor traders often start on exchange trading floors or futures markets, acquiring skills in rapid decision-making and physical contract handling, with a path that may lead to proprietary trading or brokerage roles. The career trajectory for market makers emphasizes technology-driven trading and risk analytics, while floor traders focus on market intuition and direct interaction within trading pits.

Market Maker vs Floor Trader Infographic

jobdiv.com

jobdiv.com