Commodity traders specialize in buying and selling physical goods such as oil, metals, and agricultural products, focusing on market supply, demand, and price fluctuations of tangible assets. Securities traders deal primarily with financial instruments like stocks, bonds, and options, analyzing market trends and company performance to execute trades. Both roles require keen market insight and risk management but differ significantly in the nature of the assets traded and the factors influencing their value.

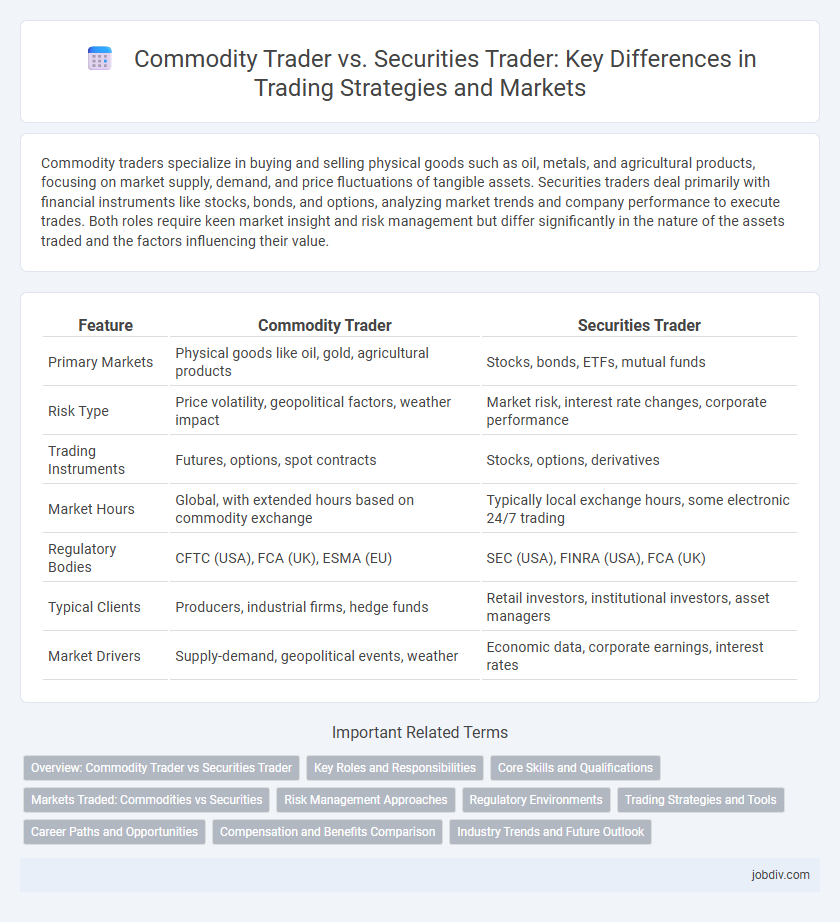

Table of Comparison

| Feature | Commodity Trader | Securities Trader |

|---|---|---|

| Primary Markets | Physical goods like oil, gold, agricultural products | Stocks, bonds, ETFs, mutual funds |

| Risk Type | Price volatility, geopolitical factors, weather impact | Market risk, interest rate changes, corporate performance |

| Trading Instruments | Futures, options, spot contracts | Stocks, options, derivatives |

| Market Hours | Global, with extended hours based on commodity exchange | Typically local exchange hours, some electronic 24/7 trading |

| Regulatory Bodies | CFTC (USA), FCA (UK), ESMA (EU) | SEC (USA), FINRA (USA), FCA (UK) |

| Typical Clients | Producers, industrial firms, hedge funds | Retail investors, institutional investors, asset managers |

| Market Drivers | Supply-demand, geopolitical events, weather | Economic data, corporate earnings, interest rates |

Overview: Commodity Trader vs Securities Trader

Commodity traders specialize in buying and selling physical goods such as oil, metals, and agricultural products, often dealing with futures contracts to hedge market risks. Securities traders focus on financial instruments including stocks, bonds, and derivatives, operating primarily within stock exchanges and electronic platforms. Both roles require sharp market analysis skills but differ in asset types, trading strategies, and regulatory environments.

Key Roles and Responsibilities

Commodity traders specialize in buying and selling physical goods such as oil, metals, and agricultural products, managing supply chain risks and market fluctuations. Securities traders focus on trading financial instruments like stocks, bonds, and derivatives, analyzing market trends and executing high-frequency trades. Both roles require strong analytical skills, risk management strategies, and deep market knowledge to maximize profits and minimize losses.

Core Skills and Qualifications

Commodity traders require strong analytical skills, in-depth knowledge of global supply chains, and expertise in market trends related to physical goods like oil, metals, and agricultural products. Securities traders focus on proficiency in financial instruments, regulatory compliance, and the ability to interpret market data for stocks, bonds, and derivatives. Both roles demand strong risk management capabilities, attention to detail, and effective decision-making under pressure to optimize trading outcomes.

Markets Traded: Commodities vs Securities

Commodity traders primarily operate in physical goods markets including energy, metals, and agricultural products, engaging in futures contracts and spot trading. Securities traders focus on financial markets involving stocks, bonds, options, and other derivative instruments, executing trades on exchanges like NYSE and NASDAQ. The distinct nature of commodities versus securities markets influences risk profiles, regulatory environments, and trading strategies employed by each type of trader.

Risk Management Approaches

Commodity traders implement risk management strategies such as hedging with futures contracts and options to mitigate the impact of price volatility in physical goods like oil, metals, and agricultural products. Securities traders focus on portfolio diversification, stop-loss orders, and market analysis to manage risks linked to equities, bonds, and derivatives. Both types utilize real-time market data and volatility modeling but adjust their approaches based on asset liquidity and regulatory frameworks.

Regulatory Environments

Commodity traders operate under regulatory bodies such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), which enforce strict rules on futures contracts and derivatives trading. Securities traders are regulated by the Securities and Exchange Commission (SEC) and must comply with the Securities Act of 1933 and the Securities Exchange Act of 1934, focusing on transparency and investor protection. Differences in regulatory frameworks impact reporting requirements, permissible instruments, and risk management practices in commodity versus securities trading.

Trading Strategies and Tools

Commodity traders use futures contracts, options, and physical delivery strategies to manage price volatility in raw materials like oil, metals, and agricultural products. Securities traders focus on equities, bonds, and derivatives, applying technical analysis, algorithmic trading, and portfolio diversification to maximize returns. Both rely on market data platforms, risk management software, and real-time analytics tools to inform decision-making and execute trades efficiently.

Career Paths and Opportunities

Commodity traders specialize in buying and selling physical goods like oil, metals, and agricultural products, often requiring expertise in global supply chains and market volatility. Securities traders deal primarily with financial instruments such as stocks, bonds, and derivatives, focusing on market analysis and regulatory compliance. Career opportunities for commodity traders often arise in industries like energy and agriculture, while securities traders find roles in investment banks, hedge funds, and brokerage firms.

Compensation and Benefits Comparison

Commodity traders typically earn higher base salaries and benefit from substantial performance-based bonuses linked to market volatility and deal size, reflecting the high-risk nature of commodities markets. Securities traders often receive compensation packages that combine base pay with bonuses tied to trade volume and profitability, alongside benefits like health insurance and retirement plans common in financial institutions. Both roles may offer stock options or profit-sharing, but commodity traders generally experience greater income variability due to fluctuating commodity prices.

Industry Trends and Future Outlook

Commodity traders navigate volatile markets influenced by geopolitical tensions and climate change impacts on supply chains, driving increased demand for real-time data analytics and sustainable trading practices. Securities traders face growing integration of artificial intelligence and algorithmic trading, enhancing speed and precision while intensifying regulatory scrutiny on market manipulation and transparency. Future industry trends indicate a convergence of technology-driven strategies across both sectors, emphasizing risk management, environmental, social, and governance (ESG) factors, and expanded use of blockchain for secure transaction settlements.

Commodity Trader vs Securities Trader Infographic

jobdiv.com

jobdiv.com