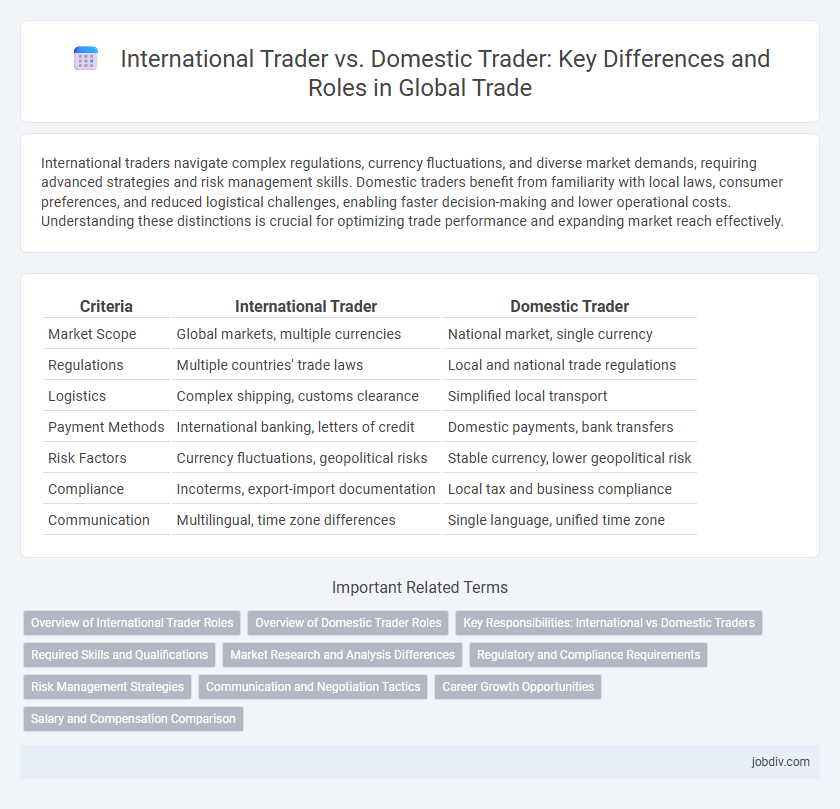

International traders navigate complex regulations, currency fluctuations, and diverse market demands, requiring advanced strategies and risk management skills. Domestic traders benefit from familiarity with local laws, consumer preferences, and reduced logistical challenges, enabling faster decision-making and lower operational costs. Understanding these distinctions is crucial for optimizing trade performance and expanding market reach effectively.

Table of Comparison

| Criteria | International Trader | Domestic Trader |

|---|---|---|

| Market Scope | Global markets, multiple currencies | National market, single currency |

| Regulations | Multiple countries' trade laws | Local and national trade regulations |

| Logistics | Complex shipping, customs clearance | Simplified local transport |

| Payment Methods | International banking, letters of credit | Domestic payments, bank transfers |

| Risk Factors | Currency fluctuations, geopolitical risks | Stable currency, lower geopolitical risk |

| Compliance | Incoterms, export-import documentation | Local tax and business compliance |

| Communication | Multilingual, time zone differences | Single language, unified time zone |

Overview of International Trader Roles

International traders manage cross-border transactions, navigating complex regulations, tariffs, and currency fluctuations to facilitate global trade. They coordinate logistics, negotiate with foreign partners, and ensure compliance with international trade laws. Mastery of cultural differences and global market trends is essential to optimize supply chains and expand market reach.

Overview of Domestic Trader Roles

Domestic traders primarily focus on buying and selling goods within their home country, managing local supply chains, and navigating national regulations. Their roles include sourcing products from local suppliers, negotiating with domestic clients, and ensuring compliance with tax laws and market standards. Expertise in regional market trends and consumer preferences is crucial for optimizing trade efficiency and profitability.

Key Responsibilities: International vs Domestic Traders

International traders manage cross-border transactions, navigate complex regulations, and handle currency fluctuations to optimize global supply chains. Domestic traders focus on local market dynamics, supplier relations, and compliance with national trade laws to ensure efficient distribution within a country. Both roles require expertise in risk assessment, contract negotiation, and market analysis tailored to their specific operational scope.

Required Skills and Qualifications

International traders require strong cross-cultural communication skills, proficiency in multiple languages, and a deep understanding of global trade regulations, tariffs, and international logistics. Domestic traders focus on expertise in local market dynamics, regulatory compliance within their country, and efficient supply chain management tailored to regional demands. Both roles demand analytical skills, negotiation abilities, and familiarity with trade documentation, but international trading necessitates additional knowledge of foreign exchange, international payment methods, and geopolitical risks.

Market Research and Analysis Differences

International traders conduct extensive market research to understand diverse economic environments, cultural nuances, and regulatory frameworks across multiple countries, requiring detailed analysis of currency fluctuations, geopolitical risks, and global supply chain dynamics. Domestic traders focus their market analysis on local demand trends, regional competition, and national regulatory policies, leveraging in-depth knowledge of domestic consumer behavior and market conditions. The complexity of data sources and the scope of risk factors make international market research significantly broader and more multifaceted compared to domestic trade analysis.

Regulatory and Compliance Requirements

International traders face complex regulatory and compliance requirements, including customs regulations, tariffs, export controls, and adherence to multiple countries' trade laws. Domestic traders primarily comply with national regulations, such as local taxes, product standards, and labor laws, which are generally less complex than cross-border rules. Understanding and managing these regulatory frameworks is crucial for reducing legal risks and ensuring smooth operations in both international and domestic trade.

Risk Management Strategies

International traders face complex risk management challenges including currency fluctuations, geopolitical instability, and diverse regulatory environments, requiring strategies such as hedging with forward contracts and comprehensive market analysis. Domestic traders primarily focus on market volatility, credit risk, and regulatory compliance within a single jurisdiction, often utilizing stop-loss orders and insurance policies to mitigate risks. Effective risk management for both involves continuous monitoring, diversification, and adapting strategies to specific trade environments to protect assets and ensure profitability.

Communication and Negotiation Tactics

International traders prioritize clear and culturally sensitive communication to bridge language barriers and avoid misunderstandings, often utilizing translators and digital platforms for effective negotiation. Domestic traders rely on familiar communication norms and shared cultural references, enabling quicker, more direct negotiation tactics based on established relationships. Understanding these distinctions enhances negotiation outcomes by tailoring communication strategies to the trader's operating environment.

Career Growth Opportunities

International traders gain access to diverse global markets, enhancing skills in cross-border regulations, foreign exchange, and international supply chains. Domestic traders develop deep expertise in local market trends, regulatory frameworks, and consumer behavior, which can lead to leadership roles within national companies. Career growth in international trade often includes roles in multinational corporations and global logistics, while domestic trade career paths may focus on regional business development and market specialization.

Salary and Compensation Comparison

International traders typically earn higher salaries than domestic traders due to the complexity of managing cross-border transactions and currency risks. Compensation packages for international traders often include bonuses tied to global market performance and may offer benefits such as expatriate allowances or multilingual skill premiums. Domestic traders usually have more stable, region-specific pay scales with fewer variables affecting their total compensation.

International Trader vs Domestic Trader Infographic

jobdiv.com

jobdiv.com