Market makers provide liquidity by continuously quoting buy and sell prices, enabling smooth and efficient trading in the pet marketplace. Order takers execute trades based on existing market prices, often consuming the liquidity created by market makers. Understanding the roles of market makers and order takers is crucial for optimizing strategies and maximizing profits in trading pets.

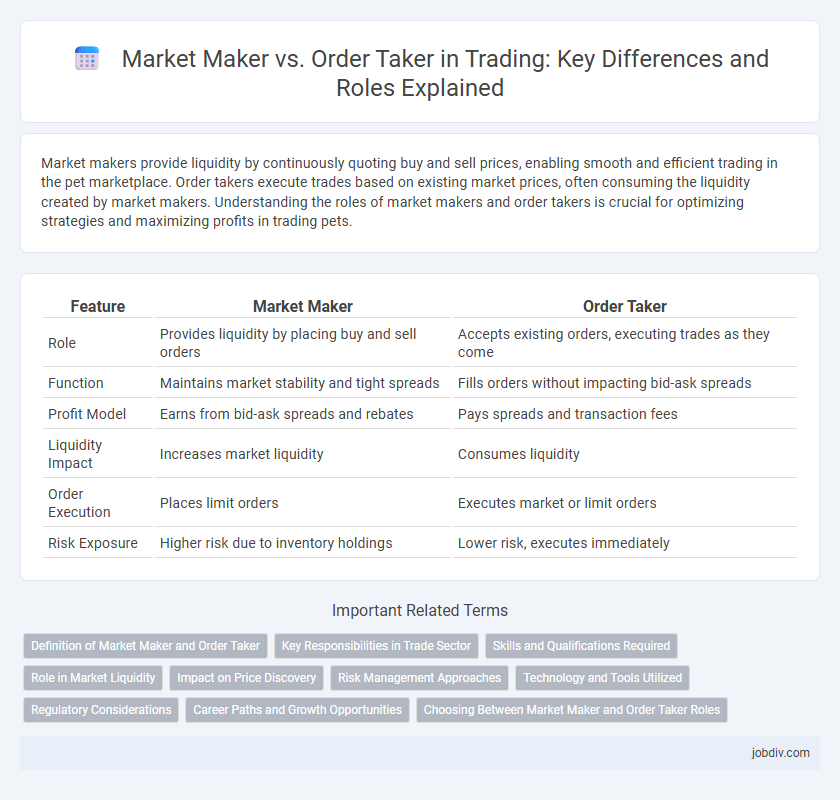

Table of Comparison

| Feature | Market Maker | Order Taker |

|---|---|---|

| Role | Provides liquidity by placing buy and sell orders | Accepts existing orders, executing trades as they come |

| Function | Maintains market stability and tight spreads | Fills orders without impacting bid-ask spreads |

| Profit Model | Earns from bid-ask spreads and rebates | Pays spreads and transaction fees |

| Liquidity Impact | Increases market liquidity | Consumes liquidity |

| Order Execution | Places limit orders | Executes market or limit orders |

| Risk Exposure | Higher risk due to inventory holdings | Lower risk, executes immediately |

Definition of Market Maker and Order Taker

A market maker is a firm or individual that provides liquidity to financial markets by continuously quoting bid and ask prices, enabling smoother trading and narrower spreads. An order taker, on the other hand, executes trades based on existing market prices without influencing the bid-ask spread or market liquidity. Market makers play a crucial role in ensuring efficient market operations, while order takers act primarily as participants executing buy or sell orders.

Key Responsibilities in Trade Sector

Market makers provide liquidity by continuously quoting buy and sell prices, facilitating smoother trade execution and reducing price volatility. Order takers execute trades based on client orders without influencing market prices, focusing on accuracy and speed of order fulfillment. Both roles are essential in maintaining efficient market operations and ensuring balanced supply and demand dynamics.

Skills and Qualifications Required

Market makers require strong analytical skills, deep understanding of market dynamics, and proficiency in risk management to provide liquidity and maintain price stability. Order takers need excellent customer service abilities, quick decision-making skills, and a solid grasp of trading platforms to efficiently execute client orders. Both roles benefit from a background in finance or economics, with market makers often holding advanced quantitative or technical expertise.

Role in Market Liquidity

Market makers enhance market liquidity by continuously providing bid and ask prices, facilitating smoother and faster transactions. Order takers consume liquidity by accepting existing prices, executing trades based on current market offers. The dynamic between market makers and order takers ensures efficient price discovery and stable trading environments.

Impact on Price Discovery

Market makers actively provide liquidity by quoting both buy and sell prices, stabilizing the market and narrowing bid-ask spreads, which enhances price discovery efficiency. Order takers, by executing market orders, primarily consume available liquidity, leading to immediate market impact and potential price volatility. The interaction between market makers and order takers shapes the accuracy and transparency of asset pricing in financial markets.

Risk Management Approaches

Market makers manage risk by continuously quoting bid and ask prices, maintaining inventory to provide liquidity while employing hedging strategies to offset potential losses from price fluctuations. Order takers face lower inventory risk as they primarily execute trades passively but must manage execution risk and potential adverse selection during volatile market conditions. Effective risk management for market makers involves dynamic position adjustments and real-time market analysis, whereas order takers focus on minimizing slippage and ensuring timely order fulfillment.

Technology and Tools Utilized

Market makers deploy advanced algorithms and high-frequency trading platforms to ensure liquidity by continuously quoting bid and ask prices, utilizing sophisticated risk management software to balance inventory. Order takers rely on electronic order management systems and access to real-time market data feeds to execute client trades efficiently, often integrating with algorithmic execution tools to minimize market impact. Both roles leverage cutting-edge technology such as smart order routing and advanced analytics to optimize execution quality and speed in modern financial markets.

Regulatory Considerations

Market makers operate under stringent regulatory frameworks that require maintaining continuous bid-ask spreads and providing liquidity, ensuring market stability and fair pricing. Order takers, as passive participants, face fewer direct regulatory obligations but must comply with trade execution and reporting standards to maintain transparency. Regulatory bodies like the SEC and FINRA impose distinct compliance rules on market makers to prevent manipulative practices and protect investor interests.

Career Paths and Growth Opportunities

Market makers often have career paths that lead to roles in trading strategy and risk management due to their expertise in liquidity provision and market dynamics. Order takers typically progress toward positions in brokerage services, client relationship management, and sales trading by leveraging their skills in executing client orders efficiently. Growth opportunities for market makers emphasize analytical and quantitative skills, whereas order takers benefit from strong communication and customer service abilities.

Choosing Between Market Maker and Order Taker Roles

Choosing between market maker and order taker roles depends on risk tolerance and trading strategy. Market makers provide liquidity by continuously quoting buy and sell prices, earning profits from the bid-ask spread but assuming inventory risk. Order takers execute trades at available prices with less risk but may face higher transaction costs and limited control over trade timing.

Market Maker vs Order Taker Infographic

jobdiv.com

jobdiv.com