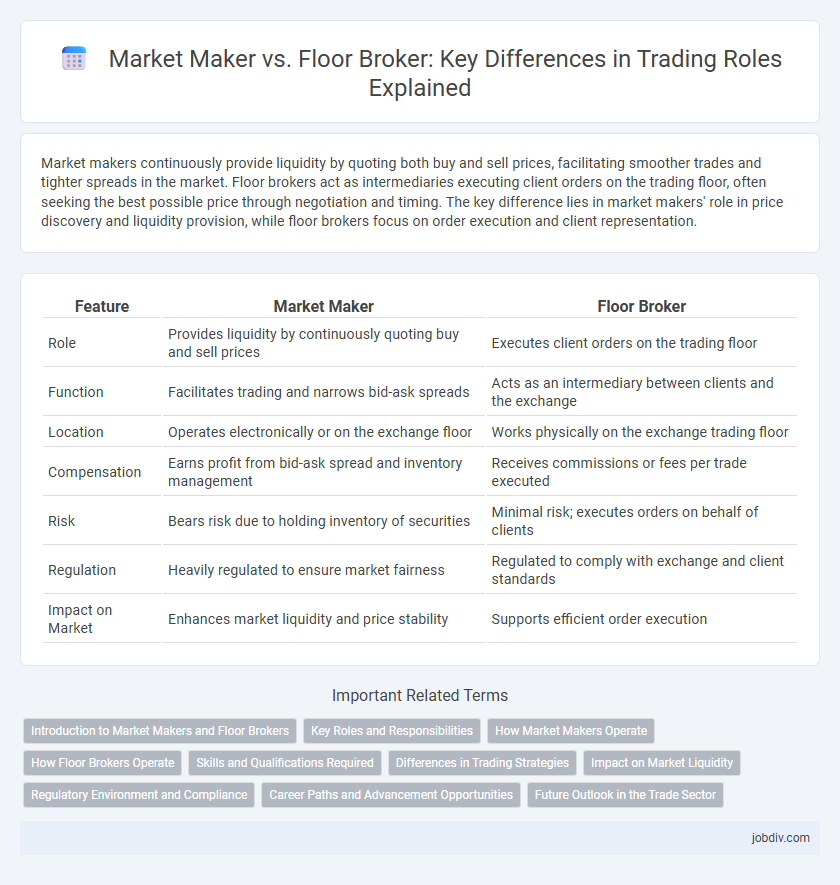

Market makers continuously provide liquidity by quoting both buy and sell prices, facilitating smoother trades and tighter spreads in the market. Floor brokers act as intermediaries executing client orders on the trading floor, often seeking the best possible price through negotiation and timing. The key difference lies in market makers' role in price discovery and liquidity provision, while floor brokers focus on order execution and client representation.

Table of Comparison

| Feature | Market Maker | Floor Broker |

|---|---|---|

| Role | Provides liquidity by continuously quoting buy and sell prices | Executes client orders on the trading floor |

| Function | Facilitates trading and narrows bid-ask spreads | Acts as an intermediary between clients and the exchange |

| Location | Operates electronically or on the exchange floor | Works physically on the exchange trading floor |

| Compensation | Earns profit from bid-ask spread and inventory management | Receives commissions or fees per trade executed |

| Risk | Bears risk due to holding inventory of securities | Minimal risk; executes orders on behalf of clients |

| Regulation | Heavily regulated to ensure market fairness | Regulated to comply with exchange and client standards |

| Impact on Market | Enhances market liquidity and price stability | Supports efficient order execution |

Introduction to Market Makers and Floor Brokers

Market makers are financial professionals or firms that provide liquidity by continuously quoting buy and sell prices for securities, ensuring smoother market transactions. Floor brokers operate on exchange trading floors, executing clients' orders by matching buy and sell orders in real-time to facilitate efficient trade execution. Both entities play crucial roles in maintaining market order and optimizing trade efficiency within different trading environments.

Key Roles and Responsibilities

Market makers provide liquidity by continuously quoting buy and sell prices for securities, ensuring smooth market functioning and tight spreads. Floor brokers execute client orders on the exchange floor, seeking best execution through negotiation and interaction with market participants. Both roles are essential in enhancing market efficiency, with market makers stabilizing prices and floor brokers offering personalized trade execution.

How Market Makers Operate

Market makers operate by continuously providing buy and sell quotes for securities, ensuring liquidity and tighter spreads in the market. They use proprietary capital to facilitate trades, aiming to profit from the bid-ask spread while managing inventory risk through hedging strategies. Their constant presence enables smoother price discovery and efficient execution of large orders in both equity and derivatives markets.

How Floor Brokers Operate

Floor brokers operate by executing orders on behalf of clients directly on the trading floor, utilizing open outcry or electronic systems to match buy and sell orders efficiently. They act as intermediaries between buyers and sellers, leveraging deep market knowledge and real-time information to secure optimal prices. Unlike market makers who provide liquidity by continuously quoting bid and ask prices, floor brokers focus on fulfilling client orders with precision and speed in a dynamic trading environment.

Skills and Qualifications Required

Market makers require strong quantitative skills, deep understanding of trading algorithms, and proficiency in risk management to provide liquidity efficiently. Floor brokers must possess exceptional communication abilities, quick decision-making skills, and in-depth knowledge of market regulations to execute client orders accurately on the exchange floor. Both roles demand a comprehensive grasp of financial instruments, but market makers emphasize analytical expertise while floor brokers prioritize interpersonal and negotiation skills.

Differences in Trading Strategies

Market makers maintain continuous bid and ask quotes to provide liquidity and profit from the bid-ask spread, using automated algorithms for high-frequency trading. Floor brokers execute client orders on the exchange floor, employing judgment and timing to minimize market impact and achieve best execution prices. Market makers take on inventory risk by holding positions, whereas floor brokers act as intermediaries without holding positions for profit.

Impact on Market Liquidity

Market makers enhance market liquidity by continuously quoting buy and sell prices, ensuring immediate trade execution and tighter bid-ask spreads. Floor brokers contribute to liquidity by facilitating large orders and providing price discovery through direct negotiation on the trading floor. The combined activities of market makers and floor brokers improve overall market efficiency, reducing volatility and enhancing price stability.

Regulatory Environment and Compliance

Market makers operate under strict regulatory frameworks established by bodies like the SEC and FINRA, requiring continuous market liquidity provision and adherence to capital and reporting standards. Floor brokers, regulated by exchange-specific rules and overseen by self-regulatory organizations, must ensure transparent and fair execution of client orders while maintaining compliance with transaction reporting and audit requirements. Both entities face rigorous compliance mandates designed to promote market integrity, prevent fraud, and protect investor interests within regulated trading environments.

Career Paths and Advancement Opportunities

Market makers often experience rapid career advancement through roles in proprietary trading and high-frequency trading firms due to their expertise in liquidity provision and risk management. Floor brokers, while having fewer automation tools, gain valuable experience in direct order execution and client interaction, which can lead to careers in brokerage management or institutional sales. Both paths offer advancement opportunities, but market makers typically benefit from technology-driven growth sectors, whereas floor brokers excel in relationship-driven environments.

Future Outlook in the Trade Sector

Market makers are increasingly leveraging algorithmic trading and artificial intelligence to provide enhanced liquidity and tighter bid-ask spreads in electronic markets. Floor brokers, traditionally reliant on face-to-face negotiations, face a decline as trading floors digitize and shift toward automated platforms. The future trade sector emphasizes speed, efficiency, and transparency, favoring market makers equipped with advanced technology over the localized expertise of floor brokers.

Market Maker vs Floor Broker Infographic

jobdiv.com

jobdiv.com