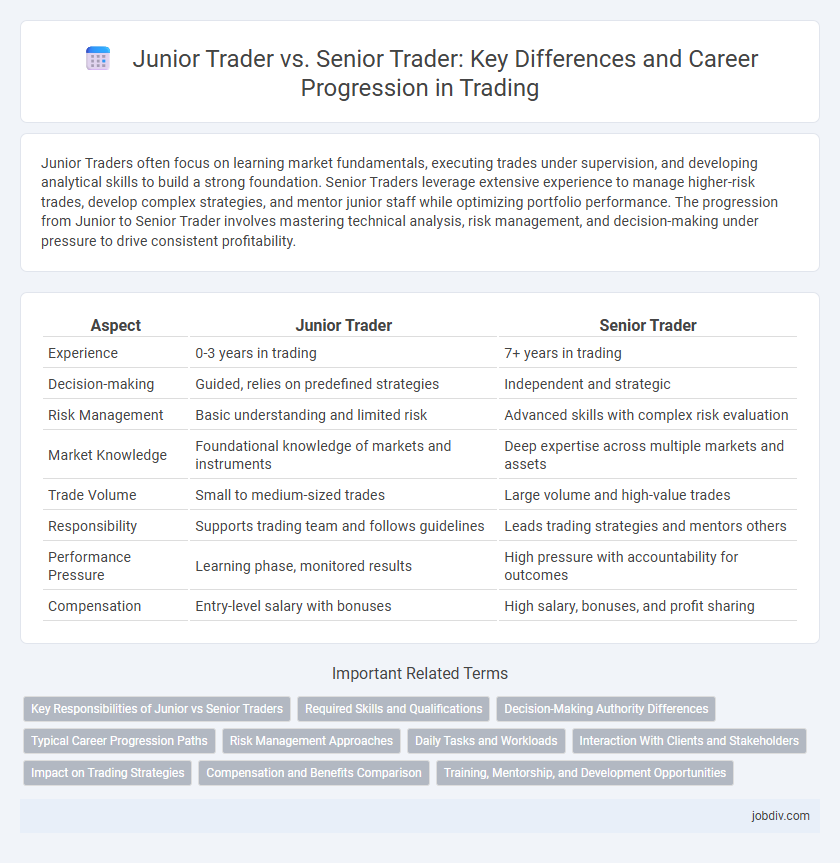

Junior Traders often focus on learning market fundamentals, executing trades under supervision, and developing analytical skills to build a strong foundation. Senior Traders leverage extensive experience to manage higher-risk trades, develop complex strategies, and mentor junior staff while optimizing portfolio performance. The progression from Junior to Senior Trader involves mastering technical analysis, risk management, and decision-making under pressure to drive consistent profitability.

Table of Comparison

| Aspect | Junior Trader | Senior Trader |

|---|---|---|

| Experience | 0-3 years in trading | 7+ years in trading |

| Decision-making | Guided, relies on predefined strategies | Independent and strategic |

| Risk Management | Basic understanding and limited risk | Advanced skills with complex risk evaluation |

| Market Knowledge | Foundational knowledge of markets and instruments | Deep expertise across multiple markets and assets |

| Trade Volume | Small to medium-sized trades | Large volume and high-value trades |

| Responsibility | Supports trading team and follows guidelines | Leads trading strategies and mentors others |

| Performance Pressure | Learning phase, monitored results | High pressure with accountability for outcomes |

| Compensation | Entry-level salary with bonuses | High salary, bonuses, and profit sharing |

Key Responsibilities of Junior vs Senior Traders

Junior Traders primarily execute trades, monitor market trends, and analyze financial data to support decision-making under supervision. Senior Traders strategize on complex trade execution, manage large portfolios, and assess risk to maximize profitability while mentoring junior team members. Both roles require strong market knowledge, but senior traders hold greater responsibility in decision-making and client management.

Required Skills and Qualifications

Junior traders typically require a strong foundation in financial analysis, proficiency in trading platforms, and knowledge of market regulations, often supported by a bachelor's degree in finance or economics. Senior traders need advanced analytical skills, deep market insight, risk management expertise, and leadership abilities, usually demonstrated through years of experience and professional certifications such as the CFA or Series 7. Both roles demand excellent decision-making skills and the ability to perform under pressure, but senior traders are expected to mentor juniors and develop trading strategies.

Decision-Making Authority Differences

Junior traders typically execute trades based on predefined strategies, with limited decision-making authority and close supervision from senior staff. Senior traders possess extensive market experience, allowing them to independently analyze market trends, assess risks, and make high-stakes decisions that significantly impact portfolio performance. The hierarchical decision-making structure ensures risk management and strategic alignment within trading firms.

Typical Career Progression Paths

Junior Traders typically begin by executing trades and managing risk under supervision, gaining market experience and developing analytical skills. Progression to Senior Trader involves mastering complex trading strategies, leading larger portfolios, and making autonomous decisions that significantly impact firm profitability. Career advancement often includes expanding responsibilities to include mentorship, strategy development, and sometimes transitioning into portfolio management or trading desk leadership roles.

Risk Management Approaches

Junior traders typically follow standardized risk management protocols and rely heavily on automated tools to minimize exposure, prioritizing learning and adherence to firm rules. Senior traders employ advanced risk assessment techniques, combining quantitative analysis with market intuition to adjust strategies dynamically and optimize portfolio performance. Their approach often includes real-time monitoring of market volatility, stress testing, and discretionary overrides to manage complex risk factors effectively.

Daily Tasks and Workloads

Junior Traders primarily focus on executing trades, monitoring market trends, and conducting data analysis to support decision-making, often under the supervision of senior team members. Senior Traders handle complex trading strategies, risk management, and portfolio optimization while overseeing junior staff and driving profit-maximizing decisions. Workloads for Senior Traders are more intense and strategic, involving high-pressure decision-making and client interactions compared to the task-oriented and learning-driven responsibilities of Junior Traders.

Interaction With Clients and Stakeholders

Junior Traders often assist in preparing reports and executing trades under the guidance of Senior Traders, maintaining routine communication with clients and stakeholders to ensure clarity and accuracy. Senior Traders lead strategic discussions with clients and stakeholders, leveraging deep market knowledge to provide insights, negotiate terms, and manage high-stakes relationships. The interaction level of Senior Traders involves decision-making authority and complex problem-solving, while Junior Traders focus on support and execution within established frameworks.

Impact on Trading Strategies

Junior traders typically follow established trading strategies with limited autonomy, focusing on executing trades and learning risk management under supervision. Senior traders develop and adapt complex trading strategies using advanced market analysis, leveraging their experience to optimize portfolio performance and mitigate risks. Their impact on trading strategies is significant, shaping decision-making processes and driving innovation in response to market conditions.

Compensation and Benefits Comparison

Junior traders typically receive lower base salaries ranging from $50,000 to $80,000 annually, with modest performance bonuses of 10-20%, reflecting limited experience and responsibility. Senior traders command significantly higher compensation, often exceeding $150,000 in base salary, coupled with performance bonuses that can reach 50% or more, driven by their proven track record and increased risk management duties. Benefits for senior traders usually include enhanced retirement plans, greater stock option packages, and exclusive access to profit-sharing programs, highlighting the financial incentives tied to their expertise and leadership roles.

Training, Mentorship, and Development Opportunities

Junior Traders benefit from structured training programs that emphasize foundational trading strategies, risk management, and market analysis, providing essential skills for career advancement. Senior Traders often take on mentorship roles, guiding juniors through complex decision-making processes and offering insights from extensive market experience. Development opportunities for Junior Traders include hands-on trading experience and continuous feedback, while Senior Traders focus on leadership growth and strategic market development.

Junior Trader vs Senior Trader Infographic

jobdiv.com

jobdiv.com