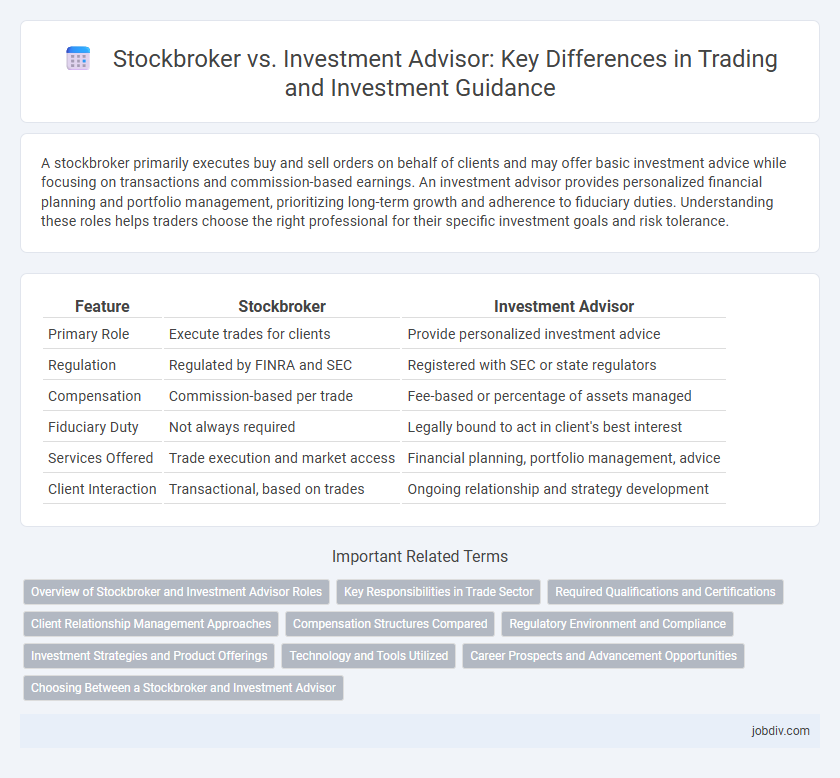

A stockbroker primarily executes buy and sell orders on behalf of clients and may offer basic investment advice while focusing on transactions and commission-based earnings. An investment advisor provides personalized financial planning and portfolio management, prioritizing long-term growth and adherence to fiduciary duties. Understanding these roles helps traders choose the right professional for their specific investment goals and risk tolerance.

Table of Comparison

| Feature | Stockbroker | Investment Advisor |

|---|---|---|

| Primary Role | Execute trades for clients | Provide personalized investment advice |

| Regulation | Regulated by FINRA and SEC | Registered with SEC or state regulators |

| Compensation | Commission-based per trade | Fee-based or percentage of assets managed |

| Fiduciary Duty | Not always required | Legally bound to act in client's best interest |

| Services Offered | Trade execution and market access | Financial planning, portfolio management, advice |

| Client Interaction | Transactional, based on trades | Ongoing relationship and strategy development |

Overview of Stockbroker and Investment Advisor Roles

Stockbrokers execute buy and sell orders for stocks and other securities on behalf of clients, typically earning commissions based on transaction volume. Investment advisors provide personalized financial advice and portfolio management services, often charging fees based on assets under management (AUM). Both roles operate within regulatory frameworks but differ in fiduciary duty, with advisors legally obligated to act in the client's best interest.

Key Responsibilities in Trade Sector

Stockbrokers execute buy and sell orders for securities on behalf of clients, providing market insights and real-time trade execution. Investment advisors focus on creating tailored financial strategies, managing portfolios, and offering advice aligned with clients' long-term investment goals. Both roles require deep knowledge of market regulations, but stockbrokers emphasize transactional expertise while investment advisors prioritize strategic asset allocation.

Required Qualifications and Certifications

Stockbrokers require a Series 7 license issued by FINRA, enabling them to execute securities trades on behalf of clients, while investment advisors must register with the SEC or state regulators and often hold the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designations. Stockbrokers focus on transaction execution, necessitating knowledge of market regulations and trading platforms, whereas investment advisors emphasize personalized financial planning and portfolio management, demanding expertise in investment strategies and fiduciary duties. Compliance with continuing education and ethical standards is mandatory for both professions to maintain certifications and regulatory approvals.

Client Relationship Management Approaches

Stockbrokers primarily focus on executing trades and providing market insights, emphasizing transactional relationships driven by commission-based incentives. Investment advisors adopt a holistic client relationship management approach, offering personalized financial planning and ongoing portfolio management tailored to long-term goals. The distinct client engagement models influence communication frequency, trust building, and service customization within the trade and investment industry.

Compensation Structures Compared

Stockbrokers typically earn commissions based on the volume or value of trades executed, incentivizing frequent transactions. Investment advisors often receive fees calculated as a percentage of assets under management (AUM), promoting long-term portfolio growth. Understanding these compensation models helps investors align their financial goals with the advisor's incentives.

Regulatory Environment and Compliance

Stockbrokers operate under the regulation of the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC), adhering to suitability standards when recommending securities. Investment advisors are regulated primarily by the SEC or state securities authorities, following a fiduciary standard that requires them to act in the best interests of their clients. Compliance for stockbrokers centers on transaction-based rules and disclosures, whereas investment advisors must implement comprehensive compliance programs to manage conflicts of interest and ensure transparent client communications.

Investment Strategies and Product Offerings

Stockbrokers primarily facilitate trade execution and provide access to a broad range of financial products such as stocks, bonds, and mutual funds, often emphasizing transaction-based services. Investment advisors develop personalized investment strategies tailored to clients' financial goals, risk tolerance, and time horizons, offering comprehensive portfolio management and ongoing advice. While stockbrokers may suggest product purchases, investment advisors focus on holistic planning and recommend strategies that optimize long-term portfolio growth and risk management.

Technology and Tools Utilized

Stockbrokers leverage advanced trading platforms with real-time market data, algorithmic tools, and mobile apps to execute rapid trades and manage client portfolios efficiently. Investment advisors utilize sophisticated financial planning software and analytics tools to provide personalized investment strategies, risk assessments, and long-term portfolio optimization. Both roles increasingly incorporate AI-driven technologies and data visualization tools to enhance decision-making and client engagement.

Career Prospects and Advancement Opportunities

Stockbrokers primarily focus on executing trades and managing client portfolios, often leading to advancement into senior trading roles or brokerage firm management. Investment advisors provide personalized financial planning and wealth management services, with career prospects expanding into portfolio management, financial consultancy, or executive positions within advisory firms. Both career paths offer growth through obtaining certifications like Series 7 for stockbrokers or Certified Financial Planner (CFP) credentials for investment advisors.

Choosing Between a Stockbroker and Investment Advisor

Choosing between a stockbroker and an investment advisor depends on your financial goals and service needs. Stockbrokers primarily execute buy and sell orders for stocks and other securities, often earning commissions on transactions, while investment advisors provide personalized financial planning and portfolio management based on fiduciary duty. Assessing factors such as fee structure, regulatory standards, and the level of tailored advice helps investors decide which professional aligns best with their trading and investment objectives.

Stockbroker vs Investment Advisor Infographic

jobdiv.com

jobdiv.com