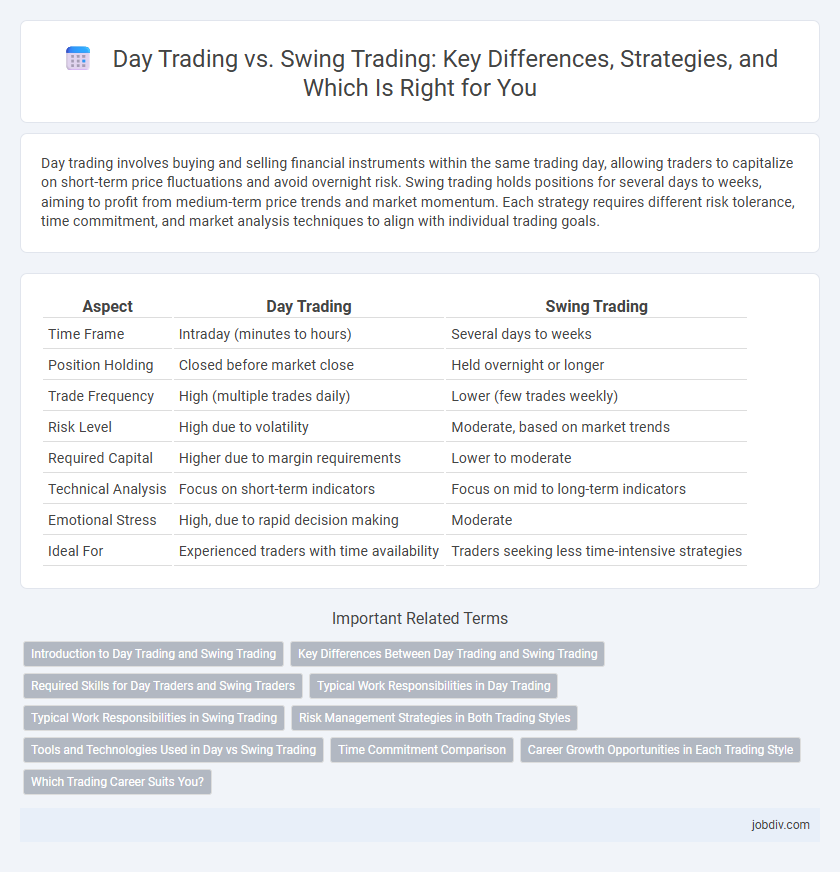

Day trading involves buying and selling financial instruments within the same trading day, allowing traders to capitalize on short-term price fluctuations and avoid overnight risk. Swing trading holds positions for several days to weeks, aiming to profit from medium-term price trends and market momentum. Each strategy requires different risk tolerance, time commitment, and market analysis techniques to align with individual trading goals.

Table of Comparison

| Aspect | Day Trading | Swing Trading |

|---|---|---|

| Time Frame | Intraday (minutes to hours) | Several days to weeks |

| Position Holding | Closed before market close | Held overnight or longer |

| Trade Frequency | High (multiple trades daily) | Lower (few trades weekly) |

| Risk Level | High due to volatility | Moderate, based on market trends |

| Required Capital | Higher due to margin requirements | Lower to moderate |

| Technical Analysis | Focus on short-term indicators | Focus on mid to long-term indicators |

| Emotional Stress | High, due to rapid decision making | Moderate |

| Ideal For | Experienced traders with time availability | Traders seeking less time-intensive strategies |

Introduction to Day Trading and Swing Trading

Day trading involves executing multiple trades within a single trading day to capitalize on short-term price fluctuations, requiring strict discipline and real-time market analysis. Swing trading targets capturing gains over several days or weeks by analyzing market trends and momentum for medium-term opportunities. Both strategies demand risk management but differ in holding periods and approach to market volatility.

Key Differences Between Day Trading and Swing Trading

Day trading involves executing multiple trades within the same trading day to capitalize on short-term market fluctuations, whereas swing trading holds positions for several days or weeks to capture medium-term price movements. Day traders require quick decision-making, advanced technical analysis tools, and strict risk management due to high trade frequency and market volatility. In contrast, swing traders rely more on technical indicators combined with fundamental analysis to identify trends and potential price reversals over a longer timeframe.

Required Skills for Day Traders and Swing Traders

Day traders require strong analytical skills, quick decision-making abilities, and proficiency in technical analysis to capitalize on rapid market fluctuations within a single trading day. Swing traders need patience, a solid understanding of market trends, and the ability to analyze both technical and fundamental data to hold positions for several days or weeks. Both trading styles demand discipline and risk management, but day traders emphasize speed and precision, while swing traders focus on strategic timing and trend identification.

Typical Work Responsibilities in Day Trading

Day trading involves actively buying and selling financial instruments within a single trading day, requiring constant market analysis and rapid decision-making to capitalize on short-term price fluctuations. Traders must monitor real-time charts, execute trades swiftly, and manage risk through stop-loss orders and position sizing. Typical responsibilities also include tracking market news, analyzing technical indicators, and maintaining discipline to adhere to a pre-defined trading strategy.

Typical Work Responsibilities in Swing Trading

Swing trading requires monitoring market trends and analyzing technical indicators to identify entry and exit points within days or weeks. Traders typically conduct in-depth chart analysis, manage risk through stop-loss orders, and adjust positions based on price movements and volume changes. Consistent tracking of economic data and news events also supports informed decision-making to optimize swing trade performance.

Risk Management Strategies in Both Trading Styles

Day trading employs tight stop-loss orders and frequent position adjustments to limit exposure to market volatility within short time frames, emphasizing rapid risk control. Swing trading involves broader stop-loss placements and position sizing strategies to manage risk over multiple days or weeks, allowing for market fluctuations while aiming to capture intermediate trends. Both trading styles require discipline in following predefined risk management rules to preserve capital and optimize potential returns.

Tools and Technologies Used in Day vs Swing Trading

Day trading relies heavily on real-time data feeds, advanced charting software, and high-speed execution platforms to capitalize on intraday price movements efficiently. Swing trading utilizes technical analysis tools, such as trend indicators and moving averages, alongside comprehensive market scanners to identify multi-day trading opportunities. Both styles benefit from algorithmic trading systems and news analysis tools, yet day trading demands lower latency environments while swing trading prioritizes robust research resources.

Time Commitment Comparison

Day trading requires constant market monitoring and quick decision-making throughout the trading day, demanding significant time investment daily. Swing trading allows for a more flexible schedule by holding positions over several days or weeks, reducing the need for continuous focus. Time commitment in day trading typically exceeds several hours daily, while swing trading often involves less than an hour of daily analysis.

Career Growth Opportunities in Each Trading Style

Day trading offers rapid skill development and immediate market feedback, fostering quick decision-making abilities essential for fast-paced trading environments. Swing trading promotes strategic analysis and patience, allowing traders to develop long-term market insight and risk management strategies. Career growth in day trading often leads to roles in proprietary trading firms, while swing trading experience can transition into portfolio management or financial analysis positions.

Which Trading Career Suits You?

Day trading requires rapid decision-making and intense focus on short-term price movements, making it ideal for traders who thrive in high-pressure environments and have the ability to analyze charts quickly. Swing trading suits those who prefer a more relaxed pace, aiming to capitalize on price trends over several days or weeks, requiring patience and a solid understanding of market patterns. Choosing between day trading and swing trading depends on your risk tolerance, time commitment, and analytical skills within the dynamic landscape of financial markets.

Day Trading vs Swing Trading Infographic

jobdiv.com

jobdiv.com