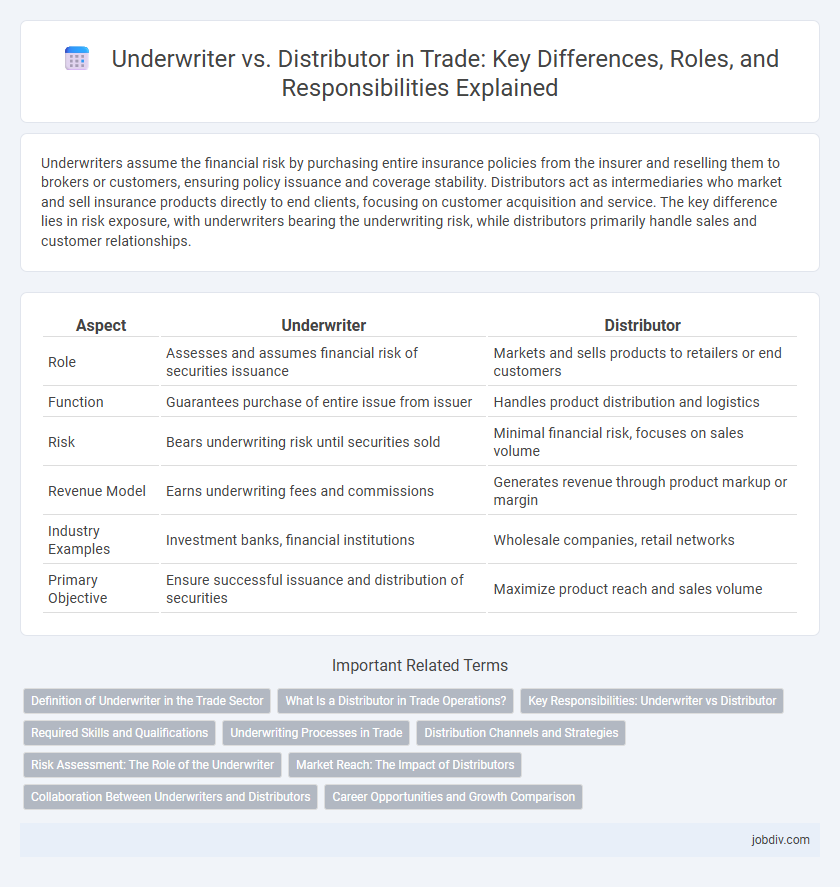

Underwriters assume the financial risk by purchasing entire insurance policies from the insurer and reselling them to brokers or customers, ensuring policy issuance and coverage stability. Distributors act as intermediaries who market and sell insurance products directly to end clients, focusing on customer acquisition and service. The key difference lies in risk exposure, with underwriters bearing the underwriting risk, while distributors primarily handle sales and customer relationships.

Table of Comparison

| Aspect | Underwriter | Distributor |

|---|---|---|

| Role | Assesses and assumes financial risk of securities issuance | Markets and sells products to retailers or end customers |

| Function | Guarantees purchase of entire issue from issuer | Handles product distribution and logistics |

| Risk | Bears underwriting risk until securities sold | Minimal financial risk, focuses on sales volume |

| Revenue Model | Earns underwriting fees and commissions | Generates revenue through product markup or margin |

| Industry Examples | Investment banks, financial institutions | Wholesale companies, retail networks |

| Primary Objective | Ensure successful issuance and distribution of securities | Maximize product reach and sales volume |

Definition of Underwriter in the Trade Sector

An underwriter in the trade sector is a financial intermediary responsible for assessing and assuming the risk of a transaction, particularly in securities issuance and insurance of trade-related financing. They evaluate the creditworthiness of parties involved and guarantee the purchase of securities or goods, ensuring capital flow and risk mitigation. Underwriters play a critical role in facilitating trade by providing assurance to sellers and buyers through risk assessment and financial backing.

What Is a Distributor in Trade Operations?

A distributor in trade operations acts as an intermediary, purchasing products from manufacturers to sell directly to retailers or end consumers, ensuring efficient market reach and inventory management. They handle logistics, warehousing, and sometimes provide marketing support to enhance product availability and sales performance. Distributors reduce manufacturers' operational burden by managing order fulfillment, payment collection, and customer relations, streamlining the supply chain.

Key Responsibilities: Underwriter vs Distributor

Underwriters assess risk and determine the terms and pricing of insurance policies or financial securities, ensuring the viability and profitability of trades. Distributors focus on the logistics of delivering products or services to end customers, managing supply chains, and optimizing market reach. Underwriters handle approval and risk management, while distributors emphasize distribution channels and customer engagement.

Required Skills and Qualifications

Underwriters require strong analytical skills, attention to detail, and expertise in risk assessment, financial modeling, and regulatory compliance to evaluate and approve insurance policies or securities offerings. Distributors need excellent communication, negotiation, and relationship management abilities, along with knowledge of supply chain logistics and market demand to effectively promote and deliver products to customers. Both roles demand proficiency in industry-specific software and an understanding of market trends to optimize trade operations.

Underwriting Processes in Trade

Underwriting processes in trade involve assessing risk, verifying financial stability, and ensuring compliance with relevant regulations to guarantee successful transactions. Underwriters analyze buyer creditworthiness and the terms of trade contracts to provide insurance or guarantees that protect sellers from payment defaults. This risk evaluation and mitigation facilitate smoother trade operations and enhance confidence among stakeholders.

Distribution Channels and Strategies

Underwriters primarily assess and assume risks in trade finance, facilitating product issuance by guaranteeing payment, while distributors actively manage distribution channels to deliver products from manufacturers to end-users. Distribution strategies by underwriters focus on risk mitigation and financial guarantees, whereas distributors optimize supply chain logistics, market reach, and direct customer engagement to maximize sales. Effective trade distribution hinges on aligning underwriter risk models with distributor channel management to ensure seamless product availability and financial security.

Risk Assessment: The Role of the Underwriter

The underwriter plays a critical role in trade by evaluating the risk profile of potential transactions to determine insurability and coverage terms. This risk assessment involves analyzing financial statements, market conditions, and buyer creditworthiness to minimize exposure to losses. Distributors focus on product distribution and sales, while underwriters specialize in managing trade-related financial risks through meticulous evaluation.

Market Reach: The Impact of Distributors

Distributors significantly expand market reach by leveraging established networks and local market knowledge, enabling faster product penetration and higher sales volumes. Unlike underwriters who primarily assume financial risk and focus on underwriting securities, distributors actively manage logistics, inventory, and customer relationships to drive product availability. Their role in optimizing supply chains and maximizing geographic coverage directly influences overall market growth and brand visibility.

Collaboration Between Underwriters and Distributors

Underwriters and distributors collaborate closely to ensure the successful launch and sustained distribution of financial products. Underwriters assess risk and determine pricing, providing critical data that distributors use to tailor marketing strategies and target appropriate customer segments. This partnership enhances efficiency in capital allocation and market penetration, driving higher sales volumes and improved risk management across trade channels.

Career Opportunities and Growth Comparison

Underwriters in trade finance specialize in risk assessment and grant approval authority, offering career growth through expertise in credit analysis and regulatory compliance, often leading to senior risk management roles. Distributors focus on product distribution and logistics, presenting career opportunities in supply chain management, sales, and market expansion, with growth potential in operations and business development. Career advancement for underwriters typically follows a path into risk control and financial strategy, whereas distributors progress through scaling distribution networks and enhancing market reach.

Underwriter vs Distributor Infographic

jobdiv.com

jobdiv.com