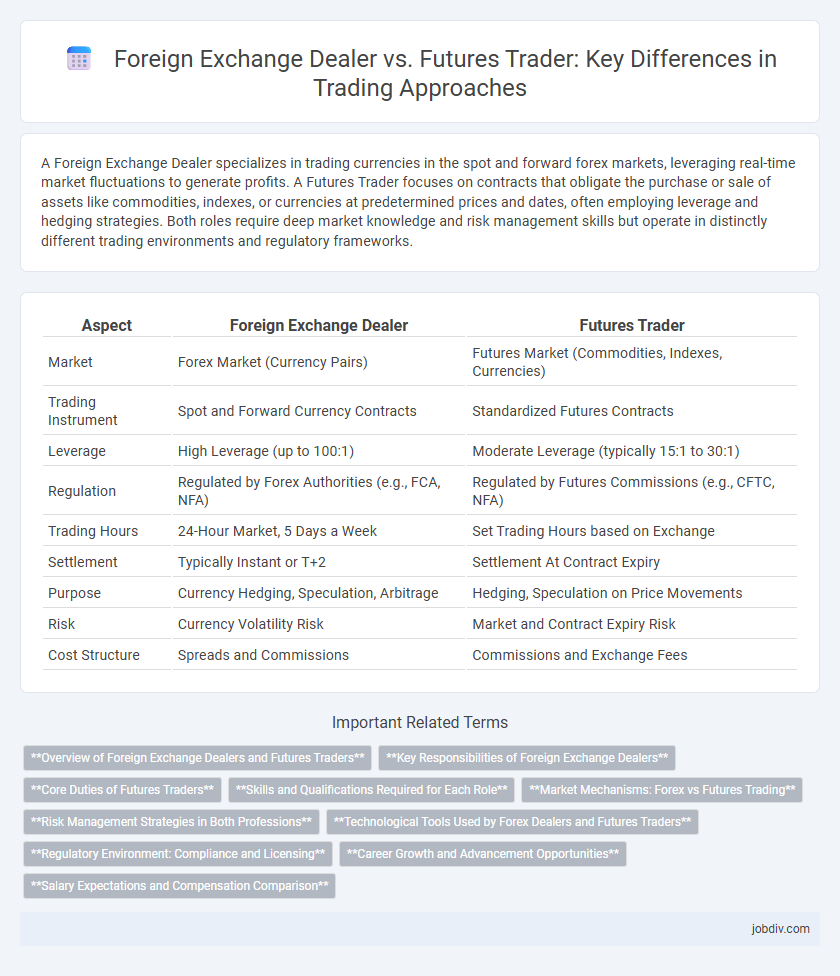

A Foreign Exchange Dealer specializes in trading currencies in the spot and forward forex markets, leveraging real-time market fluctuations to generate profits. A Futures Trader focuses on contracts that obligate the purchase or sale of assets like commodities, indexes, or currencies at predetermined prices and dates, often employing leverage and hedging strategies. Both roles require deep market knowledge and risk management skills but operate in distinctly different trading environments and regulatory frameworks.

Table of Comparison

| Aspect | Foreign Exchange Dealer | Futures Trader |

|---|---|---|

| Market | Forex Market (Currency Pairs) | Futures Market (Commodities, Indexes, Currencies) |

| Trading Instrument | Spot and Forward Currency Contracts | Standardized Futures Contracts |

| Leverage | High Leverage (up to 100:1) | Moderate Leverage (typically 15:1 to 30:1) |

| Regulation | Regulated by Forex Authorities (e.g., FCA, NFA) | Regulated by Futures Commissions (e.g., CFTC, NFA) |

| Trading Hours | 24-Hour Market, 5 Days a Week | Set Trading Hours based on Exchange |

| Settlement | Typically Instant or T+2 | Settlement At Contract Expiry |

| Purpose | Currency Hedging, Speculation, Arbitrage | Hedging, Speculation on Price Movements |

| Risk | Currency Volatility Risk | Market and Contract Expiry Risk |

| Cost Structure | Spreads and Commissions | Commissions and Exchange Fees |

Overview of Foreign Exchange Dealers and Futures Traders

Foreign exchange dealers facilitate currency trading by acting as intermediaries in the forex market, providing liquidity and enabling businesses and investors to hedge or speculate on currency movements. Futures traders operate in derivatives markets, buying and selling standardized contracts based on the future price of assets such as commodities, indices, or financial instruments. Both professionals require deep market knowledge, risk management skills, and adherence to regulatory frameworks to navigate volatile financial environments effectively.

Key Responsibilities of Foreign Exchange Dealers

Foreign exchange dealers are responsible for executing currency trades on behalf of clients or institutions, managing currency risk through spot and forward contracts, and maintaining liquidity in the foreign exchange markets. They analyze global economic indicators, geopolitical events, and central bank policies to make informed trading decisions that optimize currency portfolios. Monitoring market trends and providing accurate pricing while ensuring compliance with regulatory standards are critical to their role in facilitating seamless currency transactions.

Core Duties of Futures Traders

Futures traders specialize in buying and selling standardized contracts for assets like commodities, currencies, and indices to hedge risks or speculate on price movements. Their core duties include analyzing market trends, executing trades under strict regulatory compliance, and managing margin requirements to mitigate financial exposure. Proficiency in technical analysis and real-time decision-making is essential for optimizing trading outcomes in volatile futures markets.

Skills and Qualifications Required for Each Role

Foreign exchange dealers require strong analytical skills, proficiency in currency markets, and a deep understanding of economic indicators and geopolitical events impacting exchange rates. Futures traders need expertise in commodity markets, risk management, and technical analysis, along with the ability to interpret price charts and economic reports. Both roles demand excellent decision-making abilities, strong mathematical aptitude, and familiarity with trading platforms and regulatory compliance standards.

Market Mechanisms: Forex vs Futures Trading

Foreign exchange dealers operate in a decentralized over-the-counter (OTC) market where currency pairs are traded 24 hours a day, allowing for high liquidity and immediate execution. Futures traders engage in centralized exchanges like the Chicago Mercantile Exchange (CME), trading standardized contracts with fixed expiration dates and regulated margin requirements. The forex market offers direct currency swaps with flexible lot sizes while futures trading involves contract specifications and settlement protocols, emphasizing price transparency and regulatory oversight.

Risk Management Strategies in Both Professions

Foreign exchange dealers implement risk management strategies such as stop-loss orders, position limits, and diversification across currency pairs to mitigate volatility and geopolitical risks inherent in forex markets. Futures traders rely on margin requirements, hedging with futures contracts, and leveraging technical analysis to manage price risk and maintain liquidity amid highly leveraged environments. Both professions prioritize real-time market monitoring and adaptive strategies to minimize exposure and optimize portfolio performance under fluctuating market conditions.

Technological Tools Used by Forex Dealers and Futures Traders

Forex dealers leverage advanced electronic trading platforms such as MetaTrader 4 and 5, alongside algorithmic trading software and real-time pricing tools to execute high-frequency trades with precision. Futures traders utilize sophisticated order management systems (OMS), direct market access (DMA) platforms, and risk management software tailored for commodity, index, and interest rate futures contracts. Both rely heavily on integrated market data feeds, API connectivity, and automated execution algorithms, but futures traders often require specialized platforms supporting clearinghouse integrations and margin calculations.

Regulatory Environment: Compliance and Licensing

Foreign exchange dealers operate under strict regulatory frameworks set by authorities such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the U.S., requiring registration and adherence to anti-money laundering (AML) and know your customer (KYC) regulations. Futures traders are subject to regulations imposed by exchanges like the CME Group and regulators like the CFTC, with mandatory compliance on position limits, margin requirements, and reporting standards. Both roles demand robust licensing and continuous compliance monitoring to mitigate risks and ensure market integrity.

Career Growth and Advancement Opportunities

Foreign exchange dealers benefit from rapid career growth due to high market liquidity and continuous trading opportunities, allowing for swift skill acquisition in currency markets. Futures traders experience advancement through specialization in complex derivatives and risk management strategies, often transitioning into portfolio management or proprietary trading roles. Both career paths offer lucrative advancement, but forex trading typically provides faster entry-level promotion thanks to real-time global market exposure.

Salary Expectations and Compensation Comparison

Foreign exchange dealers typically earn an average annual salary ranging from $70,000 to $120,000, with potential bonuses depending on market performance and trading volume. Futures traders often see broader compensation variability, with salaries starting around $60,000 but reaching over $150,000, heavily influenced by profit-sharing models and commission structures. Both roles require strong analytical skills and risk management, but futures traders may achieve higher income through leveraged positions and diverse market exposure.

Foreign Exchange Dealer vs Futures Trader Infographic

jobdiv.com

jobdiv.com