Trade Risk Analysts specialize in identifying and mitigating risks related to trade transactions, focusing on credit, operational, and compliance risks within global trading activities. Market Risk Analysts evaluate risks arising from fluctuations in market variables such as interest rates, currency exchange rates, and commodity prices, using quantitative models to predict potential financial losses. Both roles require strong analytical skills, but Trade Risk Analysts emphasize transaction-specific risks, while Market Risk Analysts concentrate on broader market dynamics affecting portfolio performance.

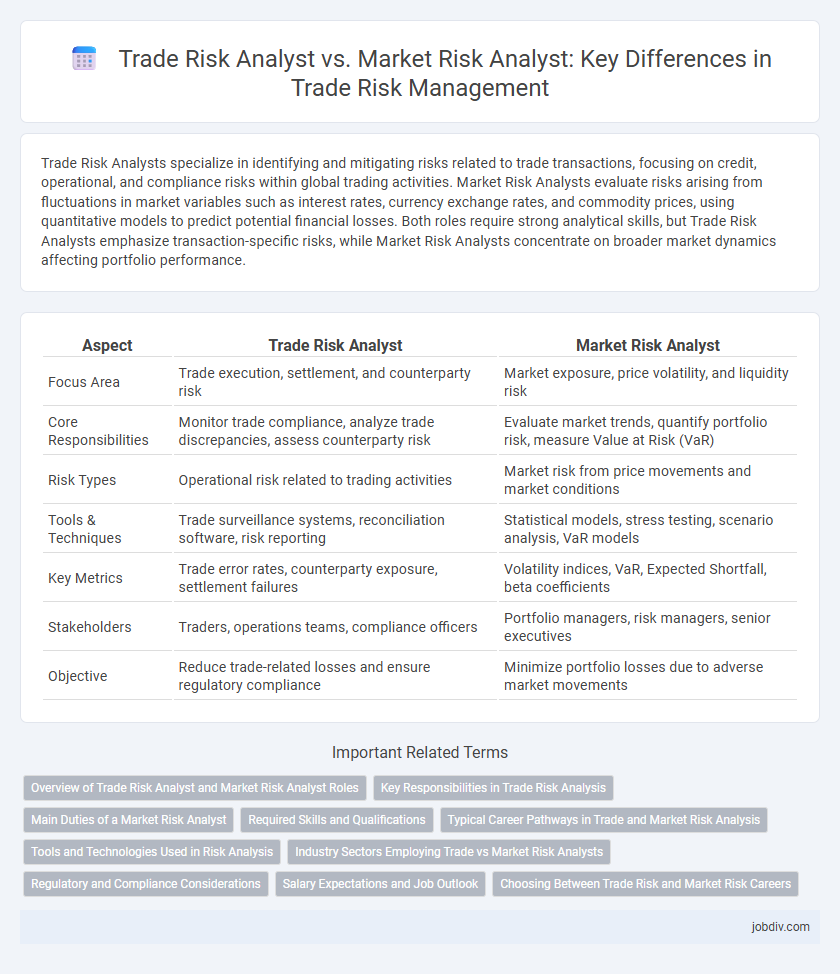

Table of Comparison

| Aspect | Trade Risk Analyst | Market Risk Analyst |

|---|---|---|

| Focus Area | Trade execution, settlement, and counterparty risk | Market exposure, price volatility, and liquidity risk |

| Core Responsibilities | Monitor trade compliance, analyze trade discrepancies, assess counterparty risk | Evaluate market trends, quantify portfolio risk, measure Value at Risk (VaR) |

| Risk Types | Operational risk related to trading activities | Market risk from price movements and market conditions |

| Tools & Techniques | Trade surveillance systems, reconciliation software, risk reporting | Statistical models, stress testing, scenario analysis, VaR models |

| Key Metrics | Trade error rates, counterparty exposure, settlement failures | Volatility indices, VaR, Expected Shortfall, beta coefficients |

| Stakeholders | Traders, operations teams, compliance officers | Portfolio managers, risk managers, senior executives |

| Objective | Reduce trade-related losses and ensure regulatory compliance | Minimize portfolio losses due to adverse market movements |

Overview of Trade Risk Analyst and Market Risk Analyst Roles

Trade Risk Analysts focus on identifying and mitigating risks specifically related to trading activities, including counterparty risk, settlement risk, and compliance with regulatory requirements. Market Risk Analysts evaluate potential losses arising from market fluctuations such as interest rates, foreign exchange rates, and equity prices, using quantitative models to assess the financial impact on portfolios. Both roles require strong analytical skills and expertise in risk management frameworks, but Trade Risk Analysts concentrate on trade execution and operational risk, while Market Risk Analysts emphasize market-driven financial exposure.

Key Responsibilities in Trade Risk Analysis

Trade Risk Analysts primarily focus on identifying, assessing, and mitigating risks associated with trading activities, such as counterparty risk, settlement risk, and operational risk within trade finance and securities trading. They monitor trade exposures, ensure compliance with regulatory requirements, and analyze transaction data to prevent fraud and financial losses. Market Risk Analysts, by contrast, concentrate on quantifying the impact of market fluctuations on portfolios, using statistical models to evaluate interest rate, currency, and asset price risks.

Main Duties of a Market Risk Analyst

Market Risk Analysts primarily assess potential losses from market fluctuations by analyzing interest rates, currency exchange rates, and equity prices to ensure portfolio stability. They develop risk models and conduct stress testing to predict the impact of adverse market conditions on trading positions and investment portfolios. Their duties also include monitoring regulatory compliance and collaborating with traders to implement risk mitigation strategies.

Required Skills and Qualifications

Trade Risk Analysts require strong expertise in commodity markets, trade finance, and regulatory compliance, alongside proficiency in data analysis tools such as SQL and Excel. Market Risk Analysts need deep knowledge of financial instruments, risk modeling techniques, and quantitative analysis, often utilizing programming languages like Python or R. Both roles demand excellent analytical skills, attention to detail, and a solid understanding of risk management frameworks and reporting standards.

Typical Career Pathways in Trade and Market Risk Analysis

Trade Risk Analysts typically advance through roles such as Risk Associate, Trade Compliance Officer, and eventually Senior Trade Risk Manager, gaining expertise in trade regulations, supply chain vulnerabilities, and geopolitical impacts. Market Risk Analysts often follow a progression from Junior Market Analyst to Quantitative Risk Specialist and then Market Risk Manager, focusing on financial modeling, market fluctuations, and asset valuation. Both paths benefit from certifications like FRM or CFA, with opportunities to transition into broader risk management or strategic trading roles within financial institutions.

Tools and Technologies Used in Risk Analysis

Trade Risk Analysts utilize advanced tools such as transaction monitoring systems, trade surveillance platforms, and specialized software like SAS and MATLAB for analyzing trade-specific risks, including counterparty exposure and settlement risk. Market Risk Analysts rely heavily on value-at-risk (VaR) models, Monte Carlo simulations, and statistical packages like R and Python libraries to evaluate market fluctuations and asset price volatility. Both roles leverage big data analytics and machine learning technologies to enhance predictive accuracy and risk mitigation strategies in their respective domains.

Industry Sectors Employing Trade vs Market Risk Analysts

Trade Risk Analysts are predominantly employed in sectors such as international trade, shipping, logistics, and commodities markets where the assessment of transaction-related risks, tariffs, and regulatory compliance is critical. Market Risk Analysts are mainly found in financial services, investment banking, asset management, and insurance industries, evaluating the impact of market price fluctuations, interest rates, and credit risks on portfolios. Financial institutions serving global trade also often employ both roles to comprehensively manage exposure across trading operations and market dynamics.

Regulatory and Compliance Considerations

Trade Risk Analysts concentrate on regulatory requirements related to transaction monitoring, trade execution compliance, and anti-money laundering (AML) standards to prevent illicit activities in trading operations. Market Risk Analysts focus on compliance with market conduct regulations, capital adequacy frameworks such as Basel III, and stress testing mandates to manage exposure to market volatility and systemic risks. Both roles require deep knowledge of financial regulations like Dodd-Frank and MiFID II to ensure robust risk governance and regulatory reporting.

Salary Expectations and Job Outlook

Trade Risk Analysts typically earn salaries ranging from $70,000 to $110,000 annually, with strong demand in global markets due to increasing regulatory scrutiny and evolving trade policies. Market Risk Analysts often command higher salaries, averaging between $80,000 and $130,000, driven by their critical role in managing financial exposures across asset classes. Both roles offer positive job outlooks, but Market Risk Analysts generally experience faster growth due to expanding financial instruments and increased volatility.

Choosing Between Trade Risk and Market Risk Careers

Trade Risk Analysts specialize in identifying and mitigating risks related to trade finance, export-import regulations, and supply chain disruptions, making them vital for companies engaged in international commerce. Market Risk Analysts focus on assessing risks from market fluctuations, including interest rates, currency exchange, and equity prices, crucial for investment firms and financial institutions. Choosing between these careers depends on whether you prefer analyzing operational trade risks or evaluating financial market volatility.

Trade Risk Analyst vs Market Risk Analyst Infographic

jobdiv.com

jobdiv.com