Trade Finance Specialists focus on managing financial products such as letters of credit, guarantees, and documentary collections to facilitate international trade transactions securely. Trade Operations Specialists handle the processing and documentation of trade deals, ensuring compliance with regulations and smooth transaction flow. Both roles are essential for efficient trade execution but emphasize different aspects--financial structuring versus operational management.

Table of Comparison

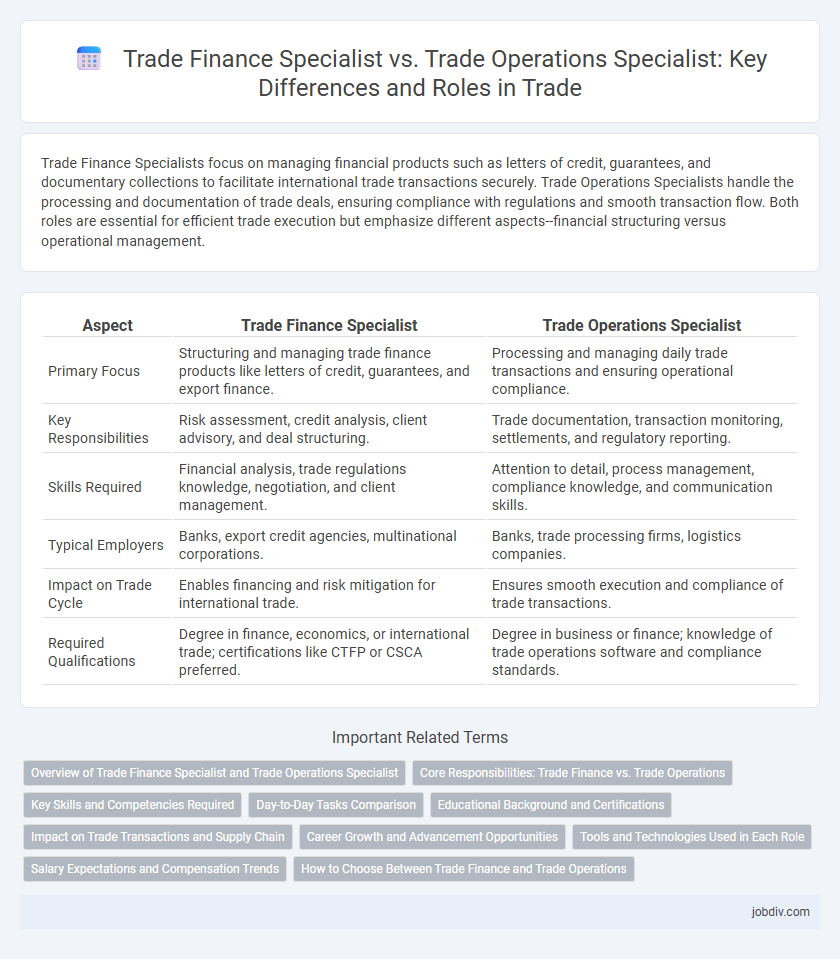

| Aspect | Trade Finance Specialist | Trade Operations Specialist |

|---|---|---|

| Primary Focus | Structuring and managing trade finance products like letters of credit, guarantees, and export finance. | Processing and managing daily trade transactions and ensuring operational compliance. |

| Key Responsibilities | Risk assessment, credit analysis, client advisory, and deal structuring. | Trade documentation, transaction monitoring, settlements, and regulatory reporting. |

| Skills Required | Financial analysis, trade regulations knowledge, negotiation, and client management. | Attention to detail, process management, compliance knowledge, and communication skills. |

| Typical Employers | Banks, export credit agencies, multinational corporations. | Banks, trade processing firms, logistics companies. |

| Impact on Trade Cycle | Enables financing and risk mitigation for international trade. | Ensures smooth execution and compliance of trade transactions. |

| Required Qualifications | Degree in finance, economics, or international trade; certifications like CTFP or CSCA preferred. | Degree in business or finance; knowledge of trade operations software and compliance standards. |

Overview of Trade Finance Specialist and Trade Operations Specialist

Trade Finance Specialists manage financial products and services that facilitate international trade, including letters of credit, bank guarantees, and trade loans, ensuring compliance with regulatory frameworks and mitigating transaction risks. Trade Operations Specialists oversee the processing, documentation, and settlement of trade transactions, maintaining accurate records and coordinating between banks, clients, and regulatory bodies for seamless trade execution. Both roles require in-depth knowledge of trade regulations, risk management, and cross-border payment systems to support global commerce efficiently.

Core Responsibilities: Trade Finance vs. Trade Operations

Trade Finance Specialists manage and structure financial instruments such as letters of credit, guarantees, and export financing solutions to mitigate risks and ensure smooth international trade transactions. Trade Operations Specialists focus on executing the logistical and compliance aspects of trade, including processing documentation, coordinating shipments, and ensuring regulatory adherence. Both roles are integral to global trade but emphasize financial risk management versus operational workflow and transaction processing.

Key Skills and Competencies Required

Trade Finance Specialists require strong knowledge of letters of credit, risk assessment, and regulatory compliance to manage financial instruments effectively in international trade. Trade Operations Specialists excel in transaction processing, workflow management, and coordination between departments to ensure smooth execution of trade activities. Both roles demand analytical skills, attention to detail, and proficiency in trade documentation and communication with global partners.

Day-to-Day Tasks Comparison

Trade Finance Specialists manage complex financial products such as letters of credit, guarantees, and invoice financing, ensuring compliance with international trade regulations and mitigating payment risks. Trade Operations Specialists focus on executing and monitoring trade transactions, processing documentation, reconciling accounts, and coordinating with banks and internal teams to ensure smooth operational flow. Both roles require attention to detail and knowledge of trade policies, but Trade Finance Specialists handle financial structuring while Trade Operations Specialists oversee transaction processing.

Educational Background and Certifications

Trade Finance Specialists typically possess degrees in finance, economics, or business administration, emphasizing knowledge in international trade laws, letters of credit, and risk management. Certifications such as the Certified Documentary Credit Specialist (CDCS) or the Certified Trade Finance Professional (CTFP) enhance their expertise and credibility in trade finance transactions. Trade Operations Specialists often hold qualifications in logistics, supply chain management, or finance, with certifications like the Certified Supply Chain Professional (CSCP) or Trade Compliance Certifications, focusing on process efficiency, transaction processing, and regulatory compliance in trade operations.

Impact on Trade Transactions and Supply Chain

Trade Finance Specialists streamline trade transactions by managing payment methods like letters of credit and documentary collections, reducing financial risk and ensuring liquidity in international trade. Trade Operations Specialists oversee the end-to-end process of trade documentation, shipment tracking, and regulatory compliance, enhancing accuracy and efficiency in supply chain execution. Both roles are critical for optimizing cash flow and minimizing delays, but Trade Finance Specialists focus on financial instruments, while Trade Operations Specialists emphasize operational workflow and compliance.

Career Growth and Advancement Opportunities

Trade Finance Specialists often experience faster career growth due to their expertise in complex financial instruments, risk assessment, and credit analysis essential for international trade transactions. Trade Operations Specialists typically advance by gaining proficiency in process optimization, compliance, and transaction management, which supports scalable business functions but may offer slower progression into strategic roles. Professionals aiming for senior leadership often benefit from combining financial acumen with operational expertise to maximize advancement opportunities in global trade organizations.

Tools and Technologies Used in Each Role

Trade Finance Specialists primarily utilize digital platforms such as trade finance software like Bolero, AgileTrade, and SWIFT for secure transaction processing and compliance management. Trade Operations Specialists rely heavily on enterprise resource planning (ERP) systems like SAP and Oracle, alongside workflow automation tools to manage end-to-end trade documentation and settlement processes efficiently. Both roles leverage advanced analytics and blockchain technology to enhance transparency, risk assessment, and operational accuracy in international trade transactions.

Salary Expectations and Compensation Trends

Trade Finance Specialists typically command higher salary expectations than Trade Operations Specialists due to their expertise in managing complex financial instruments such as letters of credit and guarantees. Compensation trends indicate that Trade Finance roles benefit from bonuses tied to deal closures and risk management performance, whereas Trade Operations Specialists receive more stable, salary-focused packages reflecting their process-driven responsibilities. Market data from 2023 shows average salaries for Trade Finance Specialists ranging from $70,000 to $110,000 annually, compared to $55,000 to $80,000 for Trade Operations Specialists.

How to Choose Between Trade Finance and Trade Operations

Choosing between a Trade Finance Specialist and a Trade Operations Specialist depends on your expertise in financial risk management versus process execution. Trade Finance Specialists focus on credit analysis, letters of credit, and mitigating payment risks, while Trade Operations Specialists manage the workflow, documentation, and compliance of trade transactions. Assess your strengths in analytical finance skills or operational efficiency to determine the best career path in trade.

Trade Finance Specialist vs Trade Operations Specialist Infographic

jobdiv.com

jobdiv.com