Floor traders operate physically on exchange trading floors, making trades through open outcry and direct interaction, which allows for immediate feedback and negotiation. Electronic traders utilize computer systems and algorithms to execute trades swiftly and efficiently without the need for physical presence, offering greater speed and access to global markets. The shift from floor to electronic trading has increased market liquidity and reduced transaction costs, transforming the dynamics of trade execution.

Table of Comparison

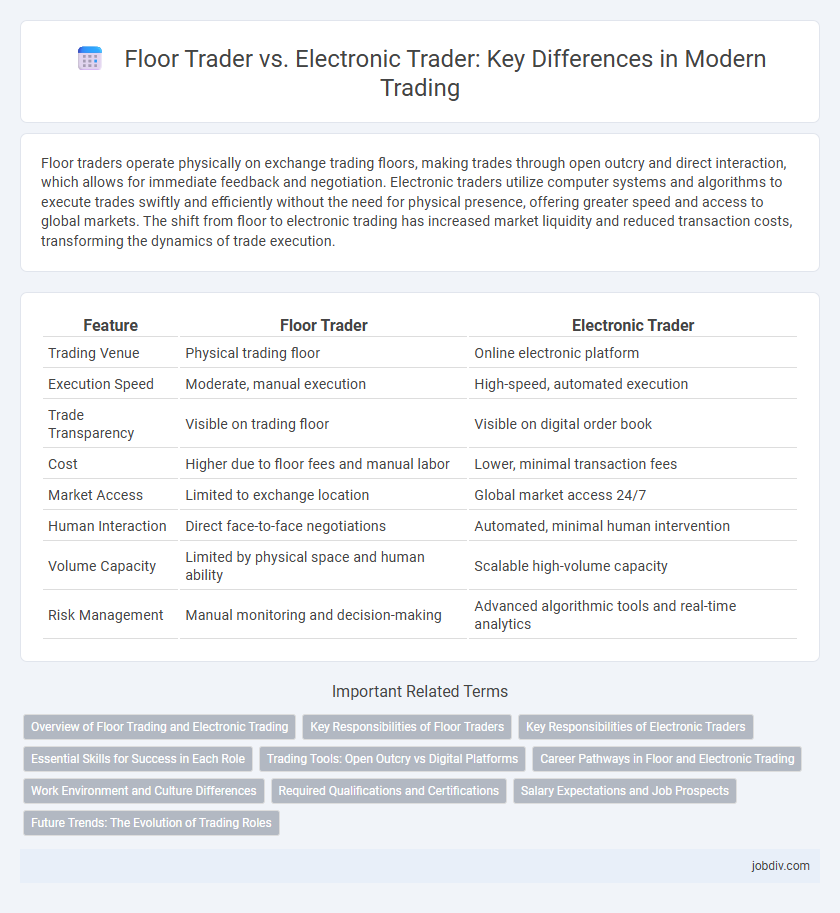

| Feature | Floor Trader | Electronic Trader |

|---|---|---|

| Trading Venue | Physical trading floor | Online electronic platform |

| Execution Speed | Moderate, manual execution | High-speed, automated execution |

| Trade Transparency | Visible on trading floor | Visible on digital order book |

| Cost | Higher due to floor fees and manual labor | Lower, minimal transaction fees |

| Market Access | Limited to exchange location | Global market access 24/7 |

| Human Interaction | Direct face-to-face negotiations | Automated, minimal human intervention |

| Volume Capacity | Limited by physical space and human ability | Scalable high-volume capacity |

| Risk Management | Manual monitoring and decision-making | Advanced algorithmic tools and real-time analytics |

Overview of Floor Trading and Electronic Trading

Floor trading involves human traders who execute orders directly on the trading floor, relying on open outcry and manual processes to match buy and sell orders. Electronic trading uses computerized systems and algorithms to automate order execution, providing faster transaction speeds and increased market accessibility worldwide. While floor trading emphasizes personal interaction and physical presence, electronic trading prioritizes efficiency, transparency, and real-time data analysis.

Key Responsibilities of Floor Traders

Floor traders execute trades directly on the exchange floor, ensuring rapid order fulfillment through open outcry and hand signals, which requires acute market awareness and quick decision-making. They manage trade execution risk by closely monitoring live market fluctuations and adjusting bids or offers to optimize transaction outcomes. Maintaining strong relationships with brokers and communicating effectively with other market participants is essential for coordinating large or complex trades on the floor.

Key Responsibilities of Electronic Traders

Electronic traders execute high-frequency trades using sophisticated algorithms and real-time market data to capitalize on price movements. They continuously monitor electronic trading platforms, manage algorithmic strategies, and adjust parameters to optimize trade execution and minimize risk. Their responsibilities include analyzing large datasets, maintaining system integrity, and ensuring compliance with regulatory requirements in fast-paced digital markets.

Essential Skills for Success in Each Role

Floor traders excel in rapid decision-making, physical presence, and non-verbal communication skills essential for navigating bustling trading pits, while electronic traders require advanced proficiency in algorithmic trading, data analysis, and technology-driven strategies to optimize market execution. Mastery of real-time market dynamics and emotional resilience is critical for floor traders, whereas electronic traders benefit from expertise in programming languages such as Python and tools like Bloomberg Terminal. Understanding regulatory compliance and effective risk management remains vital for success in both trading environments.

Trading Tools: Open Outcry vs Digital Platforms

Floor traders rely on open outcry systems, utilizing verbal and hand signals in physical trading pits to execute orders quickly and gauge market sentiment. Electronic traders leverage digital platforms with advanced algorithmic tools, real-time data feeds, and automated order execution to enhance speed, accuracy, and efficiency. The shift from open outcry to electronic trading platforms has transformed market accessibility and liquidity, favoring data-driven decision-making over traditional face-to-face interactions.

Career Pathways in Floor and Electronic Trading

Floor traders typically start as clerks or apprentices, gaining hands-on experience with live market transactions, and often advance to senior trading roles through demonstrated expertise and networking within physical trading pits. Electronic traders commonly begin their careers in quantitative analysis, programming, or data science, progressing by developing automated trading algorithms and mastering electronic platforms to manage high-frequency and algorithmic trades. Both pathways demand strong analytical skills, market knowledge, and adaptation to evolving technologies, but floor trading emphasizes interpersonal negotiation and immediacy, while electronic trading focuses on technical proficiency and system optimization.

Work Environment and Culture Differences

Floor traders operate in fast-paced, physical trading pits with direct human interaction, fostering a competitive and high-pressure environment requiring quick decision-making. Electronic traders work remotely or in office settings, relying on computer screens and algorithms, promoting a more analytical and technology-driven culture. The shift from physical to electronic trading has transformed communication styles, stress factors, and collaboration dynamics in financial markets.

Required Qualifications and Certifications

Floor traders typically require a deep understanding of market dynamics and may hold certifications such as the Series 7 or Series 63 licenses to legally trade on exchanges, emphasizing practical experience and in-person negotiation skills. Electronic traders prioritize advanced knowledge in quantitative analysis, programming languages like Python or C++, and certifications such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) to navigate algorithmic and high-frequency trading platforms. Both roles demand strong analytical capabilities, but electronic traders often need more technical expertise and formal education in computer science or engineering.

Salary Expectations and Job Prospects

Floor traders typically earn base salaries ranging from $60,000 to $150,000 annually, with potential bonuses dependent on trading performance, but job opportunities are declining due to the rise of electronic trading platforms. Electronic traders often command higher total compensation, averaging between $100,000 and $250,000, driven by algorithmic trading skills and data analysis expertise, with growing demand in proprietary trading firms and hedge funds. The shift towards automated, high-frequency trading technology favors electronic trading roles, resulting in more robust job prospects and scalability compared to the traditional floor trading profession.

Future Trends: The Evolution of Trading Roles

Floor traders increasingly integrate advanced technology to complement their on-site expertise, enhancing decision-making speed and market insight. Electronic traders leverage algorithmic strategies and artificial intelligence to execute high-frequency trades with precision and reduced latency. Future trends indicate a convergence where hybrid models blend human intuition with automated systems, driving efficiency and adaptability in evolving financial markets.

Floor Trader vs Electronic Trader Infographic

jobdiv.com

jobdiv.com