Commodity traders specialize in buying and selling physical goods like oil, metals, and agricultural products, managing risks associated with supply and demand fluctuations. Financial derivatives traders deal with contracts based on the value of underlying assets, including futures, options, and swaps, aiming to profit from price changes without owning the physical commodity. Both roles require deep market analysis, but commodity trading often involves logistics and storage considerations, while derivatives trading focuses on leveraging financial instruments to hedge or speculate.

Table of Comparison

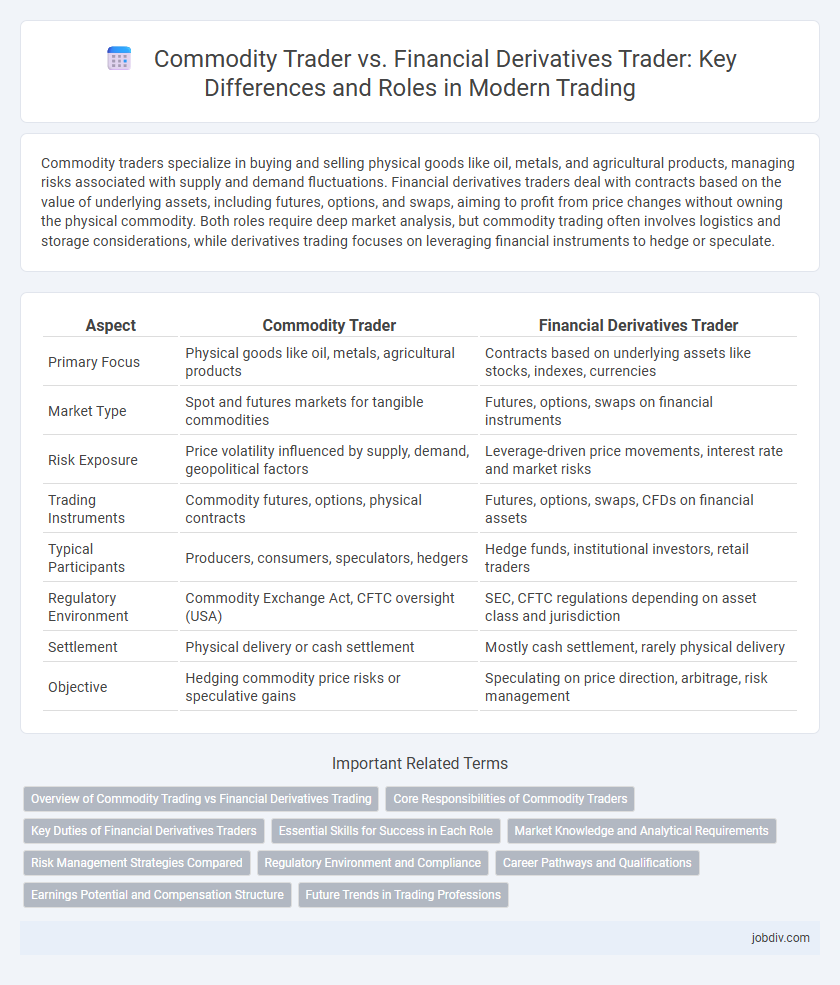

| Aspect | Commodity Trader | Financial Derivatives Trader |

|---|---|---|

| Primary Focus | Physical goods like oil, metals, agricultural products | Contracts based on underlying assets like stocks, indexes, currencies |

| Market Type | Spot and futures markets for tangible commodities | Futures, options, swaps on financial instruments |

| Risk Exposure | Price volatility influenced by supply, demand, geopolitical factors | Leverage-driven price movements, interest rate and market risks |

| Trading Instruments | Commodity futures, options, physical contracts | Futures, options, swaps, CFDs on financial assets |

| Typical Participants | Producers, consumers, speculators, hedgers | Hedge funds, institutional investors, retail traders |

| Regulatory Environment | Commodity Exchange Act, CFTC oversight (USA) | SEC, CFTC regulations depending on asset class and jurisdiction |

| Settlement | Physical delivery or cash settlement | Mostly cash settlement, rarely physical delivery |

| Objective | Hedging commodity price risks or speculative gains | Speculating on price direction, arbitrage, risk management |

Overview of Commodity Trading vs Financial Derivatives Trading

Commodity trading involves the physical buying and selling of raw materials such as oil, gold, and agricultural products, where traders capitalize on supply and demand fluctuations. Financial derivatives trading focuses on contracts like futures, options, and swaps, allowing traders to hedge risks or speculate on price movements without owning the underlying assets. Both markets require an understanding of global economic factors but differ primarily in the nature of the assets and risk management strategies involved.

Core Responsibilities of Commodity Traders

Commodity traders specialize in the buying and selling of physical goods such as oil, metals, agricultural products, and energy resources, managing supply chains and logistics to optimize inventory and delivery schedules. They assess market demand, negotiate contracts, and monitor geopolitical and environmental factors that influence commodity prices and availability. Their core responsibilities include risk management through hedging, maintaining relationships with producers and consumers, and ensuring compliance with regulatory requirements specific to the commodities market.

Key Duties of Financial Derivatives Traders

Financial derivatives traders primarily analyze and execute trades involving futures, options, swaps, and other derivative contracts to manage risk and capitalize on market fluctuations. They monitor underlying asset prices, volatility, and market conditions while using complex quantitative models to price and hedge derivative instruments. Their key duties include strategic risk assessment, portfolio optimization, and ensuring compliance with regulatory requirements in dynamic financial markets.

Essential Skills for Success in Each Role

Commodity traders excel in market analysis, risk management, and supply chain knowledge, crucial for handling physical goods like oil, metals, and agricultural products. Financial derivatives traders require advanced quantitative skills, proficiency in complex financial instruments, and strong analytical capabilities to manage futures, options, and swaps effectively. Both roles demand sharp decision-making skills and real-time market responsiveness to maximize profitability and minimize risk exposure.

Market Knowledge and Analytical Requirements

Commodity traders require deep expertise in physical markets, supply chains, and geopolitical factors influencing raw materials such as oil, metals, and agricultural products. Financial derivatives traders focus on complex mathematical models, market sentiment, and pricing dynamics of instruments like options, futures, and swaps. Both roles demand strong analytical skills, with commodity traders emphasizing real-world asset valuation and derivatives traders prioritizing quantitative analysis and risk management strategies.

Risk Management Strategies Compared

Commodity traders mitigate risk through physical asset diversification, inventory control, and hedging using futures contracts tied to real goods, ensuring price stability in volatile markets. Financial derivatives traders manage risk primarily by adopting sophisticated quantitative models, leveraging options and swaps to hedge against price fluctuations and market volatility without holding the underlying assets. Both rely on stop-loss orders and real-time market analysis, but commodity traders emphasize supply chain factors while derivatives traders focus on market sentiment and liquidity risk.

Regulatory Environment and Compliance

Commodity traders navigate complex regulatory frameworks such as the Commodity Futures Trading Commission (CFTC) rules and the Dodd-Frank Act to ensure transparency and mitigate market manipulation risks. Financial derivatives traders are subject to stringent compliance under regulations like the Securities Exchange Act and the European Market Infrastructure Regulation (EMIR), which enforce reporting, clearing, and risk management standards. Both types of traders must implement comprehensive compliance programs to adhere to anti-money laundering (AML) laws and prevention of insider trading to maintain market integrity.

Career Pathways and Qualifications

Commodity traders typically require a background in economics, finance, or agriculture, with skills in market analysis and supply chain management crucial for trading physical goods like oil, metals, and agricultural products. Financial derivatives traders often hold degrees in finance, mathematics, or engineering, emphasizing quantitative skills and risk assessment to trade instruments such as futures, options, and swaps. Career pathways diverge as commodity traders focus on understanding global commodity markets and logistics, whereas derivatives traders advance through roles centered on quantitative modeling and regulatory compliance.

Earnings Potential and Compensation Structure

Commodity traders typically earn through commissions and profits from physical asset transactions, with compensation closely tied to market volatility and trade volume. Financial derivatives traders often receive a base salary plus performance-based bonuses linked to risk-adjusted returns on instruments like options, futures, and swaps. The earnings potential for derivatives traders can be higher due to leverage and market liquidity, but it comes with increased risk and complexity compared to commodity trading.

Future Trends in Trading Professions

Commodity traders are increasingly leveraging advanced data analytics and AI to predict market shifts and optimize supply chain management, enhancing decision accuracy in volatile markets. Financial derivatives traders are adopting algorithmic trading and blockchain technologies to improve transparency, execution speed, and risk management in complex instruments. Future trends indicate a convergence of skills across both professions, emphasizing tech proficiency and regulatory adaptability to navigate evolving global trade environments.

Commodity Trader vs Financial Derivatives Trader Infographic

jobdiv.com

jobdiv.com