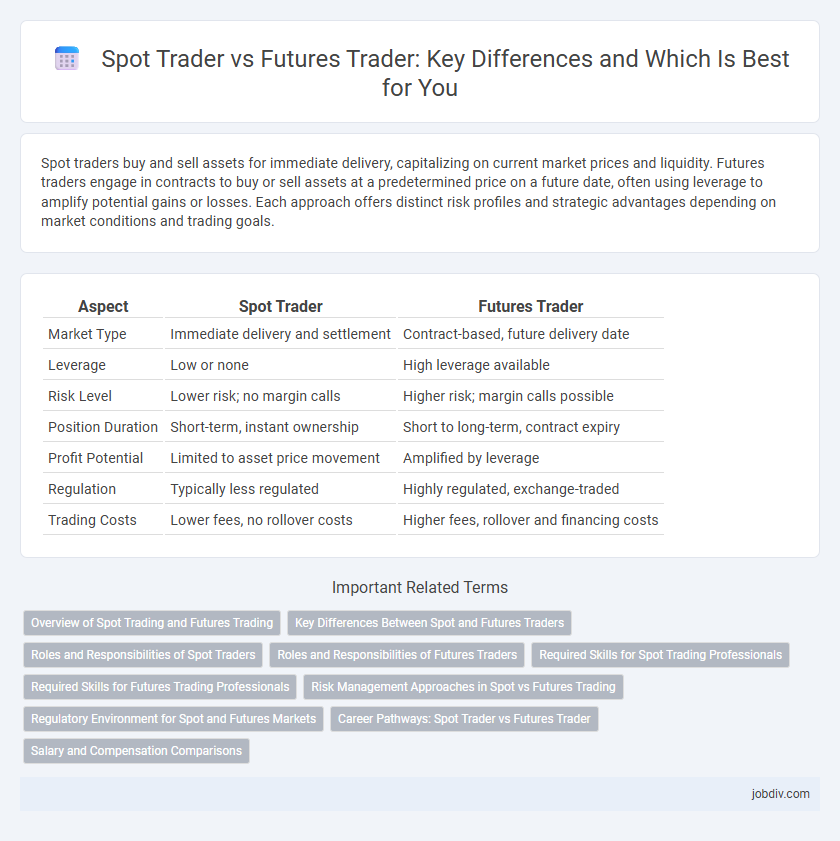

Spot traders buy and sell assets for immediate delivery, capitalizing on current market prices and liquidity. Futures traders engage in contracts to buy or sell assets at a predetermined price on a future date, often using leverage to amplify potential gains or losses. Each approach offers distinct risk profiles and strategic advantages depending on market conditions and trading goals.

Table of Comparison

| Aspect | Spot Trader | Futures Trader |

|---|---|---|

| Market Type | Immediate delivery and settlement | Contract-based, future delivery date |

| Leverage | Low or none | High leverage available |

| Risk Level | Lower risk; no margin calls | Higher risk; margin calls possible |

| Position Duration | Short-term, instant ownership | Short to long-term, contract expiry |

| Profit Potential | Limited to asset price movement | Amplified by leverage |

| Regulation | Typically less regulated | Highly regulated, exchange-traded |

| Trading Costs | Lower fees, no rollover costs | Higher fees, rollover and financing costs |

Overview of Spot Trading and Futures Trading

Spot trading involves the immediate exchange of financial instruments or commodities at current market prices, allowing traders to settle transactions instantly or within a short period. Futures trading, on the other hand, is based on contracts that obligate the buyer or seller to trade an asset at a predetermined price on a specified future date, providing opportunities for hedging and speculation. Both trading types serve distinct purposes, with spot trading emphasizing liquidity and real-time price discovery, while futures trading offers leverage and risk management through standardized agreements.

Key Differences Between Spot and Futures Traders

Spot traders execute immediate transactions for assets at current market prices, emphasizing real-time ownership transfer and liquidity. Futures traders engage in contract agreements to buy or sell assets at predetermined prices on future dates, leveraging derivatives for hedging or speculation. Key differences include delivery timing, risk exposure, margin requirements, and market strategies, with spot trading reflecting actual asset possession and futures trading involving contractual obligations.

Roles and Responsibilities of Spot Traders

Spot traders execute immediate transactions for assets such as commodities, currencies, or stocks, ensuring quick settlement and delivery in the spot market. They monitor real-time price movements and market liquidity to capitalize on short-term opportunities, often managing risk through timely order placements and portfolio adjustments. Their responsibilities include analyzing supply and demand factors, executing trades at current market prices, and maintaining accurate records for regulatory compliance.

Roles and Responsibilities of Futures Traders

Futures traders manage positions by entering contracts that obligate buying or selling assets at predetermined prices and dates, requiring in-depth market analysis and risk management skills to anticipate price movements. They fulfill roles such as hedging against price volatility, ensuring liquidity in futures markets, and leveraging speculative opportunities to generate profit. Responsibilities include monitoring margin requirements, executing timely trades, and maintaining compliance with regulatory standards to mitigate financial exposure.

Required Skills for Spot Trading Professionals

Spot trading professionals require strong analytical skills to accurately assess real-time market prices and execute immediate transactions. In-depth knowledge of market liquidity, price volatility, and order book dynamics is essential to optimize trade execution. Effective risk management and quick decision-making abilities are critical for capitalizing on short-term price movements in spot markets.

Required Skills for Futures Trading Professionals

Futures trading professionals require strong analytical skills to interpret market trends, economic indicators, and geopolitical events affecting commodity prices. Mastery of risk management techniques is essential to hedge against volatility and leverage positions effectively. Proficiency in technical analysis, coupled with disciplined decision-making and quick adaptation to market changes, distinguishes successful futures traders from spot traders.

Risk Management Approaches in Spot vs Futures Trading

Spot traders manage risk by immediately executing asset purchases or sales, minimizing exposure to market fluctuations and relying heavily on stop-loss orders to protect capital during volatile price movements. Futures traders employ margin requirements and leverage, which amplifies potential gains but necessitates strict risk controls, including maintaining margin levels and using hedging strategies to mitigate adverse price shifts. Effective risk management in futures trading demands continuous monitoring and adjusting positions to avoid margin calls, whereas spot trading emphasizes real-time asset ownership and prompt market reactions.

Regulatory Environment for Spot and Futures Markets

Regulatory environments for spot and futures traders differ significantly, with spot markets typically falling under less stringent oversight due to their immediate transaction nature, while futures markets are highly regulated by entities such as the Commodity Futures Trading Commission (CFTC) in the United States. Futures trading involves standardized contracts and obligations, necessitating comprehensive reporting, margin requirements, and position limits to mitigate systemic risk. Spot traders, operating with real-time asset exchanges, face fewer compliance complexities but must still adhere to anti-money laundering (AML) and know-your-customer (KYC) regulations.

Career Pathways: Spot Trader vs Futures Trader

Spot traders build careers by executing immediate asset transactions, gaining expertise in real-time market analysis and liquidity management, which suits roles in retail trading firms or proprietary desks. Futures traders develop skills in speculating or hedging long-term price movements, mastering derivative instruments and risk management, often leading to positions in commodity trading houses, hedge funds, or institutional investment firms. Both pathways require strong quantitative abilities, but futures trading demands deeper knowledge of contract specifications and margin requirements.

Salary and Compensation Comparisons

Spot traders typically earn salaries ranging from $70,000 to $130,000 annually, with bonuses tied directly to daily trade performance, reflecting the immediate nature of spot market transactions. Futures traders often have higher earning potential, with base salaries between $90,000 and $150,000, supplemented by commissions and profit-sharing based on contract volumes and market volatility. Compensation in futures trading is more complex due to leverage and margin requirements, leading to larger but potentially more variable payouts compared to spot trading's straightforward profit realization.

Spot Trader vs Futures Trader Infographic

jobdiv.com

jobdiv.com