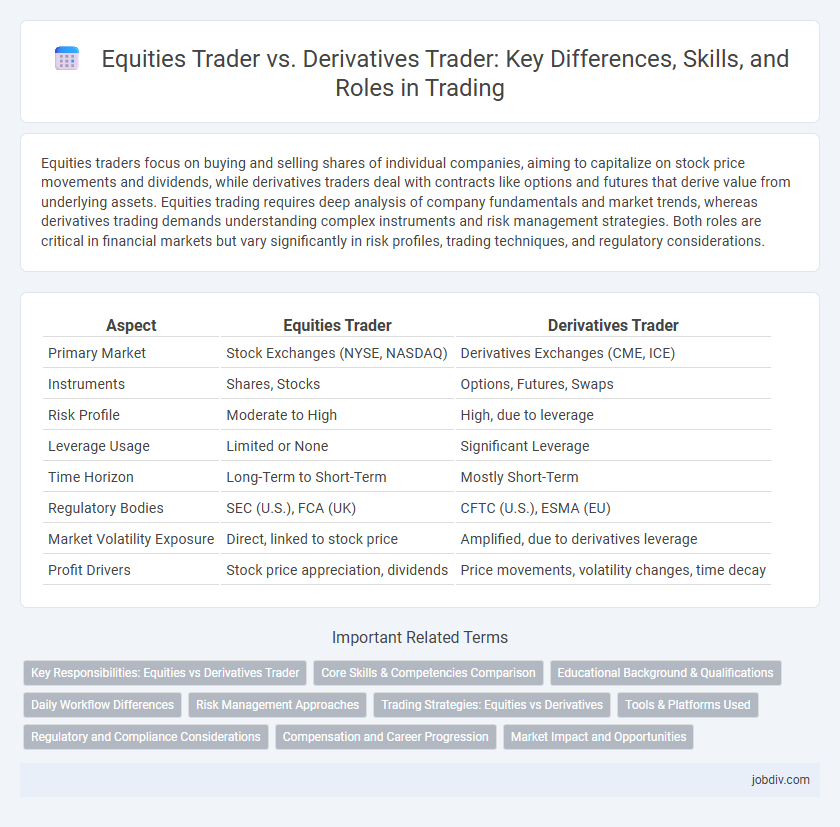

Equities traders focus on buying and selling shares of individual companies, aiming to capitalize on stock price movements and dividends, while derivatives traders deal with contracts like options and futures that derive value from underlying assets. Equities trading requires deep analysis of company fundamentals and market trends, whereas derivatives trading demands understanding complex instruments and risk management strategies. Both roles are critical in financial markets but vary significantly in risk profiles, trading techniques, and regulatory considerations.

Table of Comparison

| Aspect | Equities Trader | Derivatives Trader |

|---|---|---|

| Primary Market | Stock Exchanges (NYSE, NASDAQ) | Derivatives Exchanges (CME, ICE) |

| Instruments | Shares, Stocks | Options, Futures, Swaps |

| Risk Profile | Moderate to High | High, due to leverage |

| Leverage Usage | Limited or None | Significant Leverage |

| Time Horizon | Long-Term to Short-Term | Mostly Short-Term |

| Regulatory Bodies | SEC (U.S.), FCA (UK) | CFTC (U.S.), ESMA (EU) |

| Market Volatility Exposure | Direct, linked to stock price | Amplified, due to derivatives leverage |

| Profit Drivers | Stock price appreciation, dividends | Price movements, volatility changes, time decay |

Key Responsibilities: Equities vs Derivatives Trader

Equities traders manage buying and selling stocks to capitalize on price movements in the stock market, focusing on order execution, market analysis, and portfolio management. Derivatives traders specialize in trading contracts like options, futures, and swaps, emphasizing risk management, pricing models, and hedging strategies. Both roles require real-time decision-making and deep market knowledge, but equities traders prioritize share liquidity and volatility, while derivatives traders focus on leverage and contract specifications.

Core Skills & Competencies Comparison

Equities traders excel in skills such as stock market analysis, order execution, and portfolio management, leveraging strong knowledge of company fundamentals and market trends. Derivatives traders focus on expertise in financial instruments like options and futures, requiring advanced quantitative skills, risk management, and pricing models proficiency. Both roles demand strong decision-making abilities and market intuition, but derivatives trading emphasizes complex mathematical modeling and strategic hedging techniques.

Educational Background & Qualifications

Equities traders typically hold degrees in finance, economics, or business administration, with certifications such as the Chartered Financial Analyst (CFA) enhancing their expertise in stock market analysis and portfolio management. Derivatives traders often possess advanced qualifications in mathematics, statistics, or financial engineering, alongside professional credentials like Financial Risk Manager (FRM) or Series 7 and 63 licenses to navigate complex options, futures, and swaps markets. Both roles demand strong analytical skills and proficiency in quantitative methods, but derivatives trading requires deeper understanding of pricing models and risk assessment tools specific to derivative instruments.

Daily Workflow Differences

Equities traders primarily focus on buying and selling shares of publicly traded companies, analyzing market trends, corporate earnings, and stock performance throughout the trading day to execute timely trades. Derivatives traders manage contracts such as options, futures, and swaps, monitoring underlying asset prices, volatility, and expiration dates to optimize hedging and speculative strategies. The daily workflow for equities traders emphasizes real-time stock price movements and order execution speed, while derivatives traders prioritize complex risk assessment models and strategy adjustments based on market derivatives data.

Risk Management Approaches

Equities traders primarily manage risk through portfolio diversification, stop-loss orders, and real-time market analytics to mitigate price volatility in stocks. Derivatives traders employ complex hedging strategies using options, futures, and swaps to offset potential losses from underlying asset price fluctuations and leverage exposure. Both roles require rigorous risk assessment models, but derivatives trading demands advanced quantitative techniques to address higher leverage and margin risks.

Trading Strategies: Equities vs Derivatives

Equities traders primarily focus on buying and selling stocks to capitalize on price movements and dividends, often using strategies like momentum trading, value investing, and swing trading. Derivatives traders utilize instruments such as options, futures, and swaps to hedge risks, speculate on price fluctuations, or arbitrage pricing inefficiencies, frequently employing strategies like delta hedging, spread trading, and volatility arbitrage. The complexity and leverage inherent in derivatives trading demand advanced risk management techniques compared to the relatively straightforward approach in equities trading.

Tools & Platforms Used

Equities traders primarily utilize sophisticated order management systems (OMS) and electronic communication networks (ECNs) such as Bloomberg Terminal and E*TRADE for real-time stock trading and market analysis. Derivatives traders rely heavily on advanced risk management platforms like CME Direct and TradeLink, which support complex options, futures, and swaps trading with integrated pricing models and volatility analytics. Both roles employ algorithmic trading software and market data feeds to optimize execution strategies and capitalize on price movements efficiently.

Regulatory and Compliance Considerations

Equities traders must navigate regulations such as the SEC's Regulation National Market System (Reg NMS) and MiFID II in Europe, ensuring transparent order execution and best execution policies. Derivatives traders face stricter oversight under frameworks like the Dodd-Frank Act and EMIR, which mandate central clearing, margin requirements, and detailed reporting to reduce systemic risk. Compliance teams prioritize trade surveillance, pre- and post-trade transparency, and adherence to position limits to mitigate market manipulation and systemic exposure in both trading domains.

Compensation and Career Progression

Equities traders typically receive compensation packages that include base salary, commissions, and performance bonuses tied to stock market trading volumes and profitability, reflecting market demand and individual success. Derivatives traders often command higher variable bonuses due to the complex risk profiles and leverage involved in options, futures, and swaps trading, with compensation linked closely to managing volatility and hedging strategies. Career progression for equities traders usually advances through senior trading and portfolio management roles, while derivatives traders can move towards specialized risk management, structuring, or proprietary trading positions, often benefiting from advanced quantitative skills.

Market Impact and Opportunities

Equities traders primarily influence stock prices through direct buying and selling of shares, creating immediate market impact and liquidity fluctuations. Derivatives traders affect underlying asset prices indirectly by trading contracts like options and futures, enabling hedging strategies and speculative opportunities with leveraged exposure. Equities trading offers straightforward market impact insights, while derivatives trading provides diverse tools for risk management and arbitrage in volatile markets.

Equities Trader vs Derivatives Trader Infographic

jobdiv.com

jobdiv.com