Retail traders typically operate with smaller capital and execute trades on personal accounts, often relying on technical analysis and market sentiment. Institutional traders manage large portfolios for organizations such as banks and hedge funds, leveraging advanced strategies, superior technology, and extensive market research. The key differences lie in trade volume, access to resources, and market influence, impacting their trading behavior and risk management approaches.

Table of Comparison

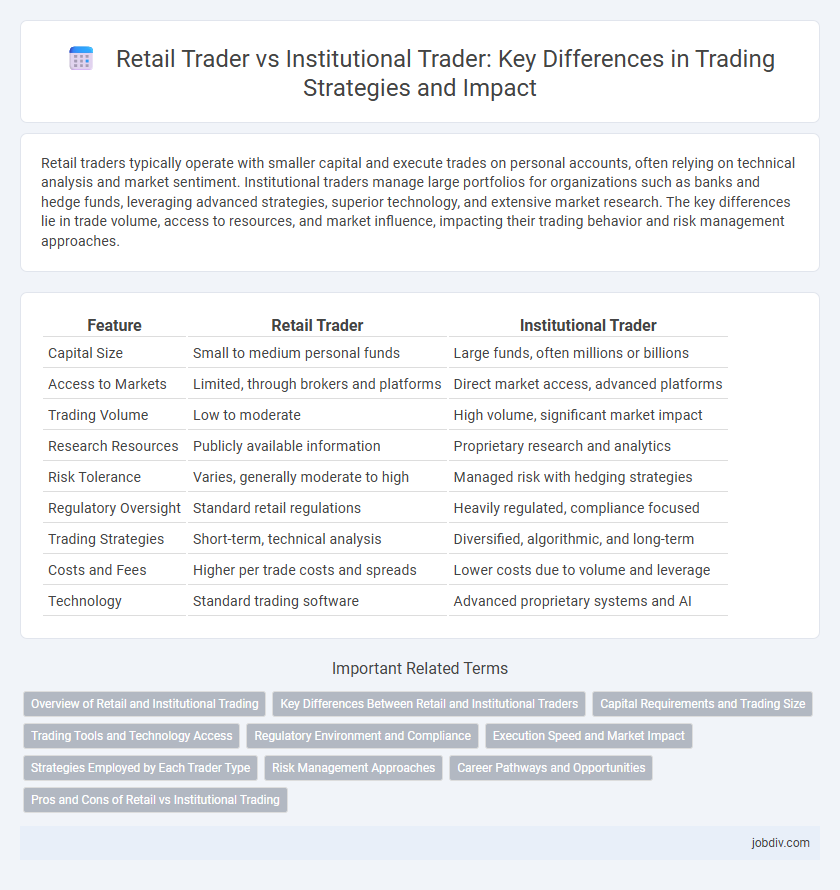

| Feature | Retail Trader | Institutional Trader |

|---|---|---|

| Capital Size | Small to medium personal funds | Large funds, often millions or billions |

| Access to Markets | Limited, through brokers and platforms | Direct market access, advanced platforms |

| Trading Volume | Low to moderate | High volume, significant market impact |

| Research Resources | Publicly available information | Proprietary research and analytics |

| Risk Tolerance | Varies, generally moderate to high | Managed risk with hedging strategies |

| Regulatory Oversight | Standard retail regulations | Heavily regulated, compliance focused |

| Trading Strategies | Short-term, technical analysis | Diversified, algorithmic, and long-term |

| Costs and Fees | Higher per trade costs and spreads | Lower costs due to volume and leverage |

| Technology | Standard trading software | Advanced proprietary systems and AI |

Overview of Retail and Institutional Trading

Retail traders execute smaller trades using personal funds, typically through online brokerage platforms, impacting market liquidity on a micro level. Institutional traders manage large-scale investments for entities such as hedge funds, pension funds, and mutual funds, leveraging advanced analytics and direct market access to influence pricing trends significantly. The disparity in capital, information, and resources between retail and institutional traders creates distinct trading behaviors and market impacts.

Key Differences Between Retail and Institutional Traders

Retail traders typically execute smaller trades using personal funds with limited access to advanced trading tools and market data, whereas institutional traders manage large-scale portfolios with significant capital and leverage sophisticated technology and proprietary algorithms. Institutional traders benefit from lower transaction costs, higher liquidity, and direct market access, enabling faster execution and greater market influence compared to retail traders who rely on brokerage platforms. The scale of operations, access to information, and strategic resources mark the primary differences shaping their trading behaviors and market impact.

Capital Requirements and Trading Size

Retail traders typically operate with smaller capital requirements, often ranging from a few hundred to tens of thousands of dollars, allowing them to trade smaller positions and leverage options. Institutional traders manage significantly larger capital pools, sometimes reaching billions of dollars, enabling them to execute substantial trades with greater market impact and access to advanced trading tools. The difference in trading size and capital directly influences liquidity, risk management strategies, and market influence between retail and institutional participants.

Trading Tools and Technology Access

Retail traders primarily rely on basic trading platforms and standard charting tools, often lacking access to advanced algorithms and high-frequency trading systems. Institutional traders benefit from proprietary algorithms, direct market access, and sophisticated risk management software that enable faster execution and deeper market analysis. The disparity in technology access significantly influences trade execution speed, order types available, and overall market impact for each trader category.

Regulatory Environment and Compliance

Retail traders operate under regulatory frameworks designed to protect individual investors, including mandatory disclosures and limits on leverage imposed by bodies such as the SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority). Institutional traders, managing large portfolios for entities like hedge funds or pension funds, face stringent compliance requirements, including detailed reporting, risk management protocols, and adherence to global regulations such as MiFID II in Europe. The regulatory environment ensures transparency and fairness but imposes differing compliance burdens tailored to the scale and nature of retail versus institutional trading activities.

Execution Speed and Market Impact

Retail traders experience slower execution speeds due to limited access to direct market channels, often resulting in delays and less favorable prices. Institutional traders benefit from advanced algorithms and direct market access, enabling faster execution and reduced market impact by splitting large orders to minimize price slippage. Execution speed and market impact are critical differentiators, influencing trade efficiency and overall profitability in high-frequency and large-volume trading environments.

Strategies Employed by Each Trader Type

Retail traders typically employ strategies such as day trading, swing trading, and using technical analysis tools like moving averages and RSI to capitalize on short-term price movements. Institutional traders utilize advanced strategies including algorithmic trading, large-scale arbitrage, and fundamental analysis backed by extensive research teams to manage sizable portfolios. The scale of capital and access to market data significantly differentiates the strategic approaches between retail and institutional traders.

Risk Management Approaches

Retail traders often employ basic risk management techniques such as setting stop-loss orders and limiting position sizes, relying on personal judgment and available trading platforms. Institutional traders utilize sophisticated risk management frameworks incorporating advanced algorithms, diversification strategies, and real-time market analytics to mitigate exposure across large portfolios. The significant difference in capital, technology, and access to market information drives the varied risk management approaches between retail and institutional traders.

Career Pathways and Opportunities

Retail traders often enter the market with limited capital and rely on self-education and online platforms to develop their skills, making it accessible for individual investors seeking flexible career options. Institutional traders typically work for banks, hedge funds, or asset management firms, benefiting from structured career pathways with higher earning potential and access to advanced trading tools and research resources. Career opportunities for institutional traders include roles such as portfolio manager, quantitative analyst, and risk manager, while retail traders may transition into professional trading, financial analysis, or advisory positions with the growth of their expertise.

Pros and Cons of Retail vs Institutional Trading

Retail traders benefit from lower capital requirements and greater flexibility but face higher transaction costs and limited market influence. Institutional traders leverage significant capital, advanced technology, and exclusive market access, enabling better trade execution and risk management, yet they encounter regulatory scrutiny and less agility. Retail trading offers individual empowerment, whereas institutional trading emphasizes scale and efficiency, each with distinct advantages and constraints.

Retail Trader vs Institutional Trader Infographic

jobdiv.com

jobdiv.com