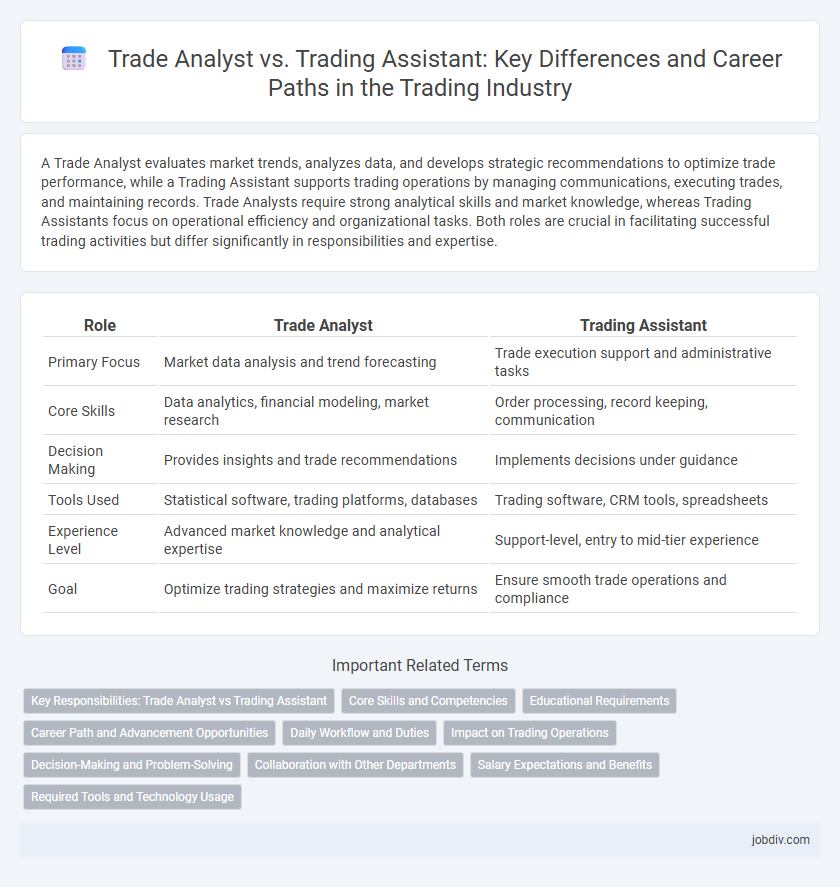

A Trade Analyst evaluates market trends, analyzes data, and develops strategic recommendations to optimize trade performance, while a Trading Assistant supports trading operations by managing communications, executing trades, and maintaining records. Trade Analysts require strong analytical skills and market knowledge, whereas Trading Assistants focus on operational efficiency and organizational tasks. Both roles are crucial in facilitating successful trading activities but differ significantly in responsibilities and expertise.

Table of Comparison

| Role | Trade Analyst | Trading Assistant |

|---|---|---|

| Primary Focus | Market data analysis and trend forecasting | Trade execution support and administrative tasks |

| Core Skills | Data analytics, financial modeling, market research | Order processing, record keeping, communication |

| Decision Making | Provides insights and trade recommendations | Implements decisions under guidance |

| Tools Used | Statistical software, trading platforms, databases | Trading software, CRM tools, spreadsheets |

| Experience Level | Advanced market knowledge and analytical expertise | Support-level, entry to mid-tier experience |

| Goal | Optimize trading strategies and maximize returns | Ensure smooth trade operations and compliance |

Key Responsibilities: Trade Analyst vs Trading Assistant

Trade Analysts focus on analyzing market trends, interpreting financial data, and creating detailed reports to support strategic decision-making. Trading Assistants primarily handle order execution, maintain trade documentation, and coordinate communication between traders and other departments. Both roles require strong knowledge of market regulations but differ in their emphasis on data analysis versus operational support.

Core Skills and Competencies

Trade Analysts excel in data analysis, market research, and economic forecasting, leveraging advanced statistical tools and software to inform strategic trade decisions. Trading Assistants specialize in transaction processing, order management, and client communication, ensuring smooth execution of trades and operational support. Both roles require strong attention to detail, knowledge of financial regulations, and proficiency in trading platforms, but Trade Analysts focus more on analytical skills while Trading Assistants emphasize operational efficiency.

Educational Requirements

Trade Analysts typically require a bachelor's degree in finance, economics, or business administration, with advanced certifications like CFA enhancing their expertise in market analysis and strategic decision-making. Trading Assistants usually need a minimum of a high school diploma or associate degree, with on-the-job training to support traders in executing orders and managing trade documentation. A strong foundation in quantitative skills and familiarity with trading platforms is essential for both roles, but Trade Analysts demand a higher level of formal education and analytical proficiency.

Career Path and Advancement Opportunities

Trade Analysts typically advance by specializing in market research, data analysis, and strategic planning, often moving into senior analyst or managerial roles within trading firms or financial institutions. Trading Assistants generally start with operational support and order management, progressing to roles such as Junior Trader or Trader, with hands-on experience in executing trades and client interaction as key career growth drivers. The Trade Analyst path emphasizes analytical skills and market strategy, while the Trading Assistant route focuses on practical trading experience and direct market involvement.

Daily Workflow and Duties

Trade Analysts primarily focus on analyzing market trends, evaluating trade data, and preparing detailed reports to guide strategic decisions, requiring strong quantitative and analytical skills. Trading Assistants support traders by managing daily trade documentation, monitoring transactions, and ensuring compliance with regulatory requirements, emphasizing organizational efficiency and attention to detail. While Trade Analysts drive insights for long-term planning, Trading Assistants handle operational tasks critical for smooth daily trading workflows.

Impact on Trading Operations

Trade Analysts optimize trading strategies by analyzing market data and forecasting trends, directly enhancing decision-making efficiency and profitability. Trading Assistants support daily operations by managing trade documentation, coordinating execution logistics, and ensuring compliance, which streamlines workflow and reduces operational risks. The combined impact of both roles improves overall trading operations by aligning strategic insights with effective trade execution and risk management.

Decision-Making and Problem-Solving

Trade Analysts specialize in decision-making by utilizing data analytics and market research to develop strategic trade recommendations that optimize profitability and mitigate risk. Trading Assistants support problem-solving processes by handling transactional tasks, monitoring trade flows, and ensuring compliance, enabling Traders and Analysts to focus on higher-level decisions. The Trade Analyst's role demands advanced analytical capabilities, whereas the Trading Assistant emphasizes operational efficiency and issue resolution within trade execution.

Collaboration with Other Departments

Trade Analysts collaborate closely with finance, marketing, and supply chain departments to interpret market trends and optimize trading strategies. Trading Assistants support these efforts by coordinating communication between sales teams and logistics, ensuring smooth execution of trade operations. Both roles require seamless interdepartmental collaboration to enhance overall trade performance and decision-making.

Salary Expectations and Benefits

Trade analysts typically command higher salary expectations due to their advanced analytical skills and strategic responsibilities, often earning between $70,000 and $95,000 annually, whereas trading assistants usually have entry-level roles with salaries ranging from $40,000 to $60,000. Benefits for trade analysts often include performance bonuses, comprehensive healthcare plans, and stock options, while trading assistants may receive standard healthcare benefits and limited bonus structures. Employers value trade analysts for their market insight and decision-making impact, influencing the disparity in compensation and perks.

Required Tools and Technology Usage

Trade Analysts primarily utilize advanced data analytics software, financial modeling tools, and market research platforms such as Bloomberg Terminal and Tableau to interpret market trends and forecast trade opportunities. Trading Assistants rely on order management systems (OMS), electronic trading platforms, and communication tools like Reuters Eikon to support trade execution and maintain transaction records. Both roles require proficiency in Excel and databases, but Trade Analysts emphasize analytical software while Trading Assistants focus on transaction and communication technologies.

Trade Analyst vs Trading Assistant Infographic

jobdiv.com

jobdiv.com