Trade Finance Officers specialize in managing and structuring trade-related financial products, ensuring smooth transactions between exporters and importers by assessing transaction risks and compliance. Credit Analysts focus on evaluating the creditworthiness of clients, analyzing financial statements and market conditions to mitigate risks associated with lending. Both roles are essential in trade finance, with Trade Finance Officers facilitating operational trade flows and Credit Analysts safeguarding the institution against credit losses.

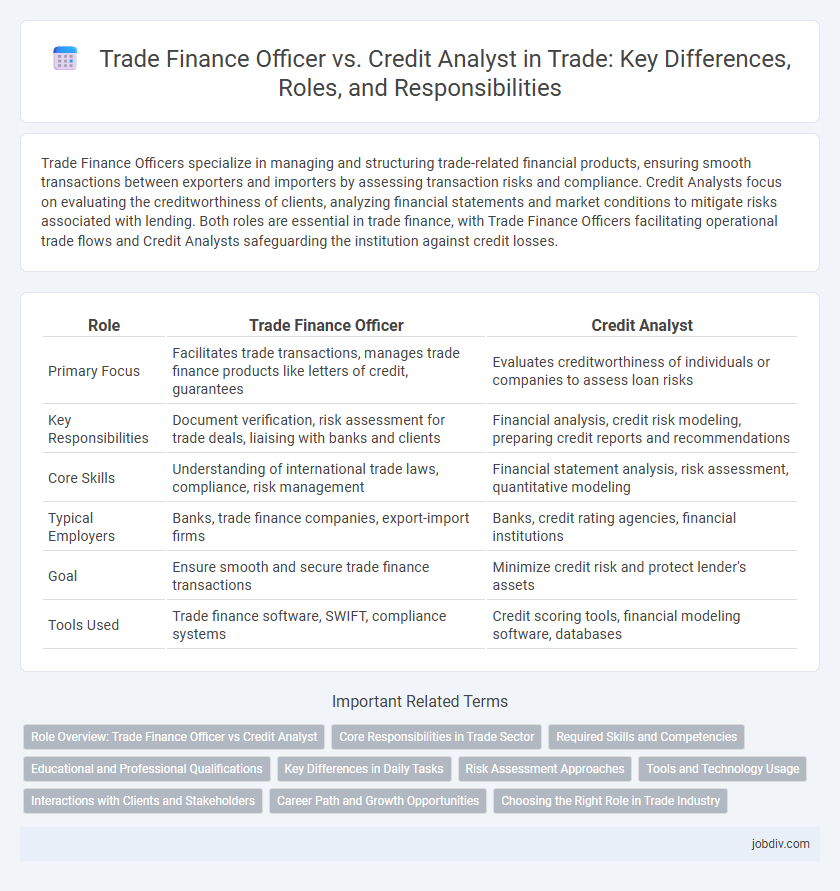

Table of Comparison

| Role | Trade Finance Officer | Credit Analyst |

|---|---|---|

| Primary Focus | Facilitates trade transactions, manages trade finance products like letters of credit, guarantees | Evaluates creditworthiness of individuals or companies to assess loan risks |

| Key Responsibilities | Document verification, risk assessment for trade deals, liaising with banks and clients | Financial analysis, credit risk modeling, preparing credit reports and recommendations |

| Core Skills | Understanding of international trade laws, compliance, risk management | Financial statement analysis, risk assessment, quantitative modeling |

| Typical Employers | Banks, trade finance companies, export-import firms | Banks, credit rating agencies, financial institutions |

| Goal | Ensure smooth and secure trade finance transactions | Minimize credit risk and protect lender's assets |

| Tools Used | Trade finance software, SWIFT, compliance systems | Credit scoring tools, financial modeling software, databases |

Role Overview: Trade Finance Officer vs Credit Analyst

Trade Finance Officers specialize in managing and facilitating international trade transactions, ensuring compliance with trade regulations and mitigating risks associated with letters of credit and guarantees. Credit Analysts assess the creditworthiness of clients and counterparties by analyzing financial statements, market conditions, and repayment capacity to minimize credit risk exposure. Both roles are critical in financial institutions, with Trade Finance Officers focusing on transaction execution and Credit Analysts concentrating on credit risk evaluation.

Core Responsibilities in Trade Sector

Trade Finance Officers manage and execute trade finance transactions, ensuring compliance with international trade regulations and mitigating risks associated with letters of credit, guarantees, and documentary collections. Credit Analysts assess the creditworthiness of trade clients by analyzing financial statements, credit reports, and market conditions to facilitate informed lending decisions and minimize default risks. Both roles are critical in supporting secure and efficient financial operations within the trade sector, with Trade Finance Officers focusing on transactional processes and Credit Analysts on risk evaluation.

Required Skills and Competencies

Trade Finance Officers require strong knowledge of international trade regulations, risk assessment, and document handling, along with excellent negotiation and communication skills to manage client relationships effectively. Credit Analysts focus on financial statement analysis, credit risk evaluation, and forecasting abilities, requiring proficiency in quantitative methods and industry-specific financial modeling. Both roles demand attention to detail, analytical thinking, and a solid understanding of banking products but differ in their emphasis on operational trade processes versus credit risk assessment.

Educational and Professional Qualifications

Trade Finance Officers typically hold degrees in finance, economics, or business administration, often complemented by certifications such as Certified Trade Finance Professional (CTFP) or International Chamber of Commerce (ICC) accreditation. Credit Analysts require strong backgrounds in accounting, finance, or economics, with professional qualifications like Chartered Financial Analyst (CFA) or Credit Risk Certification enhancing their expertise. Both roles demand analytical skills and experience in risk assessment, but Trade Finance Officers specialize in international trade regulations and financing instruments, whereas Credit Analysts focus on creditworthiness evaluation and financial statement analysis.

Key Differences in Daily Tasks

Trade Finance Officers primarily manage documentary credits, letters of credit, and trade-related payment processes, ensuring compliance with international trade regulations. Credit Analysts focus on assessing the creditworthiness of clients, analyzing financial statements, and determining credit limits to mitigate risk. While Trade Finance Officers handle transaction facilitation and operational documentation, Credit Analysts concentrate on financial evaluation and risk assessment.

Risk Assessment Approaches

Trade Finance Officers primarily assess risk by analyzing transaction documents, verifying compliance with trade regulations, and evaluating the financial health of trading partners to mitigate payment and shipment risks. Credit Analysts focus on assessing creditworthiness through detailed examination of financial statements, credit history, and market conditions to determine the borrower's ability to fulfill debt obligations. Both roles use risk assessment models, but Trade Finance Officers emphasize transactional risk in international trade, while Credit Analysts prioritize credit risk related to lending and repayment capabilities.

Tools and Technology Usage

Trade Finance Officers extensively use trade finance platforms like Bolero and blockchain-based systems to manage letters of credit, guarantees, and compliance documentation efficiently. Credit Analysts rely heavily on advanced credit scoring software, risk assessment tools such as Moody's Analytics, and financial modeling software like Excel and SAS to evaluate borrowers' creditworthiness. Both roles integrate ERP systems and data analytics to streamline processes, but Trade Finance Officers emphasize transaction monitoring while Credit Analysts focus on risk evaluation metrics.

Interactions with Clients and Stakeholders

Trade Finance Officers engage closely with clients to structure financial instruments like letters of credit, ensuring compliance with trade regulations and facilitating smooth international transactions. Credit Analysts evaluate clients' creditworthiness by analyzing financial statements and risk factors, providing crucial insights that inform lending decisions and safeguard stakeholder interests. Both roles require strong communication skills to coordinate effectively with banks, insurers, and corporate clients, enhancing trust and minimizing transactional risks.

Career Path and Growth Opportunities

Trade Finance Officers specialize in managing trade transactions, risk assessments, and facilitating international payments, often advancing to roles such as Trade Finance Manager or International Trade Consultant. Credit Analysts focus on evaluating creditworthiness and financial risk, with career growth leading to Senior Credit Analyst or Risk Manager positions. Both careers offer pathways into broader financial services, but Trade Finance emphasizes global commerce expertise while Credit Analysis centers on credit risk and financial evaluation.

Choosing the Right Role in Trade Industry

Trade Finance Officers specialize in managing trade transactions, letters of credit, and risk mitigation strategies to facilitate international trade, while Credit Analysts focus on assessing the creditworthiness of trade clients, analyzing financial statements, and determining credit risk limits. Selecting the right role depends on whether you prefer direct involvement in trade operations and relationship management or in-depth financial analysis and credit risk evaluation. Understanding industry demands and career growth opportunities in trade finance versus credit risk assessment helps align your skills with market needs.

Trade Finance Officer vs Credit Analyst Infographic

jobdiv.com

jobdiv.com