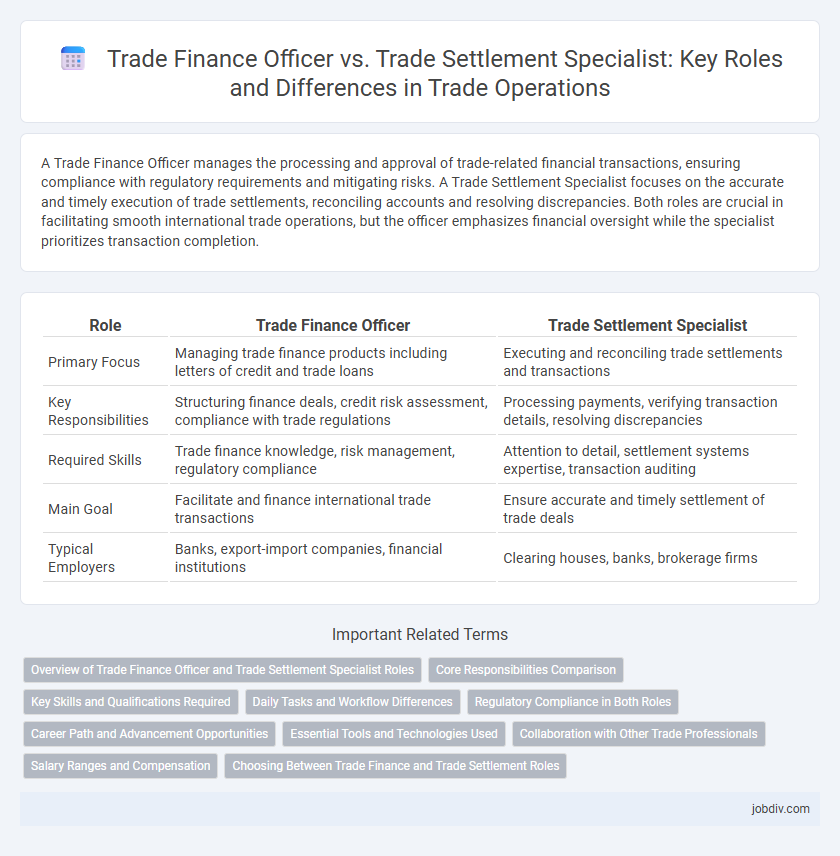

A Trade Finance Officer manages the processing and approval of trade-related financial transactions, ensuring compliance with regulatory requirements and mitigating risks. A Trade Settlement Specialist focuses on the accurate and timely execution of trade settlements, reconciling accounts and resolving discrepancies. Both roles are crucial in facilitating smooth international trade operations, but the officer emphasizes financial oversight while the specialist prioritizes transaction completion.

Table of Comparison

| Role | Trade Finance Officer | Trade Settlement Specialist |

|---|---|---|

| Primary Focus | Managing trade finance products including letters of credit and trade loans | Executing and reconciling trade settlements and transactions |

| Key Responsibilities | Structuring finance deals, credit risk assessment, compliance with trade regulations | Processing payments, verifying transaction details, resolving discrepancies |

| Required Skills | Trade finance knowledge, risk management, regulatory compliance | Attention to detail, settlement systems expertise, transaction auditing |

| Main Goal | Facilitate and finance international trade transactions | Ensure accurate and timely settlement of trade deals |

| Typical Employers | Banks, export-import companies, financial institutions | Clearing houses, banks, brokerage firms |

Overview of Trade Finance Officer and Trade Settlement Specialist Roles

Trade Finance Officers manage financial transactions and credit risk related to international trade, ensuring compliance with regulatory requirements and facilitating smooth payment processes. Trade Settlement Specialists focus on reconciling, processing, and confirming trade transactions to guarantee accurate settlement and timely delivery of trade documentation. Both roles are crucial in supporting global trade operations but emphasize different aspects of transaction management and risk mitigation.

Core Responsibilities Comparison

Trade Finance Officers manage the evaluation and processing of trade finance applications, ensuring compliance with regulatory standards and facilitating risk assessment in international trade transactions. Trade Settlement Specialists focus on the accurate execution and reconciliation of trade settlements, monitoring transaction lifecycles, and resolving discrepancies between counterparties to guarantee timely payment completion. Both roles require detailed knowledge of trade documentation, banking procedures, and cross-border transaction regulations to maintain operational efficiency and mitigate financial risks.

Key Skills and Qualifications Required

Trade Finance Officers require strong expertise in credit analysis, risk assessment, and knowledge of Letters of Credit, guarantees, and international banking regulations. Trade Settlement Specialists must demonstrate proficiency in transaction processing, reconciliation, compliance with trade regulations, and attention to detail in managing settlements and documentation. Both roles benefit from familiarity with trade finance software, strong communication skills, and a thorough understanding of global trade practices and regulatory frameworks.

Daily Tasks and Workflow Differences

Trade Finance Officers manage the issuance and processing of trade finance products such as letters of credit and guarantees, ensuring compliance with regulations and credit policies. Trade Settlement Specialists focus on the accurate and timely settlement of trade transactions, reconciling accounts, confirming trade details, and coordinating with banks and counterparties. While Trade Finance Officers concentrate on credit risk management and document verification, Trade Settlement Specialists prioritize transaction execution, payment processing, and settlement confirmation.

Regulatory Compliance in Both Roles

Trade Finance Officers ensure regulatory compliance by managing documentation and monitoring adherence to international trade laws and anti-money laundering (AML) standards. Trade Settlement Specialists focus on verifying transaction details to comply with financial regulations, ensuring accurate settlement and risk mitigation. Both roles require thorough knowledge of global trade regulations and continuous updates on compliance requirements to minimize legal and financial risks.

Career Path and Advancement Opportunities

Trade Finance Officers often advance toward senior roles in financial management or risk assessment, leveraging expertise in credit analysis and document compliance. Trade Settlement Specialists typically progress into positions emphasizing operations management and process optimization, building proficiency in transaction reconciliation and regulatory adherence. Career growth for both roles depends on developing specialized skills in international trade regulations, payment systems, and cross-border transaction handling.

Essential Tools and Technologies Used

Trade Finance Officers primarily rely on advanced risk assessment software, banking platforms like SWIFT, and documentary credit management systems to ensure secure and compliant international transactions. Trade Settlement Specialists utilize transaction monitoring tools, payment processing software, and reconciliation platforms to confirm accurate and timely settlement of trade deals. Both roles increasingly integrate blockchain technology and AI-driven analytics for enhanced efficiency and fraud prevention in global trade finance operations.

Collaboration with Other Trade Professionals

Trade Finance Officers collaborate closely with trade analysts, risk managers, and compliance officers to assess creditworthiness and structure financing solutions for international transactions. Trade Settlement Specialists coordinate with logistics teams, payment processors, and regulatory bodies to ensure accurate and timely completion of trade settlements. Both roles require seamless communication across departments to mitigate risks and guarantee smooth cross-border trade operations.

Salary Ranges and Compensation

Trade Finance Officers typically earn salaries ranging from $60,000 to $90,000 annually, reflecting their expertise in managing credit, risk, and financing solutions for international trade transactions. Trade Settlement Specialists usually have a salary range between $50,000 and $75,000, focusing on ensuring accurate and timely processing of trade documents and payments. Compensation packages for both roles may include bonuses, benefits, and performance incentives, with Trade Finance Officers generally receiving higher overall remuneration due to their strategic responsibilities.

Choosing Between Trade Finance and Trade Settlement Roles

Trade Finance Officers manage financing solutions and risk assessment for import-export transactions, ensuring liquidity and compliance with international regulations. Trade Settlement Specialists focus on accurate execution, reconciliation, and documentation of trade transactions, facilitating timely payment and delivery. Choosing between these roles depends on whether one prefers strategic financial planning and risk management or detailed operational processing and transaction accuracy.

Trade Finance Officer vs Trade Settlement Specialist Infographic

jobdiv.com

jobdiv.com