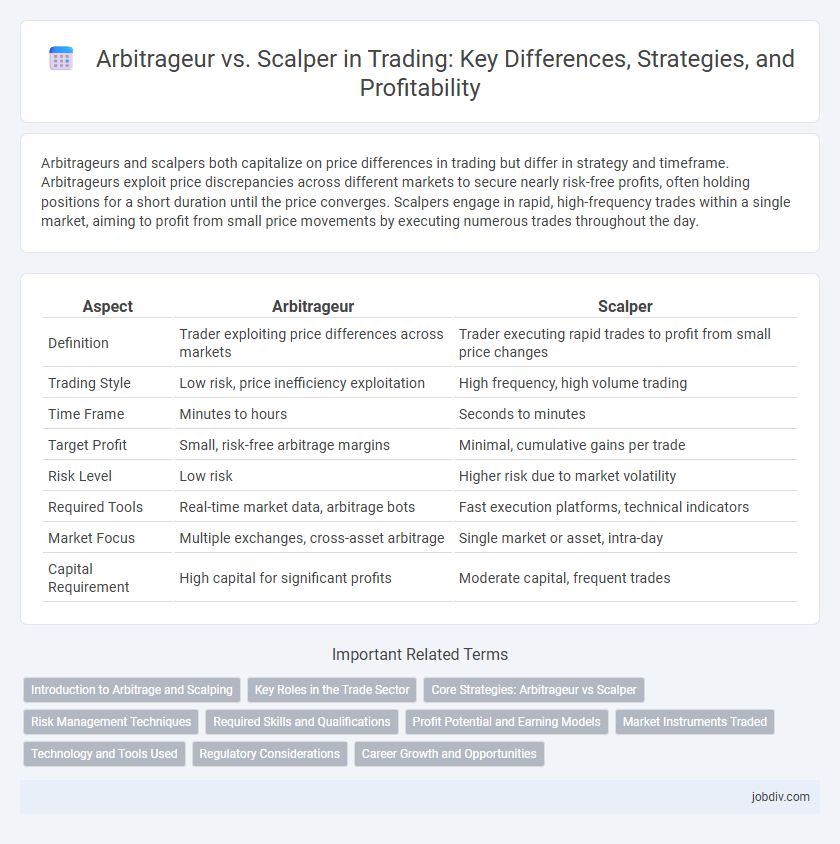

Arbitrageurs and scalpers both capitalize on price differences in trading but differ in strategy and timeframe. Arbitrageurs exploit price discrepancies across different markets to secure nearly risk-free profits, often holding positions for a short duration until the price converges. Scalpers engage in rapid, high-frequency trades within a single market, aiming to profit from small price movements by executing numerous trades throughout the day.

Table of Comparison

| Aspect | Arbitrageur | Scalper |

|---|---|---|

| Definition | Trader exploiting price differences across markets | Trader executing rapid trades to profit from small price changes |

| Trading Style | Low risk, price inefficiency exploitation | High frequency, high volume trading |

| Time Frame | Minutes to hours | Seconds to minutes |

| Target Profit | Small, risk-free arbitrage margins | Minimal, cumulative gains per trade |

| Risk Level | Low risk | Higher risk due to market volatility |

| Required Tools | Real-time market data, arbitrage bots | Fast execution platforms, technical indicators |

| Market Focus | Multiple exchanges, cross-asset arbitrage | Single market or asset, intra-day |

| Capital Requirement | High capital for significant profits | Moderate capital, frequent trades |

Introduction to Arbitrage and Scalping

Arbitrageurs exploit price discrepancies of the same asset across different markets to secure risk-free profits by simultaneously buying low in one market and selling high in another. Scalpers execute rapid trades within a single market, capitalizing on small price movements by buying and selling frequently throughout the trading session. Both strategies require sophisticated market analysis and swift execution but differ fundamentally in time horizon and risk exposure.

Key Roles in the Trade Sector

Arbitrageurs play a critical role in the trade sector by exploiting price discrepancies across different markets to ensure price uniformity and market efficiency. Scalpers, on the other hand, focus on rapid, small-profit trades within a single market, providing high liquidity and tighter bid-ask spreads. Both entities enhance market stability, with arbitrageurs reducing arbitrage opportunities and scalpers contributing to continuous price discovery.

Core Strategies: Arbitrageur vs Scalper

Arbitrageurs capitalize on price discrepancies across different markets by simultaneously buying low in one venue and selling high in another, ensuring risk-free profits through efficiency gaps. Scalpers execute rapid, high-frequency trades within a single market, exploiting minor price fluctuations to accumulate small, consistent gains. Both strategies rely heavily on speed and precision but diverge in risk exposure and market dynamics.

Risk Management Techniques

Arbitrageurs employ risk management techniques that focus on minimizing exposure through simultaneous buying and selling of assets across different markets, effectively locking in risk-free profits from price discrepancies. Scalpers manage risk by implementing tight stop-loss orders and leveraging rapid trade execution to capitalize on small price movements while limiting potential losses. Both strategies require strict discipline and real-time market monitoring to optimize risk-reward ratios in high-frequency trading environments.

Required Skills and Qualifications

Arbitrageurs require strong analytical skills, deep understanding of market microstructure, and proficiency in algorithmic trading to capitalize on price discrepancies across different markets. Scalpers need exceptional speed, quick decision-making abilities, and advanced technical analysis skills to execute numerous short-term trades effectively within milliseconds. Both roles demand high resilience, precision under pressure, and expertise in risk management to maximize profitability in fast-paced trading environments.

Profit Potential and Earning Models

Arbitrageurs capitalize on price discrepancies across different markets, ensuring near risk-free profits with relatively lower frequency but higher transaction sizes, leveraging speed and technology for precision. Scalpers engage in high-frequency trading, aiming for small, incremental gains on each trade by exploiting market inefficiencies and liquidity, often executing dozens to hundreds of trades daily. Profit potential for arbitrageurs hinges on capturing guaranteed spreads, while scalpers rely on rapid execution and volume to accumulate earnings, each model requiring distinct risk management and market conditions.

Market Instruments Traded

Arbitrageurs primarily engage in trading derivatives, equities, and commodities across multiple markets to exploit price inefficiencies and secure risk-free profits. Scalpers focus on high-liquidity instruments such as forex pairs, futures contracts, and large-cap stocks to capitalize on small price movements within short timeframes. Both strategies demand rapid execution and deep market knowledge but differ in instrument selection and trading horizon.

Technology and Tools Used

Arbitrageurs leverage advanced algorithmic trading platforms and real-time market data feeds to identify and exploit price discrepancies across different exchanges with minimal latency. Scalpers utilize high-frequency trading software, direct market access (DMA), and sophisticated charting tools to execute rapid trades within seconds, capitalizing on small price movements. Both rely heavily on low-latency networks, automated order execution systems, and machine learning algorithms to maximize trading efficiency and profitability.

Regulatory Considerations

Arbitrageurs and scalpers face distinct regulatory considerations due to the nature of their trading strategies; arbitrageurs typically engage in lower-risk trades exploiting price discrepancies across markets, often requiring compliance with cross-border trading regulations and anti-money laundering laws. Scalpers execute high-frequency trades seeking to profit from small price movements, which subjects them to stricter market abuse rules and liquidity requirements imposed by financial authorities like the SEC or FCA. Regulatory frameworks emphasize transparency, reporting obligations, and fair market practices to prevent manipulation and ensure investor protection in both arbitrage and scalping activities.

Career Growth and Opportunities

Arbitrageurs benefit from analyzing price discrepancies across markets, offering career growth through roles in hedge funds, proprietary trading firms, and asset management with strong emphasis on quantitative skills. Scalpers develop expertise in high-frequency trading environments, gaining opportunities in proprietary trading desks and brokerage firms where rapid decision-making and technical analysis are paramount. Both career paths demand adaptability and can lead to senior trading or strategy development positions within financial institutions.

Arbitrageur vs Scalper Infographic

jobdiv.com

jobdiv.com