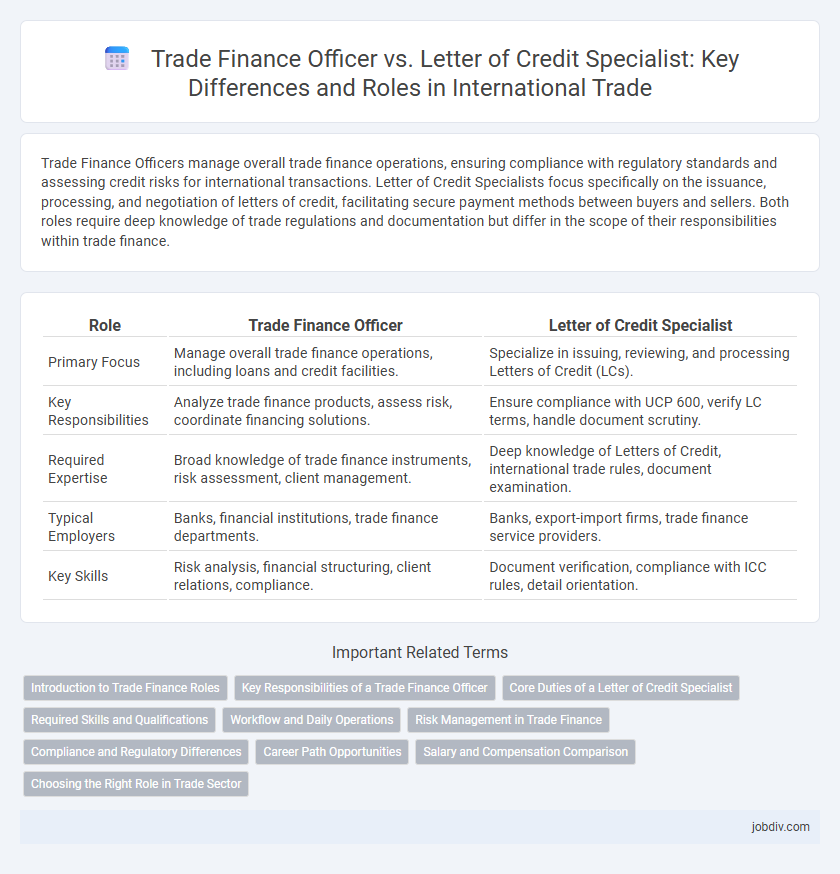

Trade Finance Officers manage overall trade finance operations, ensuring compliance with regulatory standards and assessing credit risks for international transactions. Letter of Credit Specialists focus specifically on the issuance, processing, and negotiation of letters of credit, facilitating secure payment methods between buyers and sellers. Both roles require deep knowledge of trade regulations and documentation but differ in the scope of their responsibilities within trade finance.

Table of Comparison

| Role | Trade Finance Officer | Letter of Credit Specialist |

|---|---|---|

| Primary Focus | Manage overall trade finance operations, including loans and credit facilities. | Specialize in issuing, reviewing, and processing Letters of Credit (LCs). |

| Key Responsibilities | Analyze trade finance products, assess risk, coordinate financing solutions. | Ensure compliance with UCP 600, verify LC terms, handle document scrutiny. |

| Required Expertise | Broad knowledge of trade finance instruments, risk assessment, client management. | Deep knowledge of Letters of Credit, international trade rules, document examination. |

| Typical Employers | Banks, financial institutions, trade finance departments. | Banks, export-import firms, trade finance service providers. |

| Key Skills | Risk analysis, financial structuring, client relations, compliance. | Document verification, compliance with ICC rules, detail orientation. |

Introduction to Trade Finance Roles

Trade Finance Officers manage end-to-end trade finance operations, ensuring compliance with international regulations and facilitating smooth documentation flow. Letter of Credit Specialists focus specifically on advising and processing letters of credit, mitigating payment risks in cross-border transactions. Both roles require strong knowledge of trade regulations, banking procedures, and risk management in global commerce.

Key Responsibilities of a Trade Finance Officer

A Trade Finance Officer manages the assessment and processing of trade finance transactions, ensuring compliance with international trade regulations and risk mitigation strategies. They coordinate with various financial institutions to facilitate import and export financing, oversee the preparation and verification of trade documents, and monitor credit limits and payment schedules. Their key responsibilities also include advising clients on trade financing options, maintaining detailed records, and ensuring timely settlement of trade-related payments.

Core Duties of a Letter of Credit Specialist

A Letter of Credit Specialist manages the issuance, amendment, and negotiation of letters of credit, ensuring compliance with international trade regulations and bank guidelines. This role involves detailed scrutiny of LC terms to mitigate risks, verify document accuracy, and facilitate smooth payment processes. Their expertise directly supports exporters and importers in securing guaranteed payments and minimizing financial exposure in cross-border trade transactions.

Required Skills and Qualifications

Trade Finance Officers require strong expertise in international trade regulations, risk assessment, and financial analysis, alongside proficiency in trade documentation and compliance standards. Letter of Credit Specialists must possess in-depth knowledge of UCP 600 rules, excellent attention to detail, and skills in negotiating and verifying letters of credit to ensure secure transactions. Both roles demand strong communication skills, analytical thinking, and experience with banking software platforms to facilitate smooth trade finance operations.

Workflow and Daily Operations

Trade Finance Officers manage end-to-end workflow by coordinating trade documentation, processing payment instructions, and ensuring compliance with regulatory requirements. Letter of Credit Specialists focus daily on drafting, verifying, and negotiating Letters of Credit, handling discrepancies, and liaising with banks and clients to secure payment assurances. Efficient collaboration between these roles streamlines transaction processing, reduces operational risks, and enhances client satisfaction in trade finance operations.

Risk Management in Trade Finance

Trade Finance Officers and Letter of Credit Specialists play critical roles in mitigating risks within trade finance. Trade Finance Officers oversee comprehensive risk assessments, ensuring compliance with international regulations and managing credit, fraud, and operational risks across diverse financial instruments. Letter of Credit Specialists specifically focus on minimizing payment and performance risks by verifying documentation accuracy and adherence to letter of credit terms, reducing the likelihood of disputes and financial losses in cross-border transactions.

Compliance and Regulatory Differences

Trade Finance Officers manage a broad scope of trade transactions ensuring adherence to international trade regulations, anti-money laundering (AML) policies, and sanctions compliance across diverse financial products. Letter of Credit Specialists focus specifically on the issuance and scrutiny of letters of credit, emphasizing strict compliance with Uniform Customs and Practice for Documentary Credits (UCP 600) guidelines and confirming regulatory requirements for documentary accuracy. Regulatory differences arise as Trade Finance Officers must navigate a wider range of compliance frameworks, while Letter of Credit Specialists concentrate on detailed adherence to credit documentation rules and risks associated with payment guarantees.

Career Path Opportunities

Trade Finance Officers manage a broad range of financial products including letters of credit, guarantees, and trade loans, offering diverse career advancement into roles such as Risk Management, Compliance, or Treasury. Letter of Credit Specialists focus primarily on the issuance, negotiation, and settlement of letters of credit, providing niche expertise that can lead to specialization in international trade compliance or advisory functions. Both career paths offer growth within banking institutions, but Trade Finance Officers benefit from a wider skill set that supports progression into senior managerial and strategic roles across global trade finance operations.

Salary and Compensation Comparison

Trade Finance Officers typically earn an average salary ranging from $60,000 to $90,000 annually, reflecting their broad role in managing credit and risk assessments in international trade. Letter of Credit Specialists, with a more focused expertise in letter of credit documentation and compliance, usually command salaries between $55,000 and $85,000, depending on experience and industry demand. Compensation packages for both roles may include bonuses and benefits, with Trade Finance Officers often receiving higher variable pay due to the scope of responsibilities involved in trade transaction oversight.

Choosing the Right Role in Trade Sector

Trade Finance Officers manage the overall financing solutions and risk assessment for trade transactions, ensuring smooth execution of international deals with a comprehensive understanding of credit and payment terms. Letter of Credit Specialists focus on the detailed processing, verification, and compliance of letters of credit, playing a crucial role in guaranteeing secure and reliable payment mechanisms in trade finance. Choosing between these roles depends on whether one prefers a broader strategic involvement in trade finance or a specialized expertise in documentary credit operations.

Trade Finance Officer vs Letter of Credit Specialist Infographic

jobdiv.com

jobdiv.com