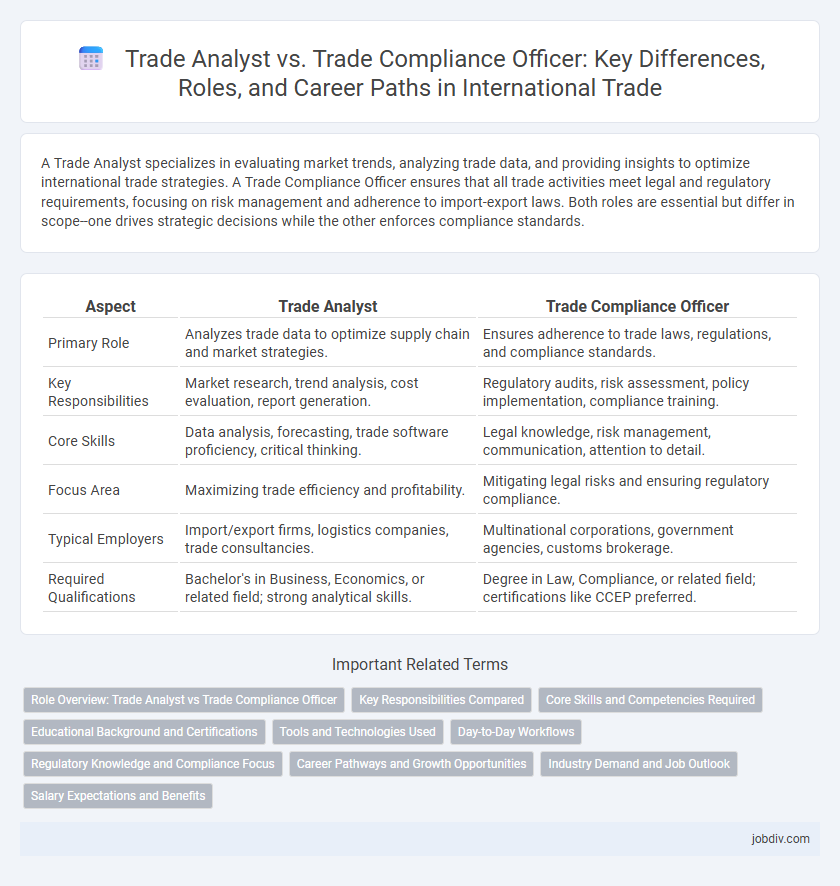

A Trade Analyst specializes in evaluating market trends, analyzing trade data, and providing insights to optimize international trade strategies. A Trade Compliance Officer ensures that all trade activities meet legal and regulatory requirements, focusing on risk management and adherence to import-export laws. Both roles are essential but differ in scope--one drives strategic decisions while the other enforces compliance standards.

Table of Comparison

| Aspect | Trade Analyst | Trade Compliance Officer |

|---|---|---|

| Primary Role | Analyzes trade data to optimize supply chain and market strategies. | Ensures adherence to trade laws, regulations, and compliance standards. |

| Key Responsibilities | Market research, trend analysis, cost evaluation, report generation. | Regulatory audits, risk assessment, policy implementation, compliance training. |

| Core Skills | Data analysis, forecasting, trade software proficiency, critical thinking. | Legal knowledge, risk management, communication, attention to detail. |

| Focus Area | Maximizing trade efficiency and profitability. | Mitigating legal risks and ensuring regulatory compliance. |

| Typical Employers | Import/export firms, logistics companies, trade consultancies. | Multinational corporations, government agencies, customs brokerage. |

| Required Qualifications | Bachelor's in Business, Economics, or related field; strong analytical skills. | Degree in Law, Compliance, or related field; certifications like CCEP preferred. |

Role Overview: Trade Analyst vs Trade Compliance Officer

Trade Analysts specialize in evaluating market trends, analyzing trade data, and providing insights to optimize supply chain strategies and improve profit margins. Trade Compliance Officers ensure adherence to international trade laws and regulations, managing import-export documentation, and mitigating risks related to customs and regulatory violations. Both roles require strong knowledge of trade policies but differ primarily in focus: Trade Analysts concentrate on data-driven market analysis, while Compliance Officers prioritize regulatory compliance and risk management.

Key Responsibilities Compared

Trade analysts focus on market trends, data analysis, and forecasting to optimize trade strategies and improve decision-making processes. Trade compliance officers ensure adherence to international trade laws and regulations, managing documentation, risk assessments, and regulatory reporting. Both roles require expertise in trade policies, but analysts emphasize data-driven insights while compliance officers prioritize regulatory enforcement.

Core Skills and Competencies Required

Trade Analysts excel in data analysis, market research, and forecasting, using advanced tools like Excel, SQL, and data visualization software to interpret trade trends and inform strategic decisions. Trade Compliance Officers require deep knowledge of international trade laws, regulations, and customs procedures, with strong skills in risk assessment, regulatory audits, and compliance management systems. Both roles demand excellent communication, attention to detail, and problem-solving abilities, but Trade Analysts prioritize analytical expertise while Trade Compliance Officers focus on regulatory adherence and risk mitigation.

Educational Background and Certifications

Trade Analysts typically hold degrees in economics, international business, or finance, with certifications such as Certified Trade Finance Professional (CTFP) enhancing their analytical skills in market trends and trade data. Trade Compliance Officers often possess degrees in law, business administration, or supply chain management, supplemented by certifications like Certified Export Compliance Officer (CECO) or Certified Customs Specialist (CCS) to ensure adherence to trade regulations and legal standards. Both roles require specialized knowledge, but Trade Analysts emphasize data analysis and market strategy, while Trade Compliance Officers focus on regulatory compliance and risk management.

Tools and Technologies Used

Trade Analysts utilize advanced data analytics software, such as Tableau and SQL databases, to interpret market trends and optimize supply chain strategies. Trade Compliance Officers rely heavily on regulatory technology (RegTech) tools like SAP GRC and Integration Point to ensure adherence to international trade laws and reduce compliance risks. Both roles increasingly incorporate AI-driven platforms for predictive analysis and automated monitoring of trade transactions.

Day-to-Day Workflows

Trade Analysts conduct data analysis to identify market trends, optimize supply chain strategies, and forecast trade performance using advanced analytics tools. Trade Compliance Officers focus on ensuring adherence to international trade regulations, conducting risk assessments, and managing documentation for customs and regulatory agencies. Both roles require collaboration with logistics, legal teams, and external partners to streamline trade operations and mitigate compliance risks.

Regulatory Knowledge and Compliance Focus

Trade Analysts primarily leverage regulatory knowledge to assess market trends and ensure alignment with trade policies, using data analytics to optimize cross-border transactions. Trade Compliance Officers focus extensively on maintaining adherence to international trade regulations, implementing control measures to prevent violations and mitigate risks related to customs laws, export controls, and sanctions. Both roles require robust expertise in global trade regulations, but Compliance Officers dedicate more attention to enforceable compliance frameworks and audit readiness.

Career Pathways and Growth Opportunities

Trade Analysts typically focus on analyzing market trends, tariffs, and trade data to optimize business strategies, offering career growth into senior analyst roles or trade consultancy. Trade Compliance Officers specialize in ensuring adherence to international trade laws and regulations, providing pathways toward compliance management, risk assessment, and regulatory affairs leadership. Both roles provide critical expertise for global trade operations, with Trade Analysts leaning toward strategic and analytical career progression, while Compliance Officers advance within regulatory and legal frameworks.

Industry Demand and Job Outlook

Trade Analysts and Trade Compliance Officers both experience growing demand driven by increasing global trade complexity and regulatory requirements. Trade Analysts are sought after for their ability to interpret market trends and optimize trade strategies, while Trade Compliance Officers are crucial for ensuring adherence to international trade laws and minimizing risk. Industry projections indicate steady job growth for both roles, with compliance expertise gaining particular emphasis due to evolving trade regulations worldwide.

Salary Expectations and Benefits

Trade Analysts typically earn an average salary ranging from $60,000 to $85,000 annually, with benefits often including performance bonuses, health insurance, and retirement plans. Trade Compliance Officers usually command higher salaries, averaging $75,000 to $100,000 per year, reflecting the increased responsibility of regulatory adherence, with benefits such as compliance training allowances, legal support, and extended leave options. Both roles offer opportunities for professional development and may include stock options or profit-sharing depending on the employer.

Trade Analyst vs Trade Compliance Officer Infographic

jobdiv.com

jobdiv.com