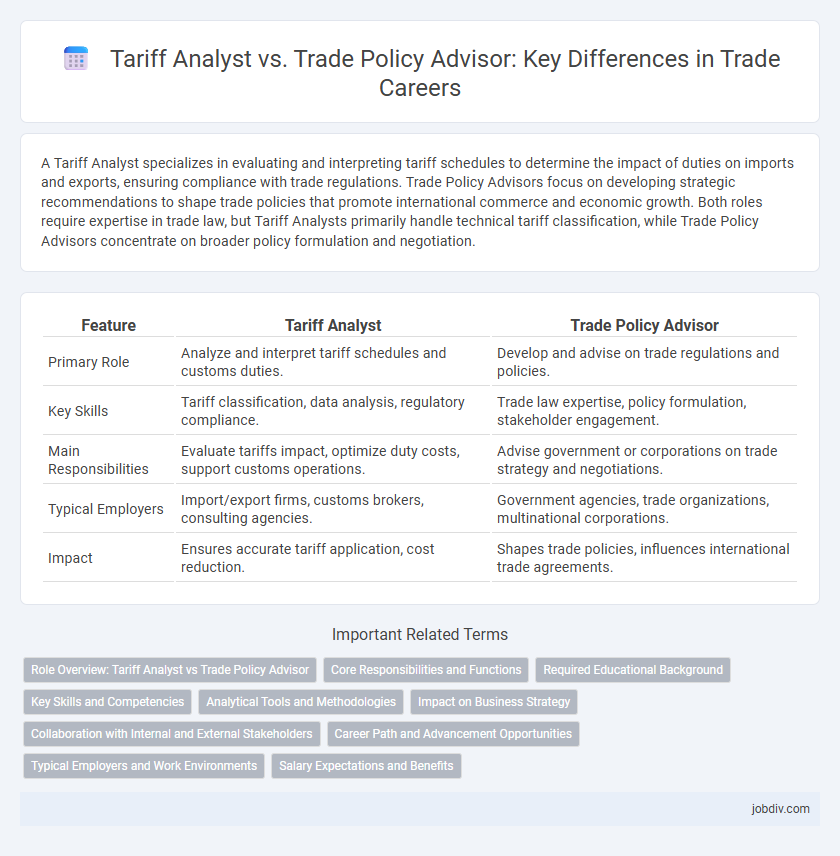

A Tariff Analyst specializes in evaluating and interpreting tariff schedules to determine the impact of duties on imports and exports, ensuring compliance with trade regulations. Trade Policy Advisors focus on developing strategic recommendations to shape trade policies that promote international commerce and economic growth. Both roles require expertise in trade law, but Tariff Analysts primarily handle technical tariff classification, while Trade Policy Advisors concentrate on broader policy formulation and negotiation.

Table of Comparison

| Feature | Tariff Analyst | Trade Policy Advisor |

|---|---|---|

| Primary Role | Analyze and interpret tariff schedules and customs duties. | Develop and advise on trade regulations and policies. |

| Key Skills | Tariff classification, data analysis, regulatory compliance. | Trade law expertise, policy formulation, stakeholder engagement. |

| Main Responsibilities | Evaluate tariffs impact, optimize duty costs, support customs operations. | Advise government or corporations on trade strategy and negotiations. |

| Typical Employers | Import/export firms, customs brokers, consulting agencies. | Government agencies, trade organizations, multinational corporations. |

| Impact | Ensures accurate tariff application, cost reduction. | Shapes trade policies, influences international trade agreements. |

Role Overview: Tariff Analyst vs Trade Policy Advisor

A Tariff Analyst specializes in examining import and export duties, ensuring compliance with international trade regulations while optimizing cost strategies for businesses. A Trade Policy Advisor focuses on developing and advising on trade regulations and agreements to influence government policy and enhance market access. Both roles require strong analytical skills but differ as the Tariff Analyst is more execution-oriented, whereas the Trade Policy Advisor operates at the strategic and regulatory level.

Core Responsibilities and Functions

Tariff Analysts specialize in evaluating and interpreting tariff schedules, classification codes, and import-export regulations to ensure compliance and optimize cost efficiency for businesses. Trade Policy Advisors focus on developing and recommending trade policies, analyzing international trade agreements, and advising governments or corporations on strategic decisions to enhance trade relations and market access. Both roles require deep expertise in trade law and economic impact assessment, but Tariff Analysts operate at the operational level while Trade Policy Advisors drive strategic frameworks.

Required Educational Background

A Tariff Analyst typically requires a bachelor's degree in economics, international trade, or a related field, often supplemented by specialization in customs regulations and tariff classification. Trade Policy Advisors generally need an advanced degree such as a master's in international relations, public policy, or law, emphasizing economic policy analysis and regulatory compliance. Both roles demand a strong understanding of international trade agreements, but Trade Policy Advisors often engage in higher-level strategic planning and policy development.

Key Skills and Competencies

Tariff Analysts excel in data analysis, tariff classification, and regulatory compliance, demonstrating strong attention to detail and expertise in customs regulations. Trade Policy Advisors specialize in economic analysis, policy development, and stakeholder engagement, requiring advanced knowledge of international trade agreements and strategic advisory skills. Both roles demand proficiency in market research and risk assessment, but Tariff Analysts focus more on operational execution while Trade Policy Advisors emphasize policy formulation and strategic impact.

Analytical Tools and Methodologies

Tariff Analysts utilize quantitative methods and data analytics software, such as Excel, SQL, and tariff classification databases, to assess trade tariffs and compliance impact. Trade Policy Advisors employ advanced economic modeling, scenario analysis, and international trade regulation frameworks to formulate strategic policy recommendations. Both roles require proficiency in customs regulations, trade data interpretation, and risk assessment tools tailored to global trade environments.

Impact on Business Strategy

Tariff Analysts evaluate import-export duties and classify products to optimize cost efficiency, directly influencing pricing strategies and supply chain decisions. Trade Policy Advisors assess regulatory developments and international trade agreements, guiding businesses in navigating compliance and leveraging market opportunities. Both roles critically shape business strategy by balancing cost management with regulatory adherence to enhance competitive advantage.

Collaboration with Internal and External Stakeholders

Tariff Analysts collaborate closely with customs officials, supply chain managers, and compliance teams to ensure accurate tariff classification and duty optimization. Trade Policy Advisors engage with government agencies, industry associations, and international trade bodies to influence and interpret trade regulations affecting business strategy. Both roles require seamless communication and alignment with legal, procurement, and finance departments to drive efficient trade operations and regulatory compliance.

Career Path and Advancement Opportunities

Tariff Analysts specialize in interpreting and applying tariff regulations to optimize import and export costs, often advancing into senior analyst or compliance management roles within multinational corporations or government agencies. Trade Policy Advisors concentrate on developing and influencing trade policies, positioning themselves for leadership roles in policy development, international trade negotiations, or advisory capacities with governmental bodies and trade organizations. Career progression for both roles benefits from expertise in international trade law, economic analysis, and strong stakeholder communication skills, with opportunities expanding into strategic consulting or global trade compliance leadership.

Typical Employers and Work Environments

Tariff Analysts typically find employment within government trade departments, customs agencies, and multinational corporations specializing in import-export compliance, working in office settings that require detailed regulatory analysis and data management. Trade Policy Advisors often work for government bodies, international trade organizations, and consulting firms, operating in dynamic environments that involve policy formulation, stakeholder engagement, and strategic advisory roles. Both roles demand strong analytical skills but vary in their focus on compliance versus policy development across public and private sector workplaces.

Salary Expectations and Benefits

Tariff Analysts typically earn between $60,000 and $80,000 annually, with benefits including health insurance, retirement plans, and performance bonuses. Trade Policy Advisors, positioned at a more strategic level, command salaries ranging from $85,000 to $120,000, often accompanied by enhanced benefits such as executive healthcare options, travel allowances, and professional development funding. Salary differences reflect the scope of responsibilities, with Trade Policy Advisors influencing broader trade regulations and Tariff Analysts concentrating on compliance and tariff classification.

Tariff Analyst vs Trade Policy Advisor Infographic

jobdiv.com

jobdiv.com