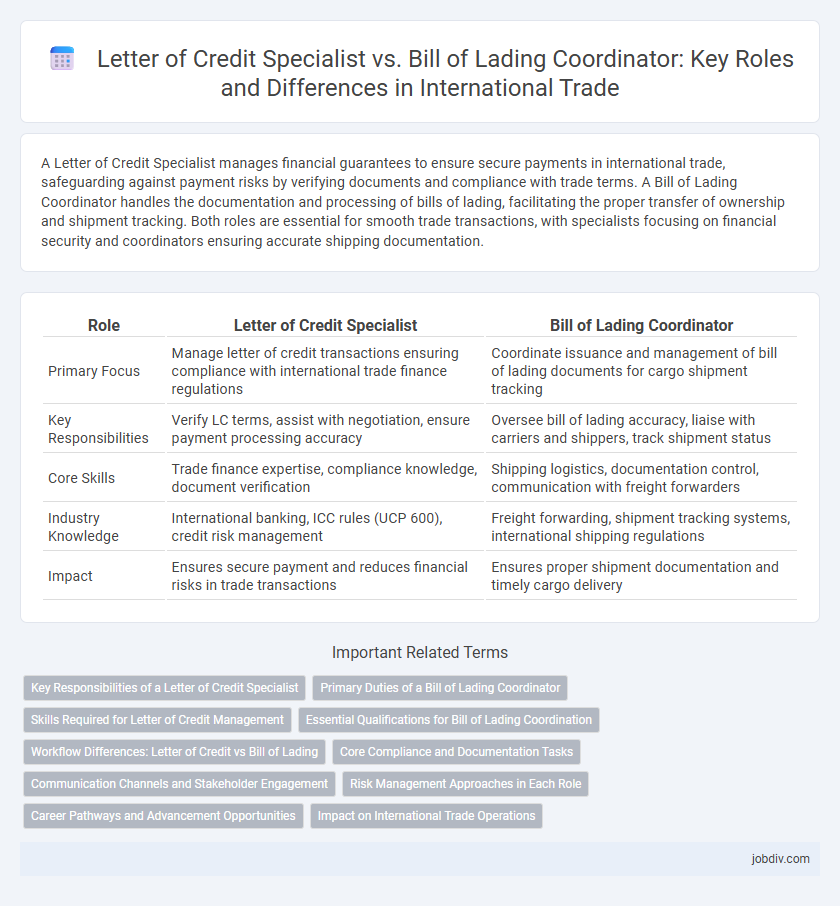

A Letter of Credit Specialist manages financial guarantees to ensure secure payments in international trade, safeguarding against payment risks by verifying documents and compliance with trade terms. A Bill of Lading Coordinator handles the documentation and processing of bills of lading, facilitating the proper transfer of ownership and shipment tracking. Both roles are essential for smooth trade transactions, with specialists focusing on financial security and coordinators ensuring accurate shipping documentation.

Table of Comparison

| Role | Letter of Credit Specialist | Bill of Lading Coordinator |

|---|---|---|

| Primary Focus | Manage letter of credit transactions ensuring compliance with international trade finance regulations | Coordinate issuance and management of bill of lading documents for cargo shipment tracking |

| Key Responsibilities | Verify LC terms, assist with negotiation, ensure payment processing accuracy | Oversee bill of lading accuracy, liaise with carriers and shippers, track shipment status |

| Core Skills | Trade finance expertise, compliance knowledge, document verification | Shipping logistics, documentation control, communication with freight forwarders |

| Industry Knowledge | International banking, ICC rules (UCP 600), credit risk management | Freight forwarding, shipment tracking systems, international shipping regulations |

| Impact | Ensures secure payment and reduces financial risks in trade transactions | Ensures proper shipment documentation and timely cargo delivery |

Key Responsibilities of a Letter of Credit Specialist

A Letter of Credit Specialist manages and verifies documentary compliance to secure payment under letters of credit, ensuring all terms and conditions are met to mitigate financial risk for importers and exporters. This role involves reviewing banking documents such as invoices, shipping documents, and certificates of origin, and liaising with banks to resolve discrepancies. Their expertise is crucial for facilitating smooth international trade transactions by guaranteeing payment security and adherence to contract terms.

Primary Duties of a Bill of Lading Coordinator

A Bill of Lading Coordinator manages the documentation and logistics related to the issuance, accuracy, and distribution of bills of lading, ensuring compliance with international shipping regulations. This role involves coordinating between shipping lines, freight forwarders, and importers to track cargo movements and resolve discrepancies. Expertise in shipping terms, customs requirements, and vessel schedules is essential to streamline trade processes and mitigate shipment delays.

Skills Required for Letter of Credit Management

Expertise in international trade finance, particularly in managing documentary compliance and mitigating risks in letters of credit, is crucial for a Letter of Credit Specialist. Proficiency in banking regulations, negotiation skills, and attention to detail for reviewing credit terms and conditions ensures smooth transaction settlements. Knowledge of financial software and strong communication capabilities are essential to coordinate between importers, exporters, and financial institutions effectively.

Essential Qualifications for Bill of Lading Coordination

Proficiency in international shipping regulations and documentation is essential for a Bill of Lading Coordinator, along with expertise in handling freight forwarding systems and customs clearance procedures. Strong organizational skills and attention to detail enable accurate preparation and verification of bills of lading, ensuring compliance with trade agreements and shipment schedules. Familiarity with maritime law and experience using electronic data interchange (EDI) platforms optimize coordination between carriers, exporters, and importers.

Workflow Differences: Letter of Credit vs Bill of Lading

A Letter of Credit Specialist manages financial documentation and ensures compliance with bank requirements to secure payment in international trade, focusing on verifying credit terms, preparing documents, and coordinating with banks. In contrast, a Bill of Lading Coordinator oversees the logistics documentation, ensuring the accurate issuance and handling of bills of lading that serve as proof of shipment and title transfer. The workflow for a Letter of Credit Specialist revolves around financial document validation and bank communication, whereas the Bill of Lading Coordinator prioritizes shipment tracking, cargo receipt confirmation, and carrier coordination.

Core Compliance and Documentation Tasks

A Letter of Credit Specialist ensures strict adherence to banking regulations and verifies all financial documents to facilitate secure international trade payments. A Bill of Lading Coordinator manages the accuracy and timely issuance of shipping documents, ensuring compliance with customs and carrier requirements. Both roles are critical in maintaining the integrity of trade transactions through precise documentation and regulatory alignment.

Communication Channels and Stakeholder Engagement

Letter of Credit Specialists primarily engage with banks, importers, exporters, and financial institutions through formal communication channels such as SWIFT messages, emails, and documentation exchanges to ensure payment terms and compliance. Bill of Lading Coordinators interact closely with shipping lines, freight forwarders, customs officials, and cargo owners, utilizing real-time tracking systems, phone calls, and shipping documentation for cargo movement and delivery coordination. Effective stakeholder engagement in trade operations demands that both roles maintain clear, timely, and accurate communication tailored to their distinct regulatory and logistical responsibilities.

Risk Management Approaches in Each Role

Letter of Credit Specialists mitigate payment risks by ensuring compliance with strict documentary requirements and coordinating with banks to facilitate secure transactions. Bill of Lading Coordinators manage shipment risks by verifying the accuracy of cargo documentation and overseeing the transfer of title to prevent disputes or cargo loss. Both roles implement risk management strategies tailored to their focus on financial security and physical shipment integrity within international trade.

Career Pathways and Advancement Opportunities

Letter of Credit Specialists focus on managing financial documents that guarantee payment between importers and exporters, providing a critical role in international trade finance. Bill of Lading Coordinators oversee the documentation and logistics of shipping goods, ensuring accurate cargo handling and delivery compliance. Career advancement for Letter of Credit Specialists often leads to finance manager or trade compliance roles, while Bill of Lading Coordinators can progress to logistics management or supply chain director positions.

Impact on International Trade Operations

Letter of Credit Specialists ensure secure payment transactions by managing documentary compliance, significantly reducing financial risks in international trade operations. Bill of Lading Coordinators facilitate the accurate documentation and timely shipment of goods, essential for seamless cargo movement and customs clearance. Both roles critically impact trade efficiency, with the former safeguarding payment processes and the latter ensuring logistics precision.

Letter of Credit Specialist vs Bill of Lading Coordinator Infographic

jobdiv.com

jobdiv.com