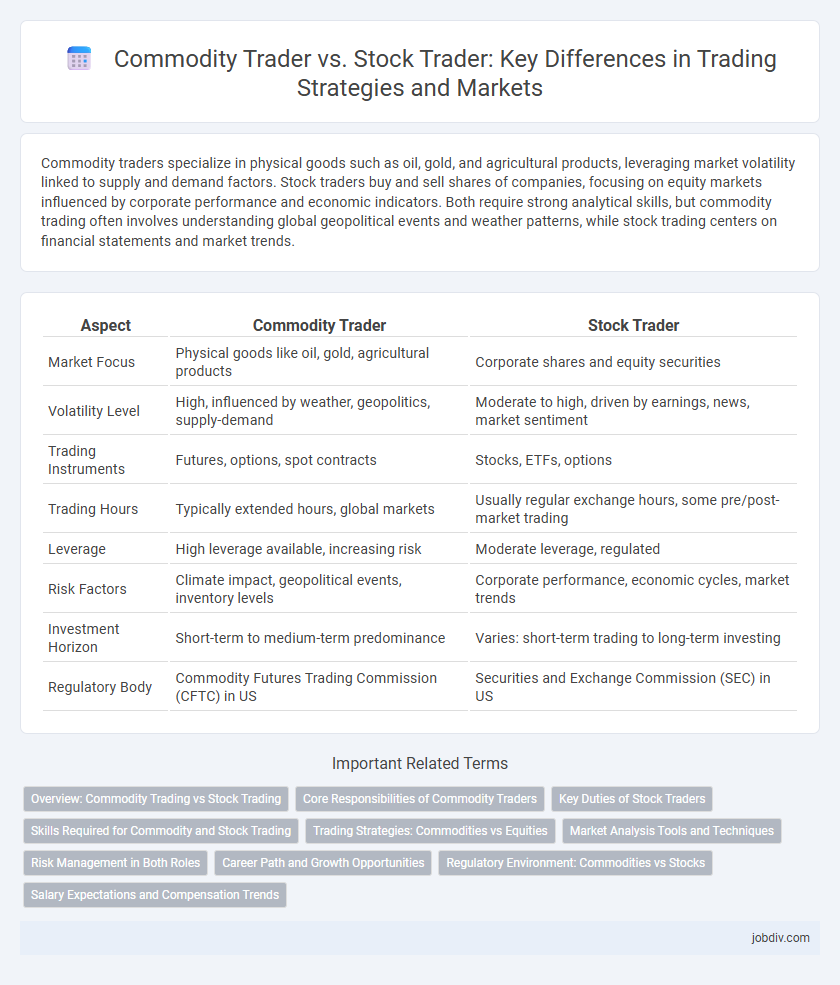

Commodity traders specialize in physical goods such as oil, gold, and agricultural products, leveraging market volatility linked to supply and demand factors. Stock traders buy and sell shares of companies, focusing on equity markets influenced by corporate performance and economic indicators. Both require strong analytical skills, but commodity trading often involves understanding global geopolitical events and weather patterns, while stock trading centers on financial statements and market trends.

Table of Comparison

| Aspect | Commodity Trader | Stock Trader |

|---|---|---|

| Market Focus | Physical goods like oil, gold, agricultural products | Corporate shares and equity securities |

| Volatility Level | High, influenced by weather, geopolitics, supply-demand | Moderate to high, driven by earnings, news, market sentiment |

| Trading Instruments | Futures, options, spot contracts | Stocks, ETFs, options |

| Trading Hours | Typically extended hours, global markets | Usually regular exchange hours, some pre/post-market trading |

| Leverage | High leverage available, increasing risk | Moderate leverage, regulated |

| Risk Factors | Climate impact, geopolitical events, inventory levels | Corporate performance, economic cycles, market trends |

| Investment Horizon | Short-term to medium-term predominance | Varies: short-term trading to long-term investing |

| Regulatory Body | Commodity Futures Trading Commission (CFTC) in US | Securities and Exchange Commission (SEC) in US |

Overview: Commodity Trading vs Stock Trading

Commodity trading involves the buying and selling of physical goods like oil, gold, and agricultural products, with prices influenced by supply and demand dynamics, geopolitical events, and weather conditions. Stock trading focuses on buying and selling shares of publicly traded companies, where price movements are driven primarily by company performance, earnings reports, and broader economic indicators. Both markets require distinct strategies and risk management approaches due to their unique volatility patterns and regulatory environments.

Core Responsibilities of Commodity Traders

Commodity traders analyze global supply and demand trends for raw materials like oil, metals, and agricultural products to make informed buying and selling decisions. They manage risks associated with price volatility by using futures contracts, options, and hedging strategies tailored to commodities markets. Commodity traders also coordinate with producers, wholesalers, and transportation firms to ensure timely delivery and optimize profit margins.

Key Duties of Stock Traders

Stock traders primarily analyze market trends, execute buy and sell orders for stocks, and manage investment portfolios to maximize returns. They conduct detailed research on company performance, economic indicators, and financial news to make informed trading decisions. Monitoring stock price fluctuations and maintaining risk management strategies are essential components of their daily responsibilities.

Skills Required for Commodity and Stock Trading

Commodity traders must excel in market analysis, risk management, and understanding global supply-demand dynamics, often requiring knowledge of weather patterns, geopolitical events, and inventory reports. Stock traders need proficiency in financial statement analysis, technical charting, and market sentiment evaluation, with a strong grasp of economic indicators, earnings reports, and corporate developments. Both roles demand sharp decision-making skills, but commodity trading emphasizes external factors influencing physical goods, while stock trading focuses more on corporate and financial performance.

Trading Strategies: Commodities vs Equities

Commodity traders often employ strategies such as hedging with futures contracts and leveraging seasonal price trends to manage supply chain risks and capitalize on market volatility. Stock traders typically utilize technical analysis, earnings reports, and momentum strategies to predict price movements and generate returns in equity markets. Understanding the distinct market drivers, such as geopolitical events for commodities and corporate performance for stocks, is crucial for tailoring effective trading strategies.

Market Analysis Tools and Techniques

Commodity traders rely heavily on fundamental analysis tools such as supply and demand data, weather reports, and geopolitical events to predict price movements in physical goods like oil, gold, and agricultural products. Stock traders predominantly use technical analysis techniques, including chart patterns, moving averages, and volume indicators, to forecast price trends based on historical market data. Both types of traders often integrate real-time news feeds and algorithmic trading software to enhance decision-making and market responsiveness.

Risk Management in Both Roles

Commodity traders manage risk by closely monitoring market volatility, geopolitical factors, and supply-demand imbalances, utilizing tools like futures contracts and options to hedge positions effectively. Stock traders emphasize risk management through portfolio diversification, stop-loss orders, and analysis of market trends and corporate fundamentals to minimize losses. Both roles require continuous assessment of price fluctuations and external economic indicators to adjust strategies and protect capital.

Career Path and Growth Opportunities

Commodity traders specialize in physical goods like oil, gold, and agricultural products, often requiring deep industry insight and expertise, leading to career paths in risk management, supply chain, and international markets. Stock traders focus on equities and securities, thriving in fast-paced financial environments with growth opportunities in portfolio management, investment analysis, and hedge funds. Growth potential in commodities often hinges on global market trends and geopolitical factors, while stock trading careers benefit from technological advancements and evolving financial regulations.

Regulatory Environment: Commodities vs Stocks

Commodity traders are regulated primarily by the Commodity Futures Trading Commission (CFTC) and must comply with the Commodity Exchange Act, ensuring transparency and limiting market manipulation in futures and options contracts. Stock traders operate under the oversight of the Securities and Exchange Commission (SEC), which enforces the Securities Act and the Securities Exchange Act to maintain fair trading practices and protect investors in equity markets. The differing regulatory frameworks reflect the unique risks and structures of commodity derivatives versus stock securities, influencing compliance, reporting, and market conduct standards.

Salary Expectations and Compensation Trends

Commodity traders typically earn higher base salaries and larger performance-based bonuses compared to stock traders due to the volatile nature and high-risk exposure of commodity markets. Compensation trends indicate that commodity traders benefit from robust profit-sharing and commission structures, reflecting the significant margin potential in commodities like oil, metals, and agricultural products. Stock traders, while earning competitive salaries, often see more stable but comparatively lower variable pay linked to equity market fluctuations and trading volumes.

Commodity Trader vs Stock Trader Infographic

jobdiv.com

jobdiv.com