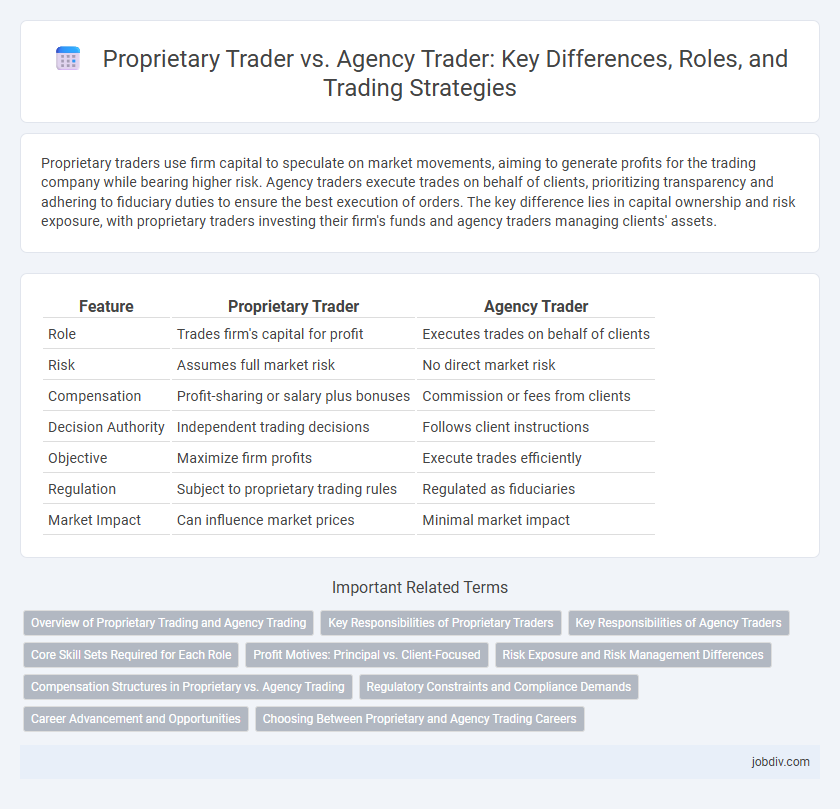

Proprietary traders use firm capital to speculate on market movements, aiming to generate profits for the trading company while bearing higher risk. Agency traders execute trades on behalf of clients, prioritizing transparency and adhering to fiduciary duties to ensure the best execution of orders. The key difference lies in capital ownership and risk exposure, with proprietary traders investing their firm's funds and agency traders managing clients' assets.

Table of Comparison

| Feature | Proprietary Trader | Agency Trader |

|---|---|---|

| Role | Trades firm's capital for profit | Executes trades on behalf of clients |

| Risk | Assumes full market risk | No direct market risk |

| Compensation | Profit-sharing or salary plus bonuses | Commission or fees from clients |

| Decision Authority | Independent trading decisions | Follows client instructions |

| Objective | Maximize firm profits | Execute trades efficiently |

| Regulation | Subject to proprietary trading rules | Regulated as fiduciaries |

| Market Impact | Can influence market prices | Minimal market impact |

Overview of Proprietary Trading and Agency Trading

Proprietary trading involves firms or individual traders using their own capital to trade financial instruments, aiming to generate profits from market movements. Agency trading, by contrast, entails executing trades on behalf of clients, where the trader acts as an intermediary without risking personal or firm capital. Proprietary traders assume higher risk but have potential for greater rewards, while agency traders prioritize executing client orders with transparency and compliance.

Key Responsibilities of Proprietary Traders

Proprietary traders execute trades using the firm's own capital, aiming to generate direct profits from market movements rather than commissions. They employ advanced quantitative models, real-time data analysis, and risk management strategies to capitalize on market inefficiencies across equities, derivatives, and forex markets. Key responsibilities include maintaining a diversified portfolio, monitoring market trends for arbitrage opportunities, and adhering to strict capital allocation limits to optimize returns while minimizing risk exposure.

Key Responsibilities of Agency Traders

Agency traders execute client orders by acting solely on behalf of their customers, ensuring transparency and best execution practices. They analyze market conditions to secure optimal prices while managing risk through strict compliance with regulatory requirements. Their responsibilities also include maintaining clear communication with clients and providing detailed trade reports to enhance decision-making.

Core Skill Sets Required for Each Role

Proprietary traders require advanced risk management skills, strong quantitative analysis, and the ability to make independent decisions under pressure to maximize profits using the firm's capital. Agency traders need exceptional client communication, order execution expertise, and market knowledge to efficiently manage trades on behalf of clients while ensuring compliance with regulations. Both roles demand real-time market analysis and a deep understanding of trading platforms and financial instruments.

Profit Motives: Principal vs. Client-Focused

Proprietary traders prioritize maximizing profits for their own firm by taking on risks with the firm's capital, aiming for direct financial gain as principals in the market. Agency traders act on behalf of clients, focusing on executing trades with the best possible outcomes to fulfill client interests rather than seeking personal or firm profit. The fundamental distinction lies in proprietary traders bearing risk and reward directly, while agency traders serve as intermediaries dedicated to client objectives.

Risk Exposure and Risk Management Differences

Proprietary traders assume direct risk as they trade using their firm's capital, aiming for higher returns but facing potential significant losses. Agency traders execute orders on behalf of clients, transferring market risk to the clients and primarily managing operational and compliance risks. Risk management for proprietary traders involves strict capital allocation, leverage limits, and real-time monitoring, while agency traders focus on ensuring best execution and mitigating transaction risks.

Compensation Structures in Proprietary vs. Agency Trading

Proprietary traders typically earn compensation through profit sharing or a percentage of the gains generated from their trading activities, aligning their income directly with performance. In contrast, agency traders receive fixed salaries or commissions based on the volume of trades executed on behalf of clients, ensuring steady income regardless of market outcomes. The compensation structure in proprietary trading incentivizes risk-taking and innovation, while agency trading emphasizes client service and transaction efficiency.

Regulatory Constraints and Compliance Demands

Proprietary traders operate using the firm's own capital, facing stringent regulatory constraints such as capital adequacy requirements under Basel III and compliance with the Volcker Rule, which limits speculative trading activities. Agency traders execute orders on behalf of clients, adhering to fiduciary duties and regulatory frameworks like MiFID II that mandate transparency, best execution, and client asset protection. Both trader types must maintain robust compliance programs to navigate complex reporting obligations, conflict of interest rules, and periodic audits enforced by bodies like the SEC and FCA.

Career Advancement and Opportunities

Proprietary traders gain direct access to capital and trading strategies, enabling rapid skill development and higher earning potential compared to agency traders who primarily execute client orders with limited profit incentives. Career advancement for proprietary traders often includes roles such as portfolio manager or risk analyst, leveraging their ability to generate returns for their firm. Agency traders, while having more structured career paths within brokerage firms, may face slower upward mobility due to lower exposure to market risk and profit-sharing opportunities.

Choosing Between Proprietary and Agency Trading Careers

Proprietary traders use a firm's capital to trade financial instruments directly, aiming for high-risk, high-reward opportunities, while agency traders execute trades on behalf of clients, emphasizing risk management and client service. Choosing between these careers depends on one's risk tolerance, desire for independence, and focus on market analysis or client interaction. Proprietary trading suits those seeking aggressive profit potential and decision-making autonomy, whereas agency trading appeals to individuals prioritizing steady income and regulatory compliance.

Proprietary Trader vs Agency Trader Infographic

jobdiv.com

jobdiv.com