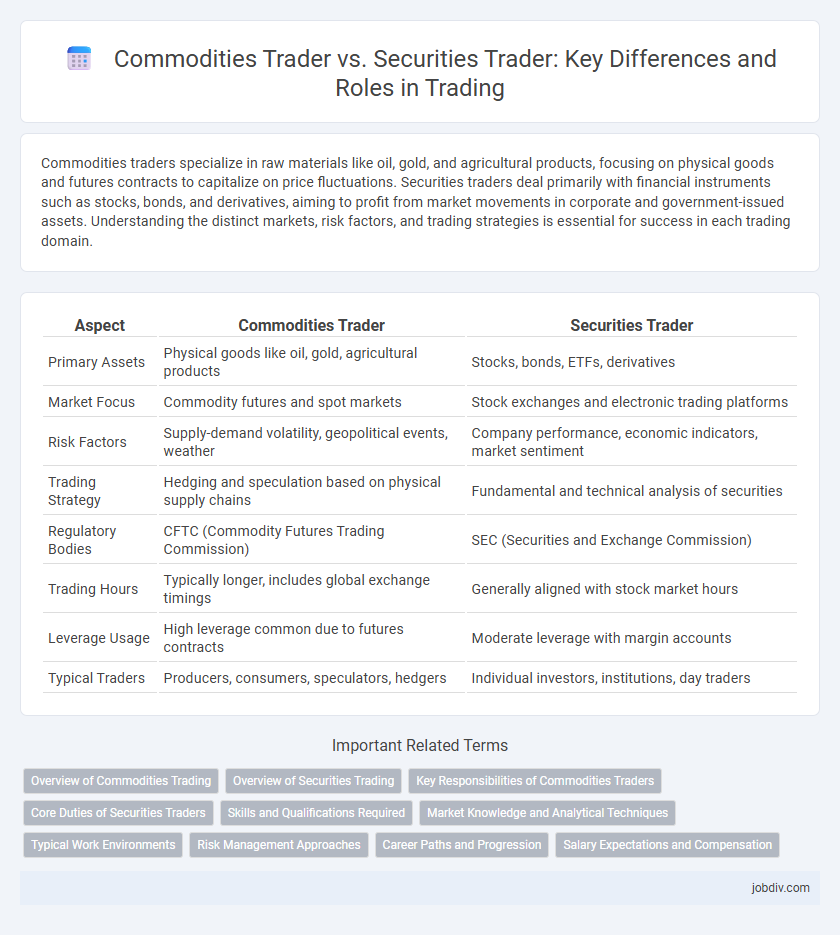

Commodities traders specialize in raw materials like oil, gold, and agricultural products, focusing on physical goods and futures contracts to capitalize on price fluctuations. Securities traders deal primarily with financial instruments such as stocks, bonds, and derivatives, aiming to profit from market movements in corporate and government-issued assets. Understanding the distinct markets, risk factors, and trading strategies is essential for success in each trading domain.

Table of Comparison

| Aspect | Commodities Trader | Securities Trader |

|---|---|---|

| Primary Assets | Physical goods like oil, gold, agricultural products | Stocks, bonds, ETFs, derivatives |

| Market Focus | Commodity futures and spot markets | Stock exchanges and electronic trading platforms |

| Risk Factors | Supply-demand volatility, geopolitical events, weather | Company performance, economic indicators, market sentiment |

| Trading Strategy | Hedging and speculation based on physical supply chains | Fundamental and technical analysis of securities |

| Regulatory Bodies | CFTC (Commodity Futures Trading Commission) | SEC (Securities and Exchange Commission) |

| Trading Hours | Typically longer, includes global exchange timings | Generally aligned with stock market hours |

| Leverage Usage | High leverage common due to futures contracts | Moderate leverage with margin accounts |

| Typical Traders | Producers, consumers, speculators, hedgers | Individual investors, institutions, day traders |

Overview of Commodities Trading

Commodities trading involves the buying and selling of physical goods such as oil, gold, agricultural products, and natural gas, focusing on supply chain dynamics and price volatility influenced by geopolitical events and seasonal demand. Traders in this sector leverage futures contracts, options, and spot markets to hedge risks or speculate on price movements, with a strong emphasis on global market trends and weather patterns. Unlike securities trading, commodities trading requires deep knowledge of physical markets and storage logistics, making it uniquely affected by tangible asset fluctuations and regulatory environments.

Overview of Securities Trading

Securities trading involves the buying and selling of financial instruments such as stocks, bonds, and derivatives on regulated exchanges or over-the-counter markets. Securities traders analyze market trends, company performance, and economic indicators to make informed decisions and manage risks effectively. Unlike commodities trading, which focuses on physical goods like metals or agricultural products, securities trading centers on financial assets that represent ownership or debt.

Key Responsibilities of Commodities Traders

Commodities traders specialize in buying and selling physical goods such as oil, gold, and agricultural products, managing risks related to price volatility through futures contracts and derivatives. They analyze supply and demand trends, geopolitical factors, and weather conditions to make informed trading decisions. Their key responsibilities include negotiating contracts, monitoring market movements, and ensuring compliance with regulatory requirements unique to commodities markets.

Core Duties of Securities Traders

Securities traders primarily focus on buying and selling financial instruments such as stocks, bonds, and options to capitalize on market fluctuations and achieve investment gains. Their core duties include analyzing market trends, executing orders efficiently, and managing risk through strategic portfolio adjustments. Unlike commodities traders who deal with physical goods like oil or agricultural products, securities traders operate within financial markets, ensuring compliance with regulatory requirements and leveraging real-time data for informed decision-making.

Skills and Qualifications Required

Commodities traders require deep knowledge of physical markets, supply chains, and economic indicators related to raw materials like oil, metals, and agricultural products, often necessitating a background in economics, finance, or commodity-specific sectors. Securities traders must excel in analyzing financial markets, securities regulations, and risk management, typically holding qualifications such as the Series 7 or CFA certification, with strong quantitative and analytical skills. Both roles demand sharp decision-making abilities, real-time market analysis, and proficiency in trading platforms, but commodities trading leans more toward understanding global commodity trends while securities trading emphasizes price movements of stocks, bonds, and derivatives.

Market Knowledge and Analytical Techniques

Commodities traders specialize in raw materials like oil, gold, and agricultural products, requiring deep understanding of supply-demand dynamics, weather patterns, and geopolitical events impacting physical markets. Securities traders focus on stocks, bonds, and derivatives, leveraging financial statements, economic indicators, and technical analysis to predict price movements. Both roles demand strong analytical techniques, but commodities trading emphasizes real-world factors while securities trading relies more heavily on quantitative models and market sentiment.

Typical Work Environments

Commodities traders typically operate in fast-paced environments such as commodity exchanges, trading floors, and brokerage firms where they monitor real-time market data and price fluctuations of physical goods like oil, metals, and agricultural products. Securities traders frequently work in investment banks, hedge funds, and stock exchanges, focusing on buying and selling financial instruments including stocks, bonds, and derivatives. Both roles demand high-pressure settings with access to advanced trading platforms and constant market analysis to execute timely transactions.

Risk Management Approaches

Commodities traders implement risk management strategies centered on price volatility and physical delivery risks, often using futures contracts and options to hedge against supply chain disruptions and market fluctuations. Securities traders prioritize diversification and real-time market data analytics to mitigate risks related to market liquidity, credit, and regulatory changes. Both roles require sophisticated quantitative models, but commodities trading emphasizes managing geopolitical and weather-related risks more heavily than securities trading.

Career Paths and Progression

A commodities trader specializes in buying and selling physical goods such as oil, metals, and agricultural products, often working with futures contracts to manage risk and profit from price fluctuations. Career progression in commodities trading typically involves gaining expertise in market analysis, risk management, and developing strong relationships with producers and buyers, advancing from junior trader to senior trader or portfolio manager. Securities traders focus on stocks, bonds, and other financial instruments, progressing by honing skills in market research, regulatory compliance, and execution strategies, with opportunities to move into roles such as trading desk manager or investment strategist.

Salary Expectations and Compensation

Commodities traders typically command higher base salaries and bonuses due to the volatile nature of raw materials markets, with average compensation ranging from $100,000 to $250,000 annually, depending on experience and market cycles. Securities traders, focusing on stocks, bonds, and derivatives, generally earn base salaries between $80,000 and $200,000, with total compensation influenced heavily by firm performance and individual deal flow. Both roles offer performance-based bonuses, but commodities traders often see larger variable pay linked to global supply-demand shifts, making their overall earnings more tied to market volatility than securities traders.

Commodities Trader vs Securities Trader Infographic

jobdiv.com

jobdiv.com