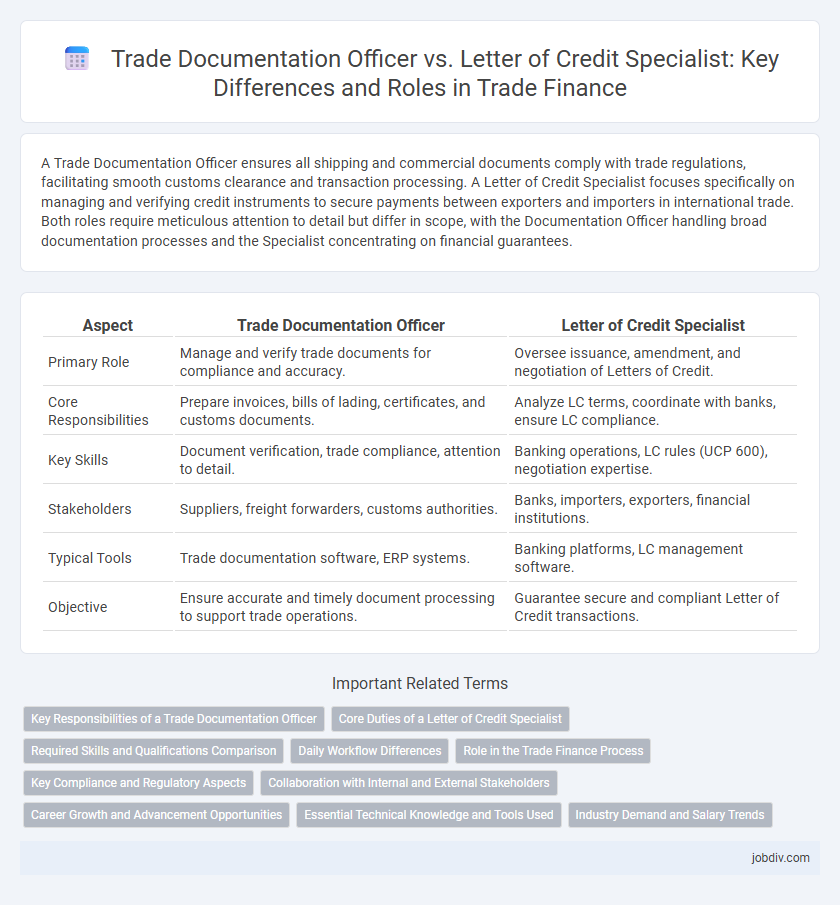

A Trade Documentation Officer ensures all shipping and commercial documents comply with trade regulations, facilitating smooth customs clearance and transaction processing. A Letter of Credit Specialist focuses specifically on managing and verifying credit instruments to secure payments between exporters and importers in international trade. Both roles require meticulous attention to detail but differ in scope, with the Documentation Officer handling broad documentation processes and the Specialist concentrating on financial guarantees.

Table of Comparison

| Aspect | Trade Documentation Officer | Letter of Credit Specialist |

|---|---|---|

| Primary Role | Manage and verify trade documents for compliance and accuracy. | Oversee issuance, amendment, and negotiation of Letters of Credit. |

| Core Responsibilities | Prepare invoices, bills of lading, certificates, and customs documents. | Analyze LC terms, coordinate with banks, ensure LC compliance. |

| Key Skills | Document verification, trade compliance, attention to detail. | Banking operations, LC rules (UCP 600), negotiation expertise. |

| Stakeholders | Suppliers, freight forwarders, customs authorities. | Banks, importers, exporters, financial institutions. |

| Typical Tools | Trade documentation software, ERP systems. | Banking platforms, LC management software. |

| Objective | Ensure accurate and timely document processing to support trade operations. | Guarantee secure and compliant Letter of Credit transactions. |

Key Responsibilities of a Trade Documentation Officer

A Trade Documentation Officer is primarily responsible for preparing, reviewing, and managing all trade-related documents to ensure compliance with international trade regulations and company policies. This role involves coordinating with shipping agents, customs authorities, and banks to facilitate smooth processing of shipments and payments. Unlike a Letter of Credit Specialist who focuses on the financial instruments of trade, the Trade Documentation Officer ensures accuracy and completeness in shipping documents such as invoices, packing lists, certificates of origin, and bills of lading.

Core Duties of a Letter of Credit Specialist

A Letter of Credit Specialist is responsible for reviewing, verifying, and processing letters of credit to ensure compliance with international trade regulations and banking standards. They coordinate with banks, exporters, and importers to facilitate secure payment terms and mitigate financial risks in cross-border transactions. Expertise in interpreting documentary credits, managing discrepancies, and maintaining accurate records is essential to their core duties.

Required Skills and Qualifications Comparison

Trade Documentation Officers require strong knowledge of international shipping regulations, proficiency in preparing and verifying export-import documents, and excellent attention to detail for compliance assurance. Letter of Credit Specialists must possess expertise in banking procedures, understanding of UCP 600 standards, and skills in handling LC amendments, negotiations, and discrepancies. Both roles benefit from strong communication abilities and familiarity with trade finance software, but the Letter of Credit Specialist demands deeper financial acumen and legal knowledge of payment guarantees.

Daily Workflow Differences

Trade Documentation Officers primarily manage the preparation and verification of shipping documents such as invoices, packing lists, and bills of lading to ensure compliance with import-export regulations. Letter of Credit Specialists concentrate on the examination and processing of Letters of Credit, ensuring terms and conditions align with contractual agreements and trade finance requirements. While Trade Documentation Officers focus on physical document accuracy and logistics coordination, Letter of Credit Specialists emphasize financial compliance and risk mitigation within international trade transactions.

Role in the Trade Finance Process

A Trade Documentation Officer ensures accurate preparation and verification of shipping and customs documents to facilitate seamless international trade transactions. A Letter of Credit Specialist manages the issuance, amendment, and compliance of letters of credit, ensuring payment security and risk mitigation for exporters and importers. Both roles are crucial in trade finance, with the Trade Documentation Officer focusing on operational accuracy and the Letter of Credit Specialist emphasizing financial guarantee processes.

Key Compliance and Regulatory Aspects

Trade Documentation Officers ensure precise preparation and verification of shipping documents to comply with international trade regulations and customs requirements, mitigating risks of delayed shipments or penalties. Letter of Credit Specialists focus on the strict adherence to terms and conditions outlined in letters of credit, guaranteeing that all documents meet banking standards and regulatory frameworks, which is vital for securing payment guarantees. Both roles demand detailed knowledge of compliance protocols like the UCP 600 and Incoterms to facilitate smooth, risk-free trade transactions.

Collaboration with Internal and External Stakeholders

Trade Documentation Officers coordinate closely with internal departments like finance and logistics to ensure accurate processing of shipping documents and compliance with trade regulations. Letter of Credit Specialists engage extensively with banks, exporters, and importers to verify terms and facilitate secure payment methods under letters of credit. Both roles require seamless communication with customs authorities and freight forwarders to maintain smooth trade operations and mitigate risks.

Career Growth and Advancement Opportunities

Trade Documentation Officers manage essential paperwork for smooth international transactions, building foundational expertise in trade regulations and compliance. Letter of Credit Specialists possess advanced knowledge of financial instruments and risk mitigation, offering greater potential for leadership roles in trade finance departments. Career growth in these roles depends on specialization, with Letter of Credit Specialists often advancing more rapidly due to their critical role in securing payment guarantees and facilitating complex trade deals.

Essential Technical Knowledge and Tools Used

Trade Documentation Officers require expertise in preparing and verifying shipping documents, invoices, and customs declarations to ensure compliance with international trade regulations. Letter of Credit Specialists possess in-depth knowledge of banking protocols, UCP 600 rules, and documentary credits to facilitate secure payment processes in trade finance. Both roles utilize software like trade management systems, document processing platforms, and risk assessment tools to streamline operations and mitigate errors.

Industry Demand and Salary Trends

Trade Documentation Officers and Letter of Credit Specialists are both crucial in international trade, with growing industry demand driven by global supply chain complexities. Letter of Credit Specialists typically command higher salaries, reflecting their specialized expertise in managing financial instruments critical for risk mitigation. Salary trends indicate a steady increase for both roles, but Letter of Credit Specialists often experience faster growth due to their technical and compliance responsibilities.

Trade Documentation Officer vs Letter of Credit Specialist Infographic

jobdiv.com

jobdiv.com