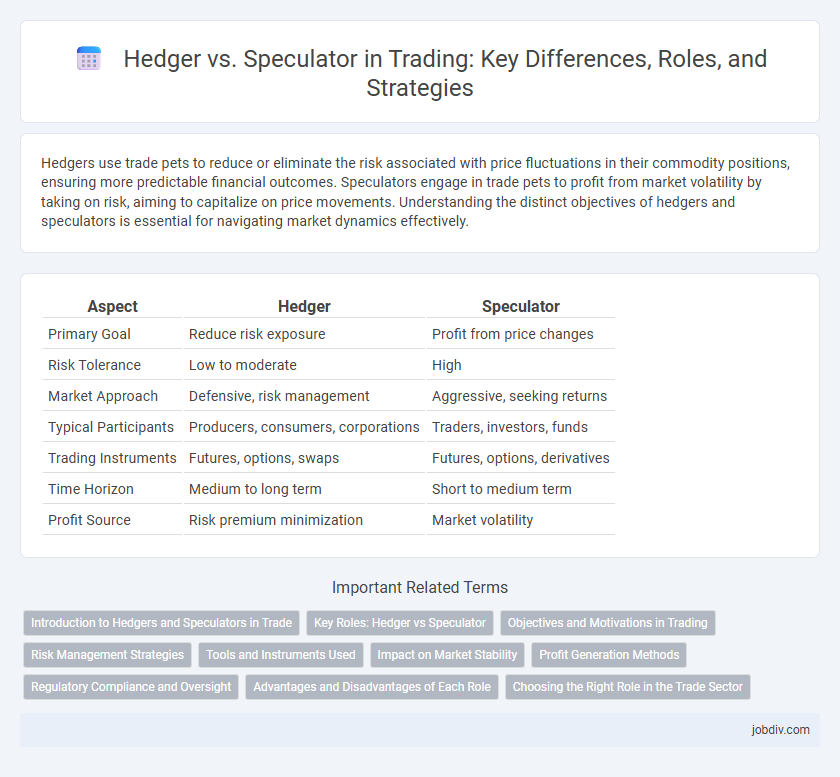

Hedgers use trade pets to reduce or eliminate the risk associated with price fluctuations in their commodity positions, ensuring more predictable financial outcomes. Speculators engage in trade pets to profit from market volatility by taking on risk, aiming to capitalize on price movements. Understanding the distinct objectives of hedgers and speculators is essential for navigating market dynamics effectively.

Table of Comparison

| Aspect | Hedger | Speculator |

|---|---|---|

| Primary Goal | Reduce risk exposure | Profit from price changes |

| Risk Tolerance | Low to moderate | High |

| Market Approach | Defensive, risk management | Aggressive, seeking returns |

| Typical Participants | Producers, consumers, corporations | Traders, investors, funds |

| Trading Instruments | Futures, options, swaps | Futures, options, derivatives |

| Time Horizon | Medium to long term | Short to medium term |

| Profit Source | Risk premium minimization | Market volatility |

Introduction to Hedgers and Speculators in Trade

Hedgers protect their investments against price fluctuations by taking opposite positions in the futures or options markets to minimize risk. Speculators, on the other hand, seek to profit from market volatility by predicting price movements and engaging in high-risk trades. Both play critical roles in enhancing market liquidity and price discovery in commodities, stocks, and foreign exchange trading.

Key Roles: Hedger vs Speculator

Hedgers aim to reduce risk by locking in prices and protecting against adverse market fluctuations, primarily using futures or options contracts to stabilize costs or revenue. Speculators seek to profit from market volatility by assuming risk, often leveraging market trends and price movements without owning the underlying asset. Key roles distinguish hedgers as risk managers focused on preservation, while speculators act as liquidity providers driving price discovery in financial markets.

Objectives and Motivations in Trading

Hedgers aim to minimize risk and protect their investments from adverse price fluctuations by locking in prices through futures or options contracts. Speculators seek to profit from market volatility by taking on higher risk positions based on price predictions and market trends. The fundamental difference lies in hedgers prioritizing security and loss prevention, while speculators focus on maximizing returns through strategic market bets.

Risk Management Strategies

Hedgers use risk management strategies to protect assets from price volatility by locking in prices through futures contracts or options, effectively minimizing financial loss in uncertain markets. Speculators accept higher risk by betting on market movements to generate profits, often using leverage and short-term trading techniques without underlying asset ownership. Effective risk management for hedgers involves diversification and position limits, while speculators rely on stop-loss orders and technical analysis to mitigate potential losses.

Tools and Instruments Used

Hedgers primarily use futures contracts, options, and swaps to manage and mitigate the risk of price fluctuations in commodities, currencies, or securities. Speculators employ the same instruments--such as options, futures, and CFDs--with a focus on leveraging price volatility to maximize short-term profits. Both rely on derivatives, but hedgers aim to protect underlying assets while speculators seek profit from market movements.

Impact on Market Stability

Hedgers contribute to market stability by reducing price volatility through risk management, stabilizing supply and demand dynamics in commodities and financial markets. Speculators provide liquidity and price discovery but can increase short-term market volatility by amplifying price swings due to speculative trading. The balance between hedgers and speculators is crucial for efficient market functioning, ensuring both risk mitigation and dynamic price adjustments.

Profit Generation Methods

Hedgers generate profit by minimizing risks associated with price fluctuations in commodities, currencies, or securities, often locking in prices through futures or options contracts to secure stable costs or revenues. Speculators, on the other hand, aim to maximize profits by taking high-risk positions based on market trends and price volatility, capitalizing on price movements without underlying exposure to the asset. The profit methods differ fundamentally: hedgers prioritize risk reduction and cost certainty, while speculators focus on leveraging market inefficiencies for potential high returns.

Regulatory Compliance and Oversight

Hedgers primarily engage in regulated markets to mitigate price risk associated with their core business activities, adhering strictly to compliance standards established by bodies such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). Speculators, while accepting higher regulatory scrutiny due to their market-driven profit motives, must comply with margin requirements, reporting obligations, and position limits designed to prevent market manipulation and excessive volatility. Both entities operate under stringent oversight frameworks that ensure transparency and integrity, but hedgers benefit from certain exemptions aimed at facilitating risk management without undermining market stability.

Advantages and Disadvantages of Each Role

Hedgers minimize risk by locking in prices to protect against market volatility, ensuring business stability but often sacrificing potential profit gains. Speculators aim for high returns by taking on risk through market predictions, which can lead to substantial profits or significant losses. Hedgers benefit from reduced uncertainty, while speculators add liquidity and price discovery to the market, although both face challenges related to market timing and external factors.

Choosing the Right Role in the Trade Sector

Hedgers manage risk by using derivatives to protect against price fluctuations, securing financial stability for their core business operations. Speculators assume market risk with the goal of profiting from price movements, relying on market analysis and timing to maximize returns. Selecting the right role depends on an individual or company's risk tolerance, financial objectives, and market expertise within the trading environment.

Hedger vs Speculator Infographic

jobdiv.com

jobdiv.com