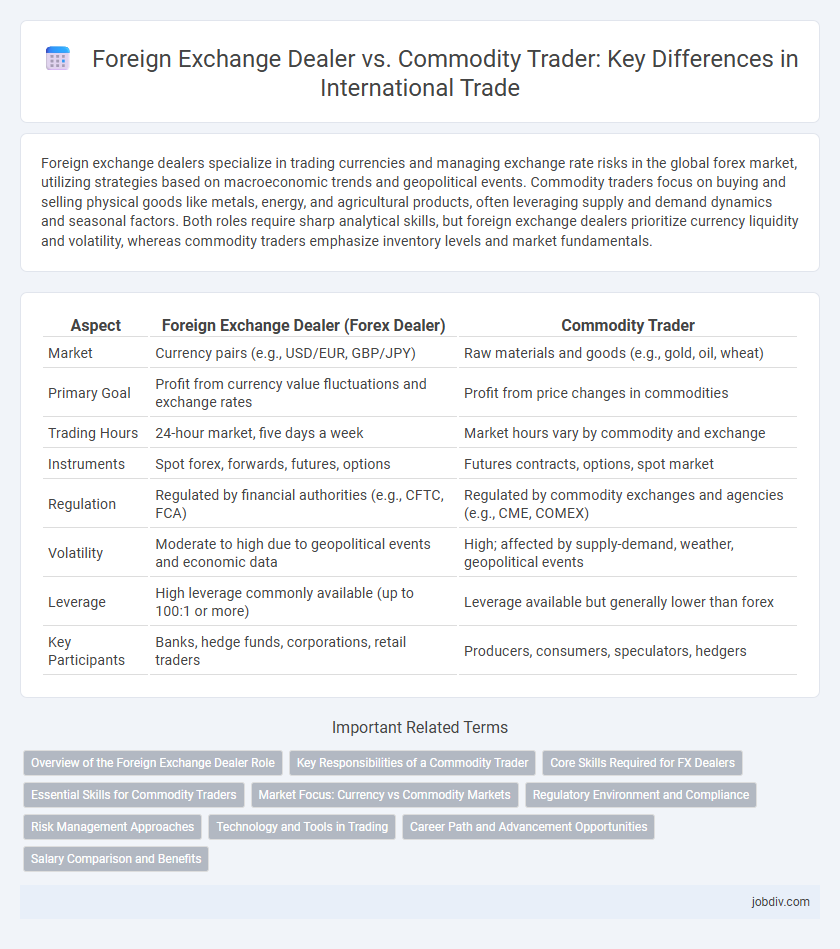

Foreign exchange dealers specialize in trading currencies and managing exchange rate risks in the global forex market, utilizing strategies based on macroeconomic trends and geopolitical events. Commodity traders focus on buying and selling physical goods like metals, energy, and agricultural products, often leveraging supply and demand dynamics and seasonal factors. Both roles require sharp analytical skills, but foreign exchange dealers prioritize currency liquidity and volatility, whereas commodity traders emphasize inventory levels and market fundamentals.

Table of Comparison

| Aspect | Foreign Exchange Dealer (Forex Dealer) | Commodity Trader |

|---|---|---|

| Market | Currency pairs (e.g., USD/EUR, GBP/JPY) | Raw materials and goods (e.g., gold, oil, wheat) |

| Primary Goal | Profit from currency value fluctuations and exchange rates | Profit from price changes in commodities |

| Trading Hours | 24-hour market, five days a week | Market hours vary by commodity and exchange |

| Instruments | Spot forex, forwards, futures, options | Futures contracts, options, spot market |

| Regulation | Regulated by financial authorities (e.g., CFTC, FCA) | Regulated by commodity exchanges and agencies (e.g., CME, COMEX) |

| Volatility | Moderate to high due to geopolitical events and economic data | High; affected by supply-demand, weather, geopolitical events |

| Leverage | High leverage commonly available (up to 100:1 or more) | Leverage available but generally lower than forex |

| Key Participants | Banks, hedge funds, corporations, retail traders | Producers, consumers, speculators, hedgers |

Overview of the Foreign Exchange Dealer Role

Foreign exchange dealers specialize in trading currencies, managing exchange rate risks, and facilitating international currency transactions for clients. They analyze market trends, monitor global economic indicators, and execute buy or sell orders to optimize currency portfolios. Proficient knowledge of forex markets, regulatory compliance, and risk management strategies are essential for effective foreign exchange dealing.

Key Responsibilities of a Commodity Trader

Commodity traders specialize in buying and selling physical goods such as metals, energy, and agricultural products while managing supply chains and market risk. They analyze market trends, negotiate contracts, and execute trades to optimize profitability in volatile commodity markets. Unlike foreign exchange dealers who focus on currency pairs and forex markets, commodity traders require expertise in product-specific logistics and global supply-demand factors.

Core Skills Required for FX Dealers

Foreign exchange dealers require strong analytical skills to interpret currency market trends, advanced knowledge of macroeconomic indicators, and proficiency in risk management strategies to mitigate losses. Mastery of trading platforms and real-time decision-making under high-pressure environments are essential for effective currency trading. These core skills differentiate FX dealers from commodity traders, who primarily focus on product-specific knowledge and supply-demand fundamentals.

Essential Skills for Commodity Traders

Commodity traders require strong analytical skills to evaluate market trends and price fluctuations of physical assets such as metals, energy, and agricultural products. Mastery of risk management techniques and the ability to interpret geopolitical and weather-related factors impacting supply and demand are essential. Proficiency in negotiation and contract management further differentiates commodity traders from foreign exchange dealers who primarily focus on currency price movements.

Market Focus: Currency vs Commodity Markets

Foreign exchange dealers specialize in currency markets, facilitating the buying and selling of global currencies such as the US dollar, euro, and yen to profit from exchange rate fluctuations. Commodity traders concentrate on commodity markets, trading physical goods like oil, gold, agricultural products, and metals with a focus on supply-demand dynamics and price volatility. Both roles require market analysis but differ fundamentally in asset types and trading instruments used.

Regulatory Environment and Compliance

Foreign exchange dealers operate under stringent regulatory frameworks such as the Dodd-Frank Act in the United States and MiFID II in the European Union, which mandate transparency, reporting, and capital requirements to prevent market manipulation. Commodity traders face compliance obligations from agencies like the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), focused on position limits, anti-fraud measures, and proper handling of commodity derivatives. Both sectors demand adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, but forex dealers often contend with more complex cross-border regulatory challenges due to the global nature of currency markets.

Risk Management Approaches

Foreign exchange dealers apply risk management strategies such as hedging through currency forwards and options to mitigate volatile exchange rate fluctuations, while commodity traders utilize futures contracts and stop-loss orders to manage price risks in agricultural, energy, and metal markets. Both types of traders employ real-time market analysis and automated trading systems to monitor risk exposure and enhance decision-making accuracy. Effective diversification across currencies or commodity classes further reduces sector-specific risks in their respective portfolios.

Technology and Tools in Trading

Foreign exchange dealers utilize advanced algorithmic trading platforms and real-time market data analytics to optimize currency trades and manage volatility. Commodity traders rely heavily on specialized software for supply chain tracking, futures contract management, and price forecasting powered by AI and big data. Emerging technologies like blockchain enhance transparency and security for both foreign exchange and commodity trading operations.

Career Path and Advancement Opportunities

Foreign Exchange dealers specialize in currency markets, often advancing by gaining certifications like the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), which enhance their prospects in risk management and trading strategy roles. Commodity traders focus on physical goods like oil, metals, and agricultural products, with career growth linked to expertise in market analysis, contract negotiation, and supply chain logistics, often progressing to senior trader or portfolio manager positions. Both career paths demand strong analytical skills, market knowledge, and adaptability, but forex dealers typically advance within financial institutions, while commodity traders may move between trading firms, commodity producers, and hedge funds.

Salary Comparison and Benefits

Foreign exchange dealers typically earn a median salary ranging from $70,000 to $120,000 annually, reflecting the high demand for currency market expertise and risk management skills. Commodity traders often have a broader salary range, from $60,000 to $150,000 or more, influenced by market volatility and trading volumes in energy, metals, and agricultural products. Benefits for both roles frequently include performance bonuses, profit sharing, health insurance, and retirement plans, with commodity traders sometimes receiving additional perks tied to physical asset management and global market access.

Foreign Exchange Dealer vs Commodity Trader Infographic

jobdiv.com

jobdiv.com