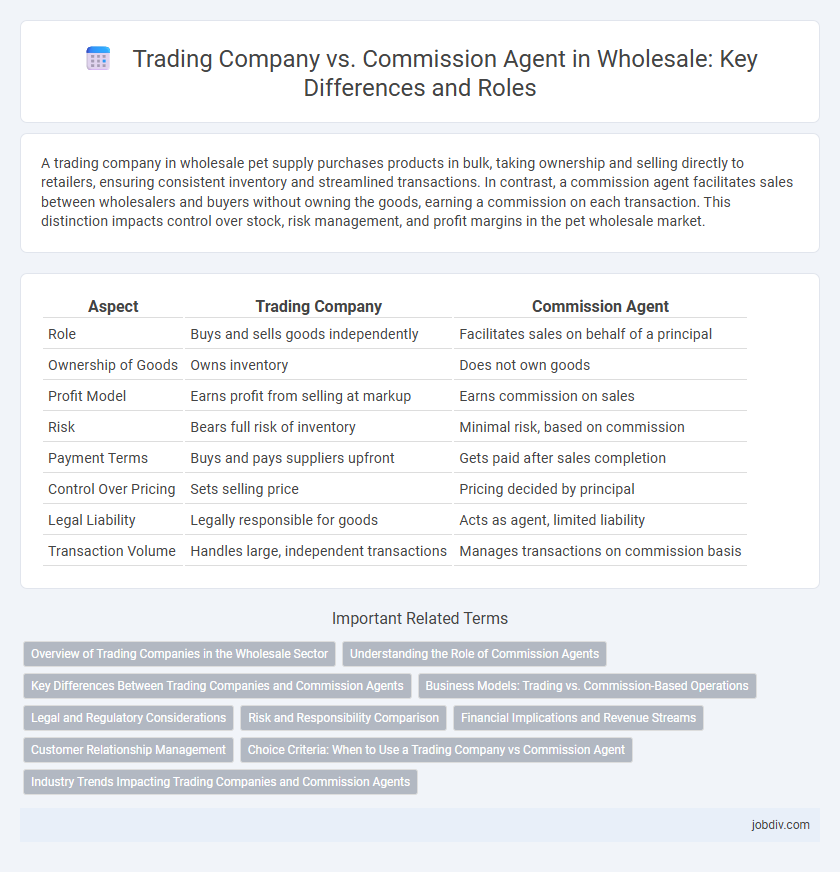

A trading company in wholesale pet supply purchases products in bulk, taking ownership and selling directly to retailers, ensuring consistent inventory and streamlined transactions. In contrast, a commission agent facilitates sales between wholesalers and buyers without owning the goods, earning a commission on each transaction. This distinction impacts control over stock, risk management, and profit margins in the pet wholesale market.

Table of Comparison

| Aspect | Trading Company | Commission Agent |

|---|---|---|

| Role | Buys and sells goods independently | Facilitates sales on behalf of a principal |

| Ownership of Goods | Owns inventory | Does not own goods |

| Profit Model | Earns profit from selling at markup | Earns commission on sales |

| Risk | Bears full risk of inventory | Minimal risk, based on commission |

| Payment Terms | Buys and pays suppliers upfront | Gets paid after sales completion |

| Control Over Pricing | Sets selling price | Pricing decided by principal |

| Legal Liability | Legally responsible for goods | Acts as agent, limited liability |

| Transaction Volume | Handles large, independent transactions | Manages transactions on commission basis |

Overview of Trading Companies in the Wholesale Sector

Trading companies in the wholesale sector act as intermediaries that purchase goods directly from manufacturers and distribute them to retailers or other businesses, ensuring streamlined supply chain management. These companies often hold large inventories, offer bulk pricing, and provide value-added services such as quality control and logistics coordination. Unlike commission agents who earn fees on sales without taking ownership of goods, trading companies assume ownership and inventory risks, enabling greater control over product distribution and pricing strategies.

Understanding the Role of Commission Agents

Commission agents act as intermediaries who sell goods on behalf of manufacturers or wholesalers without taking ownership, earning a commission on each transaction. They negotiate prices, arrange logistics, and handle client relationships, enabling manufacturers to expand market reach without direct involvement in sales processes. Unlike trading companies that purchase and resell products, commission agents facilitate transactions, reducing inventory risks and capital requirements for principal businesses.

Key Differences Between Trading Companies and Commission Agents

Trading companies purchase goods in bulk, take ownership, and sell them at a markup, assuming inventory risks and managing storage and logistics. Commission agents facilitate transactions between buyers and sellers without owning the goods, earning a commission based on sales value while transferring the risks and responsibilities to the principal parties. The primary distinction lies in ownership transfer, risk bearing, and the nature of profit generation, with trading companies operating as principal sellers and commission agents acting as intermediaries.

Business Models: Trading vs. Commission-Based Operations

Trading companies purchase goods outright, holding inventory and assuming risks associated with stock management, enabling direct control over pricing and profit margins. Commission agents act as intermediaries, facilitating transactions without owning inventory, earning revenue through a percentage of sales, which reduces capital investment and operational risk. Understanding these differing business models is essential for wholesalers seeking optimal balance between investment, control, and risk exposure.

Legal and Regulatory Considerations

Trading companies operate as independent legal entities responsible for compliance with import-export regulations, tax obligations, and contractual liabilities, while commission agents act as intermediaries without holding title to goods, typically facing fewer direct legal risks but requiring adherence to agency laws and fiduciary duties. Trading companies must obtain necessary licenses, maintain detailed transaction records, and ensure conformity with international trade agreements, whereas commission agents focus on transparent commission structures and precise contractual terms to mitigate disputes. Understanding the distinct legal frameworks governing each role is crucial for risk management and regulatory compliance in wholesale operations.

Risk and Responsibility Comparison

Trading companies assume full ownership of goods, bearing risks such as inventory loss, market fluctuations, and credit defaults, which require substantial capital investment and operational control. Commission agents operate as intermediaries without owning the products, minimizing their financial risk but limiting their responsibility to negotiation and sale facilitation. The trading company's direct market exposure contrasts with the commission agent's reduced liability framework, impacting overall risk management and accountability in wholesale transactions.

Financial Implications and Revenue Streams

Trading companies generate revenue through direct sales, managing inventory, and setting prices, which enables them to control profit margins and cash flow but requires significant working capital and financial risk. Commission agents earn income by receiving a percentage of sales value without holding inventory, minimizing financial risk and operational costs but limiting revenue potential to commission fees. Financial implications for trading companies include inventory financing and credit management, whereas commission agents face lower capital requirements but depend heavily on transaction volume and commission rates for profitability.

Customer Relationship Management

Trading companies maintain direct control over customer relationships, enabling personalized service and streamlined communication to build long-term client loyalty. Commission agents act as intermediaries, often limiting direct engagement and reliance on third-party interactions, which can reduce responsiveness and customer insights. Effective customer relationship management in wholesale favors trading companies for deeper engagement and tailored solutions, enhancing client satisfaction and retention.

Choice Criteria: When to Use a Trading Company vs Commission Agent

A trading company is ideal for businesses seeking direct purchase and control over inventory with consolidated logistics and bulk procurement advantages. Commission agents are preferred when market entry requires local expertise without holding stock, minimizing financial risk through performance-based remuneration. Choosing between them depends on factors such as capital investment capacity, desired operational control, and risk tolerance in wholesale distribution.

Industry Trends Impacting Trading Companies and Commission Agents

Industry trends such as digital transformation and supply chain automation are reshaping the roles of trading companies and commission agents, with trading companies increasingly adopting advanced logistics technology to enhance efficiency. Commission agents face pressure to integrate real-time market data and analytics platforms to maintain their competitive edge in dynamic wholesale markets. Regulatory changes and demand for transparency are driving both entities to strengthen compliance measures, facilitating trust and streamlined transactions across global trading networks.

Trading Company vs Commission Agent Infographic

jobdiv.com

jobdiv.com