Wholesale brokers act as intermediaries who facilitate deals between pet product suppliers and retailers without taking ownership of the goods, ensuring smooth negotiations and contract arrangements. Trading agents often represent either the buyer or seller exclusively, managing the purchase process, handling logistics, and sometimes controlling inventory to streamline wholesale transactions. Understanding the distinct roles helps pet businesses choose the right partner to optimize supply chain efficiency and cost-effectiveness.

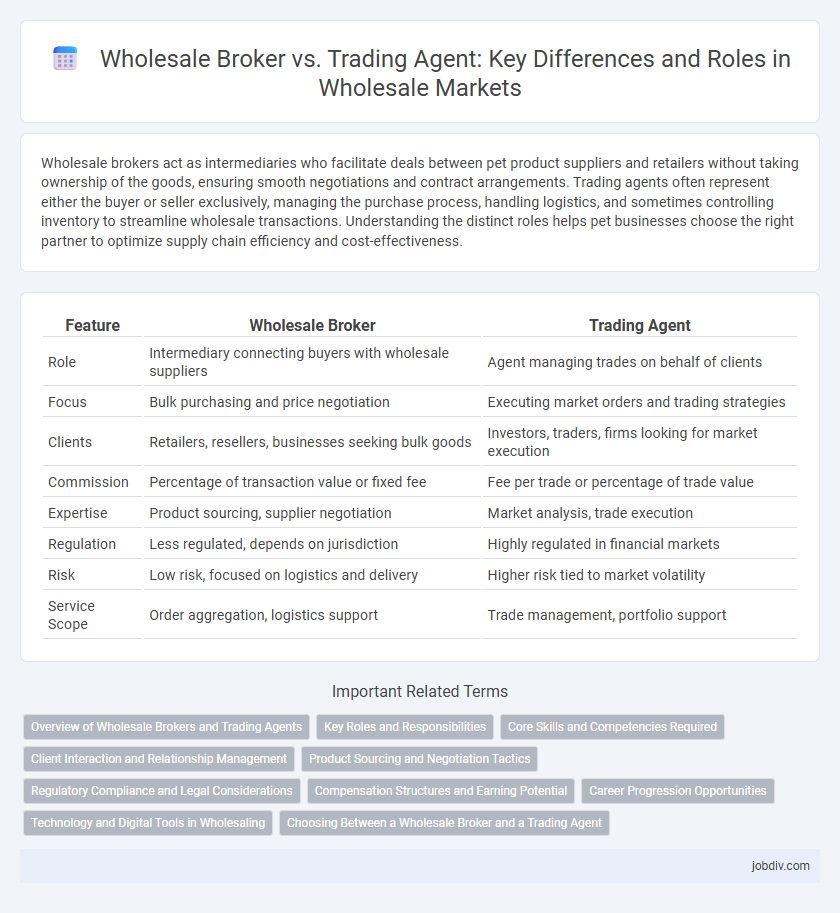

Table of Comparison

| Feature | Wholesale Broker | Trading Agent |

|---|---|---|

| Role | Intermediary connecting buyers with wholesale suppliers | Agent managing trades on behalf of clients |

| Focus | Bulk purchasing and price negotiation | Executing market orders and trading strategies |

| Clients | Retailers, resellers, businesses seeking bulk goods | Investors, traders, firms looking for market execution |

| Commission | Percentage of transaction value or fixed fee | Fee per trade or percentage of trade value |

| Expertise | Product sourcing, supplier negotiation | Market analysis, trade execution |

| Regulation | Less regulated, depends on jurisdiction | Highly regulated in financial markets |

| Risk | Low risk, focused on logistics and delivery | Higher risk tied to market volatility |

| Service Scope | Order aggregation, logistics support | Trade management, portfolio support |

Overview of Wholesale Brokers and Trading Agents

Wholesale brokers act as intermediaries who facilitate large transactions between manufacturers and retailers without taking ownership of the goods, ensuring smooth negotiation and contract management. Trading agents, on the other hand, represent buyers or sellers directly, often managing logistics, quality control, and market analysis to secure more favorable deals. Both play crucial roles in wholesale markets by optimizing supply chain efficiency and expanding market reach for businesses.

Key Roles and Responsibilities

Wholesale brokers facilitate large-scale transactions by connecting manufacturers, suppliers, and retailers, negotiating prices, and ensuring contract compliance. Trading agents represent clients in international markets, managing import/export procedures, and overseeing logistics to optimize supply chain efficiency. Both roles require strong market knowledge, but brokers primarily focus on deal-making while agents emphasize transaction execution and regulatory adherence.

Core Skills and Competencies Required

Wholesale brokers must excel in negotiation, market analysis, and regulatory compliance to effectively manage large-scale transactions and coordinate between buyers and sellers. Trading agents require strong decision-making skills, risk assessment capabilities, and in-depth knowledge of market trends to execute trades swiftly and efficiently. Both roles demand excellent communication and relationship-building abilities to maintain trust and ensure seamless operations in wholesale markets.

Client Interaction and Relationship Management

Wholesale brokers prioritize building long-term client relationships by offering personalized service and expert market advice, enhancing trust and loyalty. Trading agents focus more on executing transactions efficiently, often handling multiple clients with less emphasis on individualized communication. Effective client interaction in wholesale depends on the broker's ability to provide tailored solutions, while trading agents rely on streamlined processes and quick deal closures.

Product Sourcing and Negotiation Tactics

Wholesale brokers specialize in connecting buyers and sellers within large markets, leveraging extensive networks to source high-quality products at competitive prices. Trading agents actively engage in product sourcing by conducting market analysis, verifying supplier credibility, and negotiating favorable terms directly with manufacturers. Effective negotiation tactics for brokers often involve leveraging buyer volume to secure discounts, while trading agents emphasize customized deal structures and relationship-building to optimize pricing and delivery conditions.

Regulatory Compliance and Legal Considerations

Wholesale brokers typically operate under stringent regulatory frameworks requiring licenses and adherence to national and international trade laws, ensuring transparent transactions and consumer protection. Trading agents, while also subject to legal standards, may work under less rigorous compliance requirements but must still navigate contractual obligations and anti-fraud regulations. Both roles demand thorough understanding of regulatory compliance to mitigate legal risks and maintain ethical business practices in wholesale markets.

Compensation Structures and Earning Potential

Wholesale brokers typically earn commissions based on the volume or value of deals they facilitate, aligning their compensation directly with sales performance. Trading agents may receive a fixed fee, a commission, or a combination, often depending on the complexity and frequency of transactions handled. The earning potential for wholesale brokers tends to be higher in high-volume markets, while trading agents benefit from steady income streams through negotiated contracts.

Career Progression Opportunities

Wholesale brokers typically experience faster career progression through direct deal negotiation and client relationship management, gaining skills valued in high-level sales and business development roles. Trading agents often develop expertise in market analysis and supply chain logistics, which can lead to specialized roles in procurement or risk management. Both career paths offer advancement opportunities, but brokers tend to ascend within sales leadership while agents move toward operational or strategic positions.

Technology and Digital Tools in Wholesaling

Wholesale brokers leverage advanced technology platforms and digital tools to streamline inventory management and real-time price comparisons, enhancing transaction efficiency between buyers and sellers. Trading agents utilize specialized software for market analysis and automated order processing, enabling quicker decision-making and improved communication with suppliers. Both roles increasingly depend on cloud-based solutions and AI-driven analytics to optimize wholesaling operations and reduce operational costs.

Choosing Between a Wholesale Broker and a Trading Agent

Choosing between a wholesale broker and a trading agent depends on the scale and specificity of your supply chain needs. Wholesale brokers typically offer extensive networks and expertise in negotiating bulk prices, benefiting businesses seeking diversified suppliers and cost efficiency. Trading agents focus more on facilitation and direct transaction management, ideal for companies requiring personalized service and localized market knowledge.

Wholesale Broker vs Trading Agent Infographic

jobdiv.com

jobdiv.com