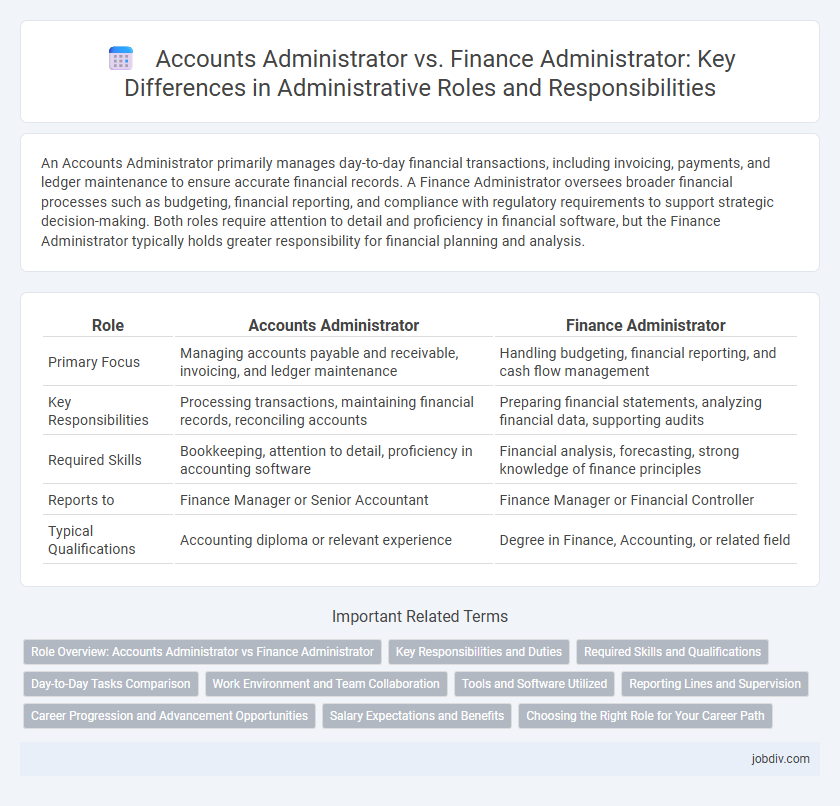

An Accounts Administrator primarily manages day-to-day financial transactions, including invoicing, payments, and ledger maintenance to ensure accurate financial records. A Finance Administrator oversees broader financial processes such as budgeting, financial reporting, and compliance with regulatory requirements to support strategic decision-making. Both roles require attention to detail and proficiency in financial software, but the Finance Administrator typically holds greater responsibility for financial planning and analysis.

Table of Comparison

| Role | Accounts Administrator | Finance Administrator |

|---|---|---|

| Primary Focus | Managing accounts payable and receivable, invoicing, and ledger maintenance | Handling budgeting, financial reporting, and cash flow management |

| Key Responsibilities | Processing transactions, maintaining financial records, reconciling accounts | Preparing financial statements, analyzing financial data, supporting audits |

| Required Skills | Bookkeeping, attention to detail, proficiency in accounting software | Financial analysis, forecasting, strong knowledge of finance principles |

| Reports to | Finance Manager or Senior Accountant | Finance Manager or Financial Controller |

| Typical Qualifications | Accounting diploma or relevant experience | Degree in Finance, Accounting, or related field |

Role Overview: Accounts Administrator vs Finance Administrator

Accounts Administrators primarily manage day-to-day financial records, including invoicing, ledger entries, and payroll processing, ensuring accuracy and compliance with accounting standards. Finance Administrators oversee broader financial operations such as budgeting, financial reporting, and cash flow management, supporting strategic decision-making. Both roles require strong numerical skills and attention to detail, but the Finance Administrator typically involves higher-level financial analysis and planning responsibilities.

Key Responsibilities and Duties

Accounts Administrators manage day-to-day financial transactions, including invoicing, payroll processing, and maintaining ledgers to ensure accurate financial records. Finance Administrators oversee budgeting, financial reporting, compliance with regulatory standards, and assist in forecasting and financial planning. Both roles require proficiency in accounting software and strong organizational skills but differ in the scope of financial strategy and operational execution.

Required Skills and Qualifications

An Accounts Administrator requires proficiency in bookkeeping, ledger management, and familiarity with accounting software such as QuickBooks or Sage, typically holding a diploma in accounting or finance. A Finance Administrator needs strong analytical skills, understanding of budgeting, forecasting, and financial reporting, often supported by a degree in finance, economics, or business administration. Both roles demand excellent attention to detail, communication skills, and knowledge of regulatory compliance standards.

Day-to-Day Tasks Comparison

Accounts Administrators primarily manage invoicing, ledger entries, and payment processing to ensure accurate financial records. Finance Administrators focus on budgeting, financial reporting, and cash flow monitoring to support strategic planning. Both roles require attention to detail and proficiency in financial software but differ in scope, with accounts concentrating on transactional accuracy and finance emphasizing financial analysis.

Work Environment and Team Collaboration

Accounts Administrators typically operate within finance departments, collaborating closely with accountants, auditors, and payroll staff to manage financial records and transactions in structured office settings. Finance Administrators engage with broader teams that may include budgeting analysts, financial planners, and compliance officers, often working in dynamic environments to support strategic financial operations. Both roles require effective communication and teamwork to ensure accurate financial reporting and seamless departmental coordination.

Tools and Software Utilized

Accounts Administrators primarily utilize accounting software such as QuickBooks, Xero, and Sage to manage invoicing, payroll, and ledger reconciliation, ensuring accurate financial record-keeping. Finance Administrators often employ enterprise resource planning (ERP) systems like SAP, Oracle Financials, and Microsoft Dynamics to oversee budgeting, financial forecasting, and compliance reporting. Both roles depend on spreadsheet tools like Microsoft Excel for data analysis and reporting but differ in the complexity and scope of software tailored to their specific administrative functions.

Reporting Lines and Supervision

Accounts Administrators typically report to the Finance Manager or Chief Accountant, overseeing daily transactional activities and ensuring accurate ledger maintenance, whereas Finance Administrators often report directly to the Finance Director or CFO, managing broader financial operations and compliance. Supervision for Accounts Administrators centers on monitoring account reconciliations and invoice processing, while Finance Administrators supervise budgeting, financial reporting, and regulatory adherence across departments. The distinction in reporting lines reflects the Accounts Administrator's operational focus compared to the Finance Administrator's strategic financial oversight.

Career Progression and Advancement Opportunities

Accounts Administrators typically focus on maintaining accurate financial records, processing invoices, and managing payroll, providing a solid foundation in bookkeeping and compliance that supports upward movement to roles such as Senior Accounts Manager or Financial Controller. Finance Administrators handle broader financial tasks like budgeting, forecasting, and regulatory reporting, offering pathways to advanced positions in financial planning, analysis, or finance management. Career progression for both roles depends on skill development in financial software, regulatory knowledge, and analytical capabilities, with Finance Administrators often having more diverse opportunities due to their strategic involvement in financial decision-making.

Salary Expectations and Benefits

Accounts Administrators typically earn between $45,000 and $60,000 annually, with benefits including health insurance, retirement plans, and paid leave. Finance Administrators often command higher salaries ranging from $55,000 to $75,000, reflecting responsibilities in budgeting, financial analysis, and reporting. Benefits for Finance Administrators may include performance bonuses, professional development opportunities, and enhanced healthcare packages.

Choosing the Right Role for Your Career Path

Choosing between an Accounts Administrator and a Finance Administrator depends on your career goals and skills; Accounts Administrators typically focus on managing invoices, payroll, and transaction records, requiring strong attention to detail and accounting knowledge. Finance Administrators handle broader financial planning, budgeting, and reporting tasks, which demand analytical skills and strategic thinking. Aligning your strengths with these role-specific responsibilities ensures a more fulfilling career path and professional growth in administration.

Accounts Administrator vs Finance Administrator Infographic

jobdiv.com

jobdiv.com