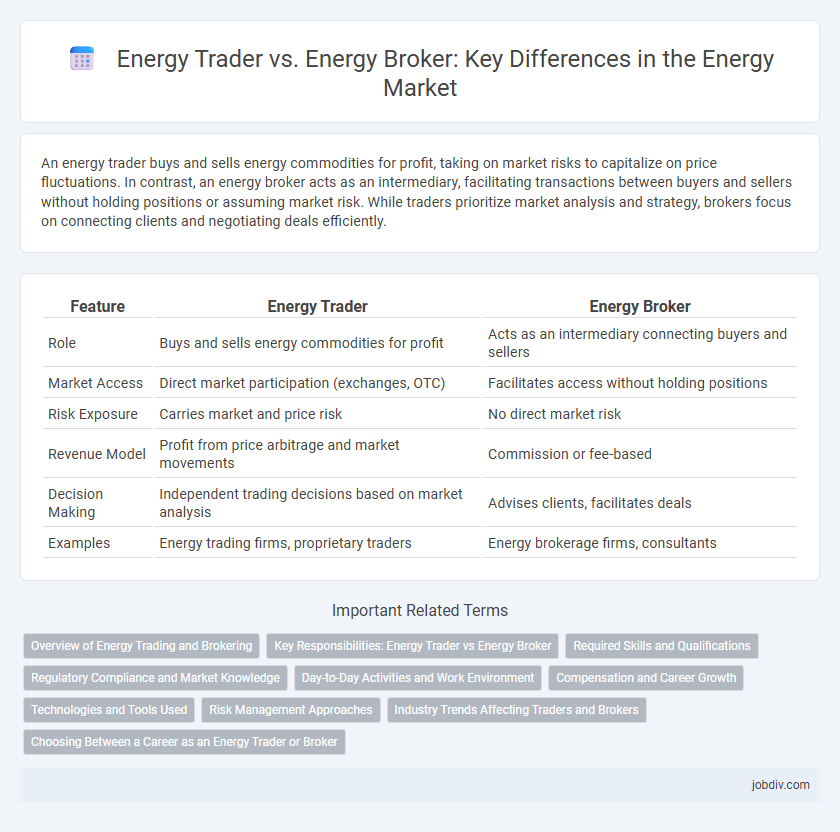

An energy trader buys and sells energy commodities for profit, taking on market risks to capitalize on price fluctuations. In contrast, an energy broker acts as an intermediary, facilitating transactions between buyers and sellers without holding positions or assuming market risk. While traders prioritize market analysis and strategy, brokers focus on connecting clients and negotiating deals efficiently.

Table of Comparison

| Feature | Energy Trader | Energy Broker |

|---|---|---|

| Role | Buys and sells energy commodities for profit | Acts as an intermediary connecting buyers and sellers |

| Market Access | Direct market participation (exchanges, OTC) | Facilitates access without holding positions |

| Risk Exposure | Carries market and price risk | No direct market risk |

| Revenue Model | Profit from price arbitrage and market movements | Commission or fee-based |

| Decision Making | Independent trading decisions based on market analysis | Advises clients, facilitates deals |

| Examples | Energy trading firms, proprietary traders | Energy brokerage firms, consultants |

Overview of Energy Trading and Brokering

Energy traders actively buy and sell energy commodities like electricity, natural gas, and oil on wholesale markets to capitalize on price fluctuations and market demand. Energy brokers facilitate transactions between buyers and sellers without taking ownership of the commodities, earning commissions by matching counterparties in the energy market. Both roles are crucial for liquidity and price discovery, but traders assume market risks while brokers operate as intermediaries.

Key Responsibilities: Energy Trader vs Energy Broker

Energy traders actively buy and sell energy commodities such as oil, natural gas, or electricity, aiming to capitalize on price fluctuations by analyzing market trends and executing high-frequency trades. Energy brokers act as intermediaries connecting buyers and sellers without owning the commodities, focusing on negotiating contracts, securing competitive pricing, and facilitating smooth transactions. Traders assume market risk for profit, while brokers prioritize client service and market access.

Required Skills and Qualifications

Energy traders require strong analytical skills, proficiency in market analysis, and a deep understanding of energy commodities and financial instruments to make rapid, informed trading decisions. Essential qualifications include a background in finance, economics, or engineering, combined with certifications such as the Chartered Financial Analyst (CFA) or Energy Risk Professional (ERP). Energy brokers must excel in communication, negotiation, and relationship management, with qualifications centered on industry knowledge and sometimes licensing, such as the Series 3 National Commodity Futures Exam, to facilitate effective client transactions.

Regulatory Compliance and Market Knowledge

Energy traders possess in-depth market knowledge and must adhere to stringent regulatory compliance standards set by bodies like the Federal Energy Regulatory Commission (FERC) and the North American Electric Reliability Corporation (NERC). Energy brokers facilitate transactions between buyers and sellers without taking ownership of the energy commodities, requiring compliance primarily with trade reporting and brokerage regulations. Traders often navigate complex risk management and trading strategies, whereas brokers focus on transparency and accuracy in transaction execution within regulated frameworks.

Day-to-Day Activities and Work Environment

Energy traders execute buying and selling of energy commodities like electricity, natural gas, and oil on exchanges or OTC markets, analyzing market data, monitoring price movements, and managing risk exposure to maximize profit margins. Energy brokers act as intermediaries between buyers and sellers, facilitating transactions without taking ownership of the commodities, often negotiating contracts and providing market insights to clients. Traders typically operate in high-pressure trading floors or digital platforms requiring rapid decision-making, whereas brokers work in client-focused environments involving negotiation and relationship management.

Compensation and Career Growth

Energy traders typically earn compensation through base salaries combined with performance-based bonuses linked to successful trades and market movement predictions, offering significant earning potential in volatile markets. Energy brokers, on the other hand, generally receive commissions based on the volume and value of energy contracts they facilitate, which can provide steady income but with less upside compared to traders. Career growth for energy traders often involves advancing to senior trading roles or portfolio management, while brokers may progress into specialized consulting or brokerage firm leadership positions.

Technologies and Tools Used

Energy traders utilize advanced algorithmic trading platforms and real-time data analytics tools to execute rapid transactions on energy markets, optimizing price fluctuations and demand forecasts. Energy brokers rely heavily on customer relationship management (CRM) software and market intelligence platforms to facilitate negotiations and match buyers with sellers effectively. Both leverage blockchain for transaction transparency and IoT sensors for real-time monitoring of energy assets but apply these technologies differently according to their operational roles.

Risk Management Approaches

Energy traders use quantitative risk management techniques such as Value at Risk (VaR), scenario analysis, and real-time market monitoring to optimize portfolio performance and hedge exposure. Energy brokers primarily facilitate transactions between buyers and sellers, focusing on risk mitigation by providing market intelligence, contract flexibility, and access to diverse counterparties. The trader's approach is proactive and data-driven, while brokers emphasize advisory and transactional risk controls to reduce counterparty and market risks.

Industry Trends Affecting Traders and Brokers

Energy traders and brokers navigate an increasingly complex market shaped by rising renewable integration, regulatory shifts, and volatile commodity prices. Traders leverage advanced algorithms and real-time data analytics to manage risks and capitalize on price fluctuations, while brokers focus on facilitating transactions and providing market intelligence amidst evolving contract structures. The growing emphasis on sustainability and decarbonization intensifies competition, driving both roles to adapt through technology adoption and strategic partnerships in the energy sector.

Choosing Between a Career as an Energy Trader or Broker

Energy traders specialize in buying and selling energy commodities such as oil, natural gas, and electricity, using market analysis and risk management to maximize profits. Energy brokers act as intermediaries, facilitating deals between energy producers and consumers while earning commissions without taking ownership of the commodities. Choosing between a career as an energy trader or broker depends on one's preference for market risk exposure, analytical intensity, and the desire for direct asset control versus client-focused negotiation roles.

Energy Trader vs Energy Broker Infographic

jobdiv.com

jobdiv.com