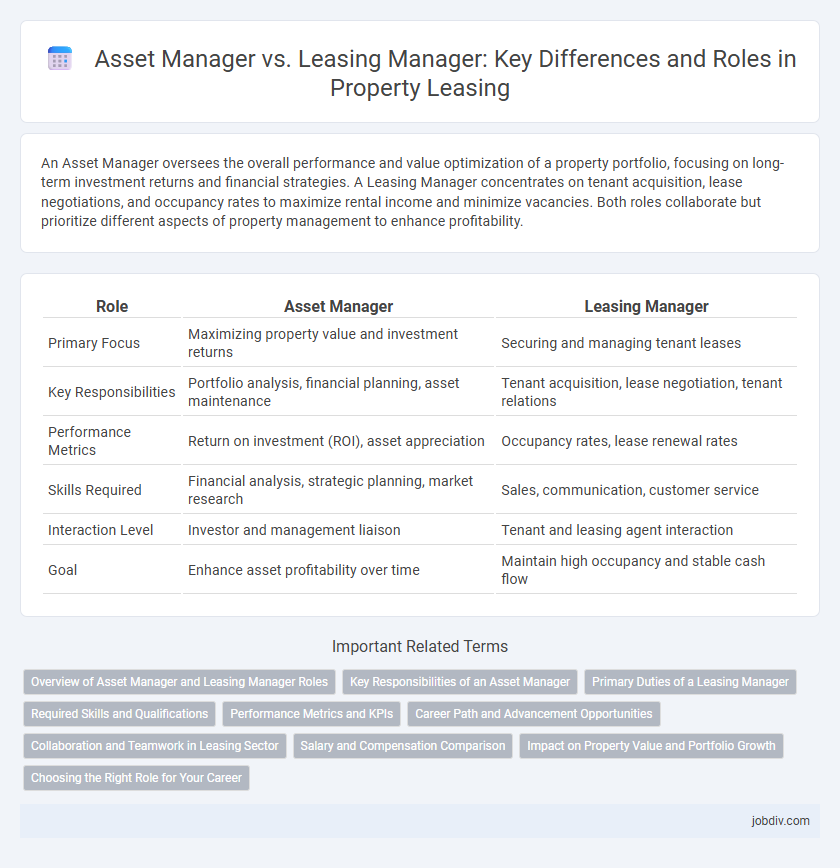

An Asset Manager oversees the overall performance and value optimization of a property portfolio, focusing on long-term investment returns and financial strategies. A Leasing Manager concentrates on tenant acquisition, lease negotiations, and occupancy rates to maximize rental income and minimize vacancies. Both roles collaborate but prioritize different aspects of property management to enhance profitability.

Table of Comparison

| Role | Asset Manager | Leasing Manager |

|---|---|---|

| Primary Focus | Maximizing property value and investment returns | Securing and managing tenant leases |

| Key Responsibilities | Portfolio analysis, financial planning, asset maintenance | Tenant acquisition, lease negotiation, tenant relations |

| Performance Metrics | Return on investment (ROI), asset appreciation | Occupancy rates, lease renewal rates |

| Skills Required | Financial analysis, strategic planning, market research | Sales, communication, customer service |

| Interaction Level | Investor and management liaison | Tenant and leasing agent interaction |

| Goal | Enhance asset profitability over time | Maintain high occupancy and stable cash flow |

Overview of Asset Manager and Leasing Manager Roles

An Asset Manager oversees the performance and value optimization of a property portfolio, focusing on financial metrics, risk management, and strategic planning to maximize returns. A Leasing Manager specializes in tenant acquisition, lease negotiations, and maintaining occupancy rates to ensure steady cash flow. Both roles collaborate closely to enhance property profitability and long-term asset growth.

Key Responsibilities of an Asset Manager

An Asset Manager oversees the strategic performance, valuation, and profitability of real estate or equipment portfolios, ensuring optimal returns through market analysis and investment planning. They manage financial reporting, risk assessment, and long-term asset preservation, aligning property operations with ownership goals. In contrast, a Leasing Manager primarily focuses on tenant acquisition, lease negotiations, and occupancy rates within the asset portfolio.

Primary Duties of a Leasing Manager

A Leasing Manager's primary duties include overseeing tenant acquisition and retention, negotiating lease terms, and ensuring compliance with leasing policies. They coordinate property marketing strategies to maximize occupancy rates and revenue generation. Leasing Managers also manage lease documentation and serve as the primary point of contact for prospective and current tenants.

Required Skills and Qualifications

An Asset Manager in leasing requires strong financial analysis expertise, portfolio management skills, and proficiency in risk assessment to optimize asset performance and maximize returns. A Leasing Manager needs exceptional negotiation abilities, customer relationship management, and knowledge of lease agreements to effectively secure tenants and manage leasing operations. Both roles demand excellent communication skills and a solid understanding of market trends, but the Asset Manager emphasizes strategic financial oversight while the Leasing Manager focuses on operational leasing activities.

Performance Metrics and KPIs

Asset Managers prioritize long-term portfolio performance metrics such as net operating income (NOI), asset value appreciation, and capital expenditures efficiency to maximize overall asset profitability. Leasing Managers focus on tactical KPIs like lease-up velocity, occupancy rates, tenant retention, and rental revenue growth to optimize property cash flow and reduce vacancy periods. Both roles require strategic alignment, with Asset Managers driving high-level financial outcomes and Leasing Managers managing operational leasing performance indicators.

Career Path and Advancement Opportunities

Asset Managers typically focus on overseeing a portfolio of properties, optimizing asset performance and value, which positions them for advancement into executive roles such as Director of Asset Management or Chief Investment Officer. Leasing Managers specialize in tenant relations, lease negotiations, and occupancy rates, developing expertise that can lead to roles like Senior Leasing Manager or Leasing Director. Career progression in both paths depends on demonstrated leadership, market knowledge, and strategic decision-making within the real estate and property management sectors.

Collaboration and Teamwork in Leasing Sector

Asset Managers and Leasing Managers collaborate closely to optimize property performance and tenant satisfaction. Asset Managers focus on long-term investment strategies and financial outcomes, while Leasing Managers handle tenant acquisition and lease negotiations to maximize occupancy rates. Effective teamwork ensures alignment of asset goals with leasing activities, enhancing revenue growth and portfolio value.

Salary and Compensation Comparison

Asset Managers in leasing typically earn higher salaries, with average annual compensation ranging from $90,000 to $130,000, reflecting their broader responsibility for portfolio performance and investment strategy. Leasing Managers usually receive salaries between $60,000 and $90,000, emphasizing tenant relations and lease negotiations. Bonuses and profit-sharing are more substantial for Asset Managers due to their direct impact on asset value and revenue growth.

Impact on Property Value and Portfolio Growth

An Asset Manager focuses on maximizing long-term property value and portfolio growth by strategically overseeing property performance, capital improvements, and financial metrics. A Leasing Manager primarily drives occupancy rates and tenant acquisition, directly influencing short-term cash flow but with less emphasis on overarching asset appreciation. Effective collaboration between both roles enhances overall property valuation and sustainable portfolio expansion.

Choosing the Right Role for Your Career

An Asset Manager focuses on maximizing the value and return of property portfolios through strategic planning, capital improvements, and financial analysis, making it ideal for professionals interested in investment performance and long-term growth. A Leasing Manager specializes in tenant acquisition, lease negotiations, and occupancy rates, perfect for those who excel in relationship management and sales-oriented roles within real estate. Choosing the right role depends on whether your career aligns more with financial asset optimization or hands-on leasing operations and tenant engagement.

Asset Manager vs Leasing Manager Infographic

jobdiv.com

jobdiv.com