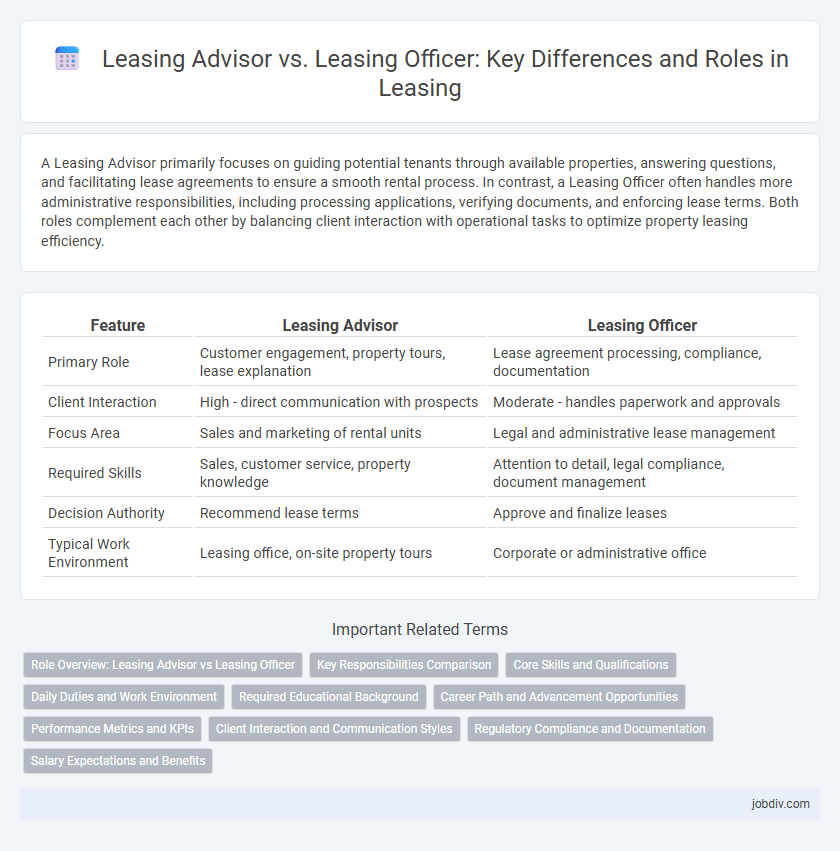

A Leasing Advisor primarily focuses on guiding potential tenants through available properties, answering questions, and facilitating lease agreements to ensure a smooth rental process. In contrast, a Leasing Officer often handles more administrative responsibilities, including processing applications, verifying documents, and enforcing lease terms. Both roles complement each other by balancing client interaction with operational tasks to optimize property leasing efficiency.

Table of Comparison

| Feature | Leasing Advisor | Leasing Officer |

|---|---|---|

| Primary Role | Customer engagement, property tours, lease explanation | Lease agreement processing, compliance, documentation |

| Client Interaction | High - direct communication with prospects | Moderate - handles paperwork and approvals |

| Focus Area | Sales and marketing of rental units | Legal and administrative lease management |

| Required Skills | Sales, customer service, property knowledge | Attention to detail, legal compliance, document management |

| Decision Authority | Recommend lease terms | Approve and finalize leases |

| Typical Work Environment | Leasing office, on-site property tours | Corporate or administrative office |

Role Overview: Leasing Advisor vs Leasing Officer

A Leasing Advisor primarily focuses on client engagement by promoting properties, guiding prospects through available leasing options, and enhancing tenant satisfaction to drive lease agreements. In contrast, a Leasing Officer handles the administrative and compliance aspects, including processing lease applications, verifying documentation, and ensuring adherence to leasing policies and regulations. Both roles collaborate to streamline the leasing process but emphasize different stages--customer relationship management for Leasing Advisors and operational execution for Leasing Officers.

Key Responsibilities Comparison

Leasing Advisors primarily focus on customer engagement by assisting prospective tenants with property tours, explaining lease terms, and addressing inquiries to facilitate rental agreements. Leasing Officers concentrate on administrative duties such as verifying tenant applications, conducting background checks, preparing lease documents, and ensuring compliance with legal and company policies. Both roles collaborate to maximize occupancy rates, but Leasing Officers emphasize regulatory adherence while Leasing Advisors prioritize tenant relations and sales support.

Core Skills and Qualifications

Leasing Advisors excel in customer service, communication, and market knowledge, focusing on client engagement and property showings to drive rentals. Leasing Officers possess strong analytical skills, contract management expertise, and regulatory compliance knowledge, emphasizing lease administration and financial processing. Both roles require proficiency in property management software and a thorough understanding of fair housing laws.

Daily Duties and Work Environment

Leasing Advisors primarily engage with prospective tenants by showcasing rental properties, conducting tours, and addressing applicant inquiries to facilitate lease agreements. Leasing Officers focus on contractual responsibilities, including verifying applicant qualifications, preparing leasing documents, and ensuring compliance with housing regulations. Both roles operate within property management offices or leasing centers, requiring strong communication skills and familiarity with rental market trends.

Required Educational Background

A Leasing Advisor typically requires a high school diploma or equivalent, with preferred knowledge in customer service and real estate fundamentals. A Leasing Officer often demands a higher education level, such as an associate or bachelor's degree in business administration, finance, or property management. Specialized certifications in leasing or real estate can enhance qualifications for both positions, emphasizing the importance of formal education and industry-specific training.

Career Path and Advancement Opportunities

Leasing Advisors typically focus on client interactions, guiding prospective tenants through property options and lease terms, which builds strong customer service and sales skills essential for long-term success. Leasing Officers often handle more administrative and compliance responsibilities, managing leasing documentation and ensuring adherence to lease agreements, which provides a solid foundation in property management and regulatory knowledge. Advancing from Leasing Advisor to Leasing Officer or higher property management roles is common, with opportunities for growth into senior leasing management, regional supervision, or real estate portfolio management.

Performance Metrics and KPIs

Leasing Advisors and Leasing Officers differ significantly in performance metrics and KPIs, with Advisors primarily measured on tenant engagement rates, lease conversion ratios, and customer satisfaction scores. Leasing Officers focus on portfolio occupancy rates, lease renewal percentages, and rent collection efficiency. Both roles emphasize timely lease processing and adherence to compliance standards to drive overall property revenue growth.

Client Interaction and Communication Styles

Leasing Advisors prioritize proactive client engagement, utilizing personalized communication techniques to educate prospective tenants about available properties and lease terms. Leasing Officers focus on formal communication, ensuring accurate documentation and adherence to leasing policies while addressing client inquiries efficiently. Both roles require strong interpersonal skills, but Leasing Advisors emphasize relationship-building, whereas Leasing Officers emphasize compliance and transactional clarity.

Regulatory Compliance and Documentation

Leasing Advisors specialize in guiding clients through lease options while ensuring all documentation adheres to regulatory compliance standards set by housing laws and local statutes. Leasing Officers oversee the execution and verification of lease agreements, meticulously managing legal documents to maintain compliance with federal and state regulations. Both roles require a deep understanding of lease contracts, fair housing laws, and accurate record-keeping to prevent legal disputes and ensure transparent tenant relations.

Salary Expectations and Benefits

Leasing Advisors typically earn an average salary ranging from $35,000 to $50,000 annually, focusing on client engagement and property tours, while Leasing Officers command higher salaries between $50,000 and $70,000 due to their responsibilities in lease enforcement and legal compliance. Benefits for Leasing Officers often include performance bonuses, health insurance, and retirement plans, reflecting their advanced role in property management. Leasing Advisors may receive commission-based incentives and flexible schedules, emphasizing customer service and tenant relations.

Leasing Advisor vs Leasing Officer Infographic

jobdiv.com

jobdiv.com