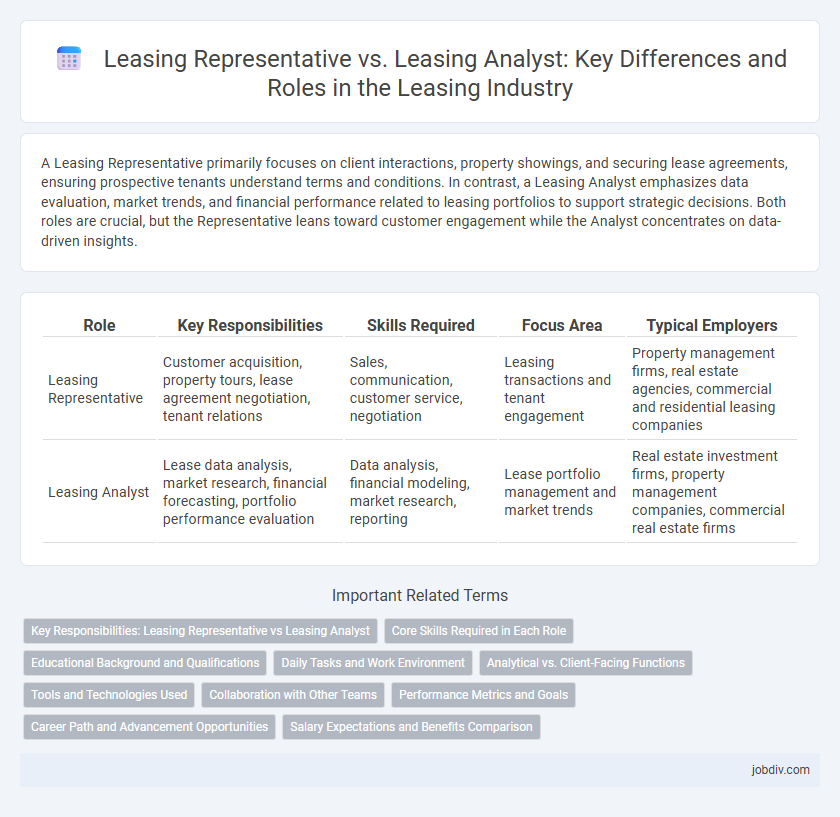

A Leasing Representative primarily focuses on client interactions, property showings, and securing lease agreements, ensuring prospective tenants understand terms and conditions. In contrast, a Leasing Analyst emphasizes data evaluation, market trends, and financial performance related to leasing portfolios to support strategic decisions. Both roles are crucial, but the Representative leans toward customer engagement while the Analyst concentrates on data-driven insights.

Table of Comparison

| Role | Key Responsibilities | Skills Required | Focus Area | Typical Employers |

|---|---|---|---|---|

| Leasing Representative | Customer acquisition, property tours, lease agreement negotiation, tenant relations | Sales, communication, customer service, negotiation | Leasing transactions and tenant engagement | Property management firms, real estate agencies, commercial and residential leasing companies |

| Leasing Analyst | Lease data analysis, market research, financial forecasting, portfolio performance evaluation | Data analysis, financial modeling, market research, reporting | Lease portfolio management and market trends | Real estate investment firms, property management companies, commercial real estate firms |

Key Responsibilities: Leasing Representative vs Leasing Analyst

Leasing Representatives primarily handle tenant relations, property showings, lease documentation, and customer service to drive occupancy rates. Leasing Analysts focus on data analysis, market trend evaluation, lease portfolio performance, and financial reporting to support strategic leasing decisions. Both roles contribute to lease management but differ in direct tenant interaction versus data-driven insights.

Core Skills Required in Each Role

Leasing Representatives excel in customer service, negotiation, and communication skills essential for engaging prospective tenants and closing lease agreements. Leasing Analysts require strong analytical abilities, proficiency in data interpretation, and attention to detail to assess market trends, financial reports, and lease performance. Both roles benefit from knowledge of property management software and regulatory compliance, but the Representative emphasizes interpersonal expertise while the Analyst focuses on quantitative analysis.

Educational Background and Qualifications

A Leasing Representative typically requires a high school diploma or equivalent, with strong interpersonal and sales skills emphasized through on-the-job training or a certificate in real estate or property management. In contrast, a Leasing Analyst often holds a bachelor's degree in finance, business administration, or real estate, equipped with advanced analytical skills and proficiency in data analysis software. Professional certifications such as Certified Property Manager (CPM) or Accredited Residential Manager (ARM) further distinguish candidates in both roles, with the analyst role demanding a deeper understanding of market trends and financial modeling.

Daily Tasks and Work Environment

A Leasing Representative primarily manages client interactions, conducts property tours, processes rental applications, and handles lease agreements within fast-paced leasing offices or on-site locations. In contrast, a Leasing Analyst focuses on data collection, market research, and financial reporting to optimize leasing strategies, typically working in office environments with access to analytics software. Both roles require strong communication skills but differ in emphasis on direct client engagement versus analytical evaluation.

Analytical vs. Client-Facing Functions

Leasing Representatives primarily engage in client-facing functions, facilitating tenant interactions, property tours, and lease negotiations to drive occupancy rates. Leasing Analysts focus on analytical functions, conducting market research, financial modeling, and portfolio performance analysis to inform leasing strategies and optimize revenue. The synergy between these roles enhances overall leasing operations by combining direct customer engagement with data-driven decision-making.

Tools and Technologies Used

Leasing Representatives primarily use customer relationship management (CRM) software like Salesforce and leasing-specific platforms such as Yardi Voyager to manage tenant interactions and lease agreements efficiently. Leasing Analysts rely heavily on advanced data analytics tools, including Excel with pivot tables, SQL databases, and real estate financial modeling software like ARGUS Enterprise to evaluate leasing performance and forecast revenue. Both roles utilize digital communication tools, but Analysts prioritize data visualization software like Tableau to interpret market trends and optimize leasing strategies.

Collaboration with Other Teams

Leasing Representatives work closely with marketing, property management, and customer service teams to ensure smooth tenant onboarding and retention processes. Leasing Analysts collaborate with finance, legal, and operations departments to analyze lease data, forecast trends, and support strategic decision-making. Effective communication between Leasing Representatives and Analysts enhances overall leasing efficiency and improves tenant satisfaction metrics.

Performance Metrics and Goals

Leasing Representatives focus on direct tenant interactions, lease agreements, and occupancy rates, making metrics like lease renewal rates, new lease conversions, and customer satisfaction pivotal for performance evaluation. Leasing Analysts prioritize data-driven insights, analyzing market trends, lease performance, and financial metrics such as rent collections and revenue forecasting to optimize portfolio management. Both roles align their goals towards maximizing property profitability, with the Representative targeting tenant acquisition and retention, and the Analyst ensuring strategic decision-making through detailed performance analysis.

Career Path and Advancement Opportunities

Leasing Representatives typically begin their careers focusing on client interactions, property tours, and lease negotiations, which build strong sales and customer service skills. Leasing Analysts advance by leveraging data analysis, market research, and financial modeling to optimize leasing strategies and support decision-making processes. Progression from Leasing Representative to Leasing Analyst often involves developing analytical expertise, opening opportunities in property management, real estate investment, or portfolio analysis roles.

Salary Expectations and Benefits Comparison

Leasing Representatives typically earn an average salary ranging from $35,000 to $50,000 annually, with benefits including commissions and performance bonuses tied to lease agreements. Leasing Analysts often command higher salaries, averaging between $50,000 and $70,000 per year, reflecting their analytical role in market trends and portfolio management, accompanied by comprehensive benefits such as healthcare, retirement plans, and professional development opportunities. Salary expectations for Leasing Analysts are generally higher due to increased responsibilities and required expertise in financial analysis and reporting within the leasing sector.

Leasing Representative vs Leasing Analyst Infographic

jobdiv.com

jobdiv.com