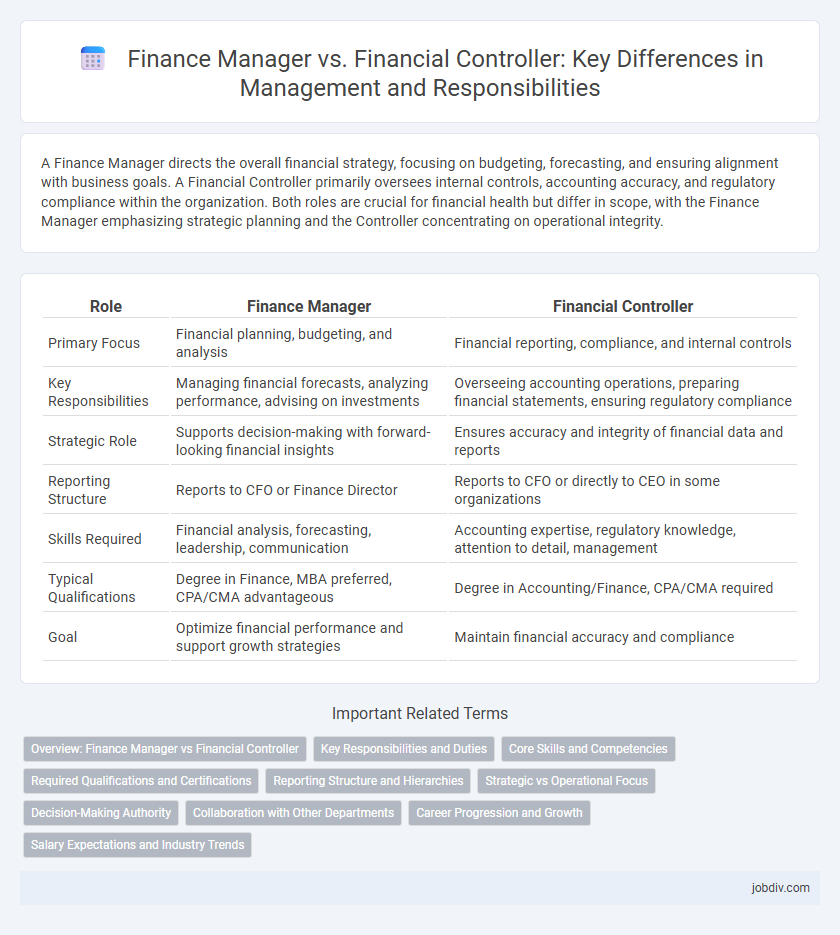

A Finance Manager directs the overall financial strategy, focusing on budgeting, forecasting, and ensuring alignment with business goals. A Financial Controller primarily oversees internal controls, accounting accuracy, and regulatory compliance within the organization. Both roles are crucial for financial health but differ in scope, with the Finance Manager emphasizing strategic planning and the Controller concentrating on operational integrity.

Table of Comparison

| Role | Finance Manager | Financial Controller |

|---|---|---|

| Primary Focus | Financial planning, budgeting, and analysis | Financial reporting, compliance, and internal controls |

| Key Responsibilities | Managing financial forecasts, analyzing performance, advising on investments | Overseeing accounting operations, preparing financial statements, ensuring regulatory compliance |

| Strategic Role | Supports decision-making with forward-looking financial insights | Ensures accuracy and integrity of financial data and reports |

| Reporting Structure | Reports to CFO or Finance Director | Reports to CFO or directly to CEO in some organizations |

| Skills Required | Financial analysis, forecasting, leadership, communication | Accounting expertise, regulatory knowledge, attention to detail, management |

| Typical Qualifications | Degree in Finance, MBA preferred, CPA/CMA advantageous | Degree in Accounting/Finance, CPA/CMA required |

| Goal | Optimize financial performance and support growth strategies | Maintain financial accuracy and compliance |

Overview: Finance Manager vs Financial Controller

A Finance Manager oversees budgeting, forecasting, and financial planning to support strategic decision-making and ensure efficient resource allocation. In contrast, a Financial Controller concentrates on financial reporting, compliance, and internal controls to maintain accurate accounting records and regulatory adherence. Both roles collaborate closely to optimize an organization's financial health, with the Finance Manager driving forward-looking strategies while the Financial Controller ensures historical financial accuracy and integrity.

Key Responsibilities and Duties

Finance Managers oversee financial planning, budgeting, and forecasting to ensure efficient resource allocation and support strategic decision-making. Financial Controllers manage day-to-day accounting operations, internal controls, and financial reporting to maintain compliance and accuracy in financial statements. Both roles collaborate to optimize financial performance, with Finance Managers emphasizing future growth and Financial Controllers focusing on operational integrity.

Core Skills and Competencies

Finance Managers excel in strategic financial planning, budget management, and stakeholder communication, leveraging skills in forecasting, investment analysis, and risk management. Financial Controllers demonstrate expertise in financial reporting, compliance, internal controls, and audit coordination, focusing on accuracy and regulatory adherence. Both roles require strong analytical abilities and proficiency in financial software, but Finance Managers prioritize growth and decision-making, while Controllers emphasize governance and operational efficiency.

Required Qualifications and Certifications

Finance Managers typically require a bachelor's degree in finance, accounting, or business administration, often complemented by certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) to enhance strategic financial planning skills. Financial Controllers generally need a degree in accounting or finance, with professional qualifications like Certified Public Accountant (CPA) or Chartered Accountant (CA) being essential to validate expertise in regulatory compliance and financial reporting. Both roles demand strong analytical abilities and proficiency in financial software, but Controllers emphasize certifications tied to audit and control standards, while Managers focus on broader fiscal strategy and investment knowledge.

Reporting Structure and Hierarchies

Finance Managers typically report to the Financial Controller, who holds a higher position in the organizational hierarchy and oversees the entire finance function. The Financial Controller is responsible for managing financial reporting, compliance, and internal controls, while the Finance Manager focuses on budget preparation, financial analysis, and monitoring performance within specific departments. This reporting structure ensures a clear chain of command that supports accurate financial data flow and strategic decision-making.

Strategic vs Operational Focus

A Finance Manager primarily concentrates on strategic financial planning, budgeting, and forecasting to drive long-term business growth, aligning financial goals with organizational strategies. In contrast, a Financial Controller focuses on operational finance activities, including overseeing accounting processes, financial reporting, and compliance to ensure accuracy and control in daily financial transactions. The Finance Manager's role is forward-looking and strategy-driven, while the Financial Controller's responsibilities are rooted in maintaining operational finance integrity and regulatory adherence.

Decision-Making Authority

A Finance Manager typically holds broader decision-making authority over budgeting, forecasting, and financial planning to support business growth initiatives. In contrast, a Financial Controller exercises more control over financial reporting, compliance, and internal controls, ensuring accurate and timely financial data. The Finance Manager's decisions often drive strategic investment, while the Controller focuses on operational financial accuracy and risk management.

Collaboration with Other Departments

A Finance Manager collaborates closely with sales, marketing, and operations teams to align budgeting and forecasting with business goals, ensuring resource allocation supports growth strategies. A Financial Controller primarily partners with accounting, audit, and compliance departments to maintain accurate financial records and regulatory adherence. Both roles facilitate cross-departmental communication but focus on different aspects of financial stewardship within the organization.

Career Progression and Growth

A Finance Manager typically oversees budgeting, forecasting, and financial analysis, positioning themselves for strategic roles such as Financial Director or CFO by gaining broad business acumen and leadership skills. In contrast, a Financial Controller specializes in regulatory compliance, financial reporting, and internal controls, often advancing to senior finance administration or audit leadership roles through deep expertise in accounting and governance. Career progression for both roles benefits from professional certifications like CMA, CPA, or ACCA, which enhance credibility and open opportunities in corporate finance and executive management.

Salary Expectations and Industry Trends

Finance Managers typically command higher salaries than Financial Controllers due to broader strategic responsibilities, with average salaries ranging from $90,000 to $130,000 annually compared to $75,000 to $110,000 for Financial Controllers. Industry trends indicate increased demand for Finance Managers skilled in financial planning and analysis amid digital transformation, while Financial Controllers are evolving towards roles with enhanced compliance and regulatory oversight. Salary expectations fluctuate based on sector, with finance industry roles often offering premium compensation relative to manufacturing or nonprofit sectors.

Finance Manager vs Financial Controller Infographic

jobdiv.com

jobdiv.com