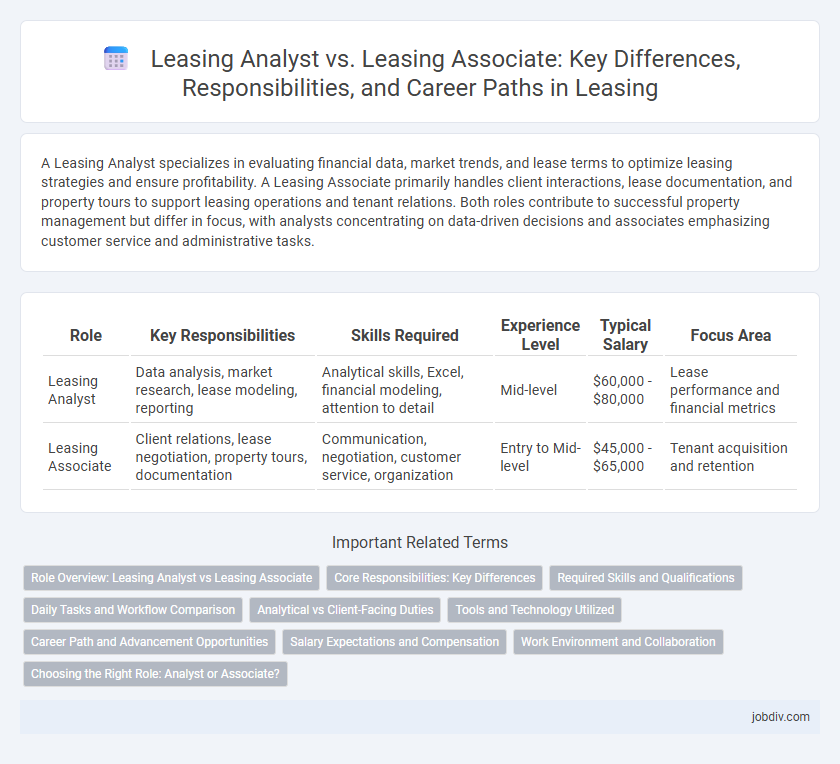

A Leasing Analyst specializes in evaluating financial data, market trends, and lease terms to optimize leasing strategies and ensure profitability. A Leasing Associate primarily handles client interactions, lease documentation, and property tours to support leasing operations and tenant relations. Both roles contribute to successful property management but differ in focus, with analysts concentrating on data-driven decisions and associates emphasizing customer service and administrative tasks.

Table of Comparison

| Role | Key Responsibilities | Skills Required | Experience Level | Typical Salary | Focus Area |

|---|---|---|---|---|---|

| Leasing Analyst | Data analysis, market research, lease modeling, reporting | Analytical skills, Excel, financial modeling, attention to detail | Mid-level | $60,000 - $80,000 | Lease performance and financial metrics |

| Leasing Associate | Client relations, lease negotiation, property tours, documentation | Communication, negotiation, customer service, organization | Entry to Mid-level | $45,000 - $65,000 | Tenant acquisition and retention |

Role Overview: Leasing Analyst vs Leasing Associate

Leasing Analysts specialize in evaluating market trends, financial data, and lease agreements to optimize property revenue and investment decisions. Leasing Associates primarily manage tenant relations, conduct property tours, and handle lease documentation to support leasing operations and ensure occupancy. Both roles are essential in real estate leasing but differ in focus: Analysts drive strategic insights, while Associates focus on customer interactions and leasing processes.

Core Responsibilities: Key Differences

A Leasing Analyst primarily focuses on data-driven tasks such as market analysis, financial modeling, and reporting to optimize leasing strategies and portfolio performance. In contrast, a Leasing Associate handles direct tenant interactions, lease documentation, and property showings, ensuring smooth lease execution and tenant satisfaction. The analyst's role emphasizes quantitative assessment and strategic insights, while the associate centers on operational support and client communication.

Required Skills and Qualifications

Leasing Analysts require strong analytical skills, proficiency in data interpretation, and experience with financial modeling and lease agreements, often holding degrees in finance, economics, or business administration. Leasing Associates typically need excellent customer service abilities, negotiation skills, and knowledge of property management software, with qualifications including a background in real estate or related fields. Both roles benefit from strong communication skills, attention to detail, and familiarity with lease laws and market trends.

Daily Tasks and Workflow Comparison

Leasing Analysts focus on data-driven tasks such as evaluating market trends, analyzing lease performance metrics, and preparing financial reports to optimize leasing strategies. Leasing Associates handle client interactions, conduct property tours, process lease applications, and coordinate lease document execution to support daily leasing operations. The workflow of Leasing Analysts is analytical and report-centric, while Leasing Associates maintain a customer-facing, operational workflow focused on lease administration.

Analytical vs Client-Facing Duties

A Leasing Analyst primarily focuses on data analysis, market research, financial modeling, and lease agreement evaluation to support strategic leasing decisions. Leasing Associates engage directly with clients, managing tenant relations, property showings, lease negotiations, and customer service activities. The role of an analyst emphasizes quantitative assessment and reporting, whereas the associate role prioritizes interpersonal communication and client management.

Tools and Technology Utilized

Leasing Analysts primarily utilize data analytics software, CRM platforms, and financial modeling tools to evaluate lease performance and market trends. Leasing Associates rely heavily on property management systems, leasing databases, and customer service applications to manage tenant interactions and lease documentation efficiently. Both roles incorporate digital communication tools, but Analysts emphasize analytical software, while Associates focus on operational technology.

Career Path and Advancement Opportunities

Leasing Analysts typically focus on data-driven insights, financial modeling, and market research, which positions them for advancement into strategic roles such as Portfolio Manager or Real Estate Analyst. Leasing Associates handle day-to-day tenant interactions, lease negotiations, and property management, creating a strong foundation for progression into Property Manager or Leasing Manager roles. Career growth in leasing often depends on developing specialized skills in analytics for Analysts or client relationship management for Associates.

Salary Expectations and Compensation

Leasing Analysts typically command higher salaries than Leasing Associates, with median annual earnings ranging from $55,000 to $75,000, reflecting their advanced skills in financial modeling and market analysis. Leasing Associates earn approximately $40,000 to $55,000 per year, focusing more on client interaction and lease documentation. Compensation packages for Leasing Analysts often include performance bonuses and profit-sharing, whereas Leasing Associates usually receive standard benefits and commission-based incentives.

Work Environment and Collaboration

Leasing Analysts typically work in office environments where they focus on financial data analysis and market research to support leasing decisions, collaborating closely with finance teams and property managers. Leasing Associates are more client-facing, spending significant time on-site interacting with prospective tenants and assisting property managers, fostering collaboration through direct customer service and lease negotiations. Both roles require effective communication skills, but Analysts emphasize internal teamwork, while Associates prioritize external client engagement.

Choosing the Right Role: Analyst or Associate?

Leasing Analysts excel in data-driven decision-making by analyzing market trends, financial reports, and lease portfolios to optimize leasing strategies, making them ideal for candidates with strong analytical skills and attention to detail. Leasing Associates focus on client interactions, property tours, and contract negotiations, fitting professionals who thrive in customer-facing roles and relationship management. Choose a Leasing Analyst role for strategic insights and data analysis or a Leasing Associate position to engage directly with clients and facilitate leasing transactions.

Leasing Analyst vs Leasing Associate Infographic

jobdiv.com

jobdiv.com