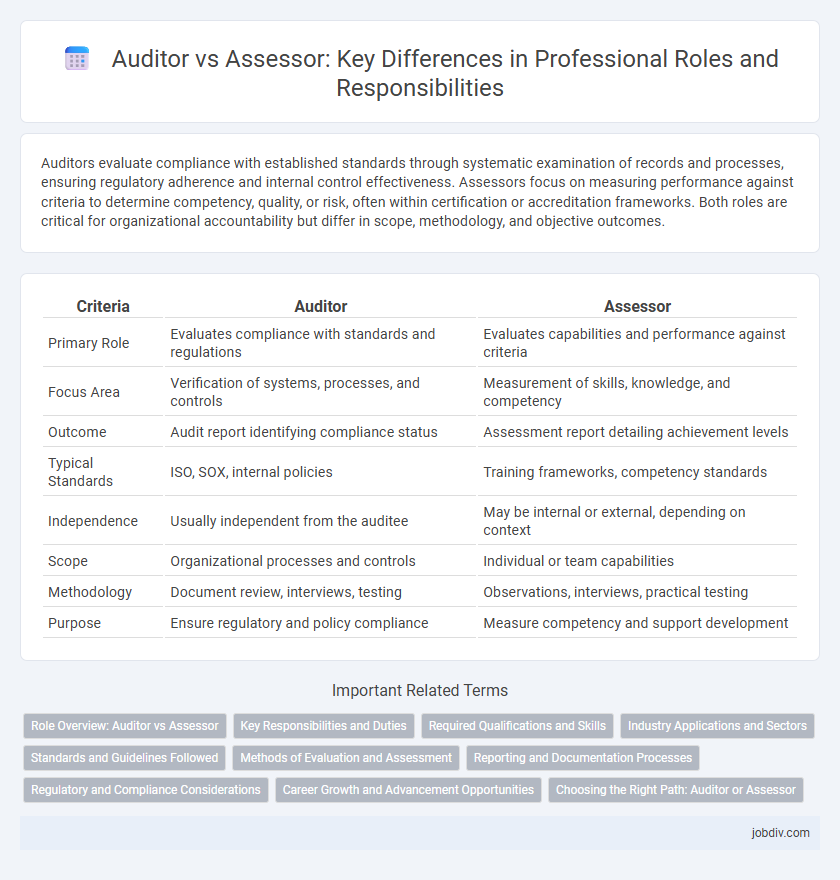

Auditors evaluate compliance with established standards through systematic examination of records and processes, ensuring regulatory adherence and internal control effectiveness. Assessors focus on measuring performance against criteria to determine competency, quality, or risk, often within certification or accreditation frameworks. Both roles are critical for organizational accountability but differ in scope, methodology, and objective outcomes.

Table of Comparison

| Criteria | Auditor | Assessor |

|---|---|---|

| Primary Role | Evaluates compliance with standards and regulations | Evaluates capabilities and performance against criteria |

| Focus Area | Verification of systems, processes, and controls | Measurement of skills, knowledge, and competency |

| Outcome | Audit report identifying compliance status | Assessment report detailing achievement levels |

| Typical Standards | ISO, SOX, internal policies | Training frameworks, competency standards |

| Independence | Usually independent from the auditee | May be internal or external, depending on context |

| Scope | Organizational processes and controls | Individual or team capabilities |

| Methodology | Document review, interviews, testing | Observations, interviews, practical testing |

| Purpose | Ensure regulatory and policy compliance | Measure competency and support development |

Role Overview: Auditor vs Assessor

An auditor systematically examines financial records and compliance with regulatory standards to ensure accuracy and transparency in reporting, often focusing on internal controls and risk management. An assessor evaluates processes, systems, or personnel performance against predefined criteria or standards, aiming to identify gaps and recommend improvements. Both roles require analytical skills, but auditors primarily concentrate on verification and compliance, while assessors emphasize evaluation and continuous enhancement.

Key Responsibilities and Duties

Auditors are responsible for evaluating financial records, ensuring compliance with laws and regulations, and verifying the accuracy of accounting statements to provide an independent opinion on financial integrity. Assessors focus on measuring performance against predefined standards or criteria, often in the context of quality, safety, or skills evaluation, to determine adherence and identify areas for improvement. Both roles require meticulous documentation and reporting but differ in scope, with auditors concentrating on financial accuracy and assessors emphasizing qualitative or procedural compliance.

Required Qualifications and Skills

Auditors require a strong background in accounting, finance, or business administration, often supported by certifications such as CPA or CIA, and expertise in regulatory compliance, risk assessment, and analytical skills. Assessors need specialized knowledge in the specific industry or field they evaluate, with qualifications such as ISO auditor certification or sector-specific credentials, combined with strong attention to detail and the ability to interpret standards and criteria accurately. Both roles demand excellent communication skills, critical thinking, and the capacity to deliver objective, evidence-based evaluations.

Industry Applications and Sectors

Auditors play a critical role across finance, manufacturing, and healthcare sectors by independently verifying compliance with regulatory standards and financial accuracy. Assessors are essential in education, certification bodies, and quality management systems, evaluating processes to ensure adherence to predefined criteria and industry benchmarks. Both professionals contribute to risk management and continuous improvement, with auditors focusing on validation and assessors on performance measurement within various industry applications.

Standards and Guidelines Followed

Auditors strictly adhere to established industry standards such as ISO, GAAP, or regulatory compliance frameworks to evaluate the accuracy and integrity of financial or operational records. Assessors follow specific guidelines, often provided by certification bodies or industry-specific protocols, to measure performance against predetermined criteria or benchmarks. Both roles emphasize adherence to standards, but auditors focus on verification of compliance, while assessors concentrate on evaluation and improvement recommendations.

Methods of Evaluation and Assessment

Auditors employ systematic, evidence-based methods such as document reviews, interviews, and on-site inspections to verify compliance with established standards and regulations. Assessors use qualitative and quantitative evaluation techniques, including performance measurements, self-assessments, and gap analyses, to gauge capability and progress toward specific objectives. Both roles prioritize accuracy and objectivity but differ in scope, with auditors focusing on compliance verification and assessors emphasizing developmental insights.

Reporting and Documentation Processes

Auditors generate comprehensive reports summarizing compliance findings, audit trails, and evidence collected to ensure accountability and regulatory adherence. Assessors focus on detailed evaluation records, scoring rubrics, and improvement recommendations to support continuous performance enhancement. Both roles require meticulous documentation, but auditors emphasize formal reporting for external stakeholders, while assessors concentrate on internal development insights.

Regulatory and Compliance Considerations

Auditors primarily evaluate financial records and internal controls to ensure compliance with established accounting standards and regulatory requirements, often producing detailed reports for stakeholders. Assessors focus on measuring organizational processes and systems against specific criteria, such as ISO standards or regulatory frameworks, to verify adherence to compliance mandates. Both roles play crucial parts in regulatory environments, with auditors emphasizing fiscal accuracy and assessors targeting operational conformity.

Career Growth and Advancement Opportunities

Auditors typically have strong career growth opportunities in financial, compliance, and internal control sectors, often progressing to senior auditor, audit manager, or chief audit executive roles. Assessors, especially in quality management and regulatory compliance, can advance to lead assessor or compliance manager, with opportunities to specialize in certifications like ISO standards. Both careers offer pathways to strategic leadership positions, but auditors generally experience broader prospects across diverse industries due to their expertise in risk evaluation and financial oversight.

Choosing the Right Path: Auditor or Assessor

Choosing the right path between auditor and assessor depends on your career goals in compliance and quality management. Auditors primarily focus on systematically evaluating processes and controls to ensure adherence to standards, while assessors emphasize measuring and judging performance against specific criteria. Understanding the distinct roles, required skills, and industry demands helps professionals align their expertise with the appropriate responsibilities in auditing or assessing.

Auditor vs Assessor Infographic

jobdiv.com

jobdiv.com